Trump's Big Ugly Law Steals from the Poor to Give to the Ultra-Rich

President Trump’s Big Ugly Law kicks more than 15 million people off their health insurance, makes the largest cuts to nutrition assistance in history, and makes higher education less affordable. Why? To pay for tax cuts that overwhelmingly benefit the ultra-rich.

Non-partisan analysis from the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) shows that the bill worsens inequality, gives the ultra-rich a historic tax break, and makes working people worse off. Adding insult to injury, when including the cost of debt service, CBO finds that this bill adds over $4 trillion to the national debt.

The Big Ugly Law leaves working families worse off

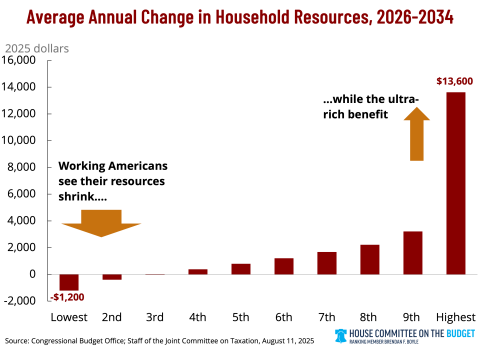

CBO analyzed the combined effects of the tax policies and spending reductions and found that working families will experience a net loss in household resources, while the ultra-rich will get richer. Specifically:

- Families already struggling to make ends meet lose the most. Households in the lowest income decile, making $24,000 a year or less, lose about $1,200 every year, mostly due to deep cuts to Medicaid and food assistance. That amounts to over 3 percent of their total income, a devastating hit for people who can afford it the least.

- Everyone in the bottom twenty percent of the income distribution, or those making less than $43,000 a year, will see a net decline in household resources.

- Middle-class families get next to nothing. For those in the 5th and 6th decile, or the middle of the distribution, they will experience a resource gain of only 0.8 to 1 percent. That is barely enough to keep up with rising costs due to President Trump's reckless actions.

- The ultra-rich get a windfall. Families making over $700,000 a year will see a $13,600 boost, almost entirely from tax cuts. That figure does not even count the massive estate tax giveaways for the ultra-rich.

The Big Ugly Law gives the ultra-rich a massive tax cut

JCT separately estimated the distributional effects of only the tax provisions in the bill. They found that working-class people get no tax cut, and in some cases a tax increase, while the ultra-rich get tens of thousands in tax cuts a year. Specifically:

- An average household making less than $15,000 a year will see a tax increase of over 9 percent in 2027. By 2033, when many temporary provisions in the tax portion of the law expire, this group will experience a 56 percent tax increase.

- While people earning $40,000 a year will see an average tax decrease of only $393, worth a few weeks of groceries, people making over $1 million a year will see their taxes go down by $97,000 in 2027.

The Big Ugly Law sets a new precedent for wealth transfers to the ultra-rich

In 2017, Trump and Republicans passed the so-called Tax Cuts and Jobs Act (TCJA), a historically bad bill which increased the deficit by $1.9 trillion. That bill gave massive handouts to the ultra-rich, but the Big Ugly Law makes the 2017 tax breaks for the richest few look small by comparison, while exploding the deficit by more than twice as much.

- The TCJA gave people making over $500,000 a year an average tax cut of $35,000 the first year after enactment. By comparison, the Big Ugly Law will give people making over $500,000 a tax cut of $47,000 in the first year alone.

- The TCJA transferred a total of $36.9 billion dollars to people making over $1 million a year in just the first year after the bill was enacted. The new bill will more than double that number, giving people making over $1 million a year $114 billion in tax cuts for 2027 alone.

- While the TCJA worsened inequality, it gave very modest tax cuts (around $20 dollars a year) to the lowest income earners. The Big Ugly Law will ask the lowest earners to pay higher taxes every year.

- Because this bill is coupled with draconian spending cuts that intentionally target working Americans, on net, the bill is even crueler and more unequal than TCJA.

Local Impact:

See the impacts of the Big Ugly Law using the House Budget Committee’s microsite, which contains information about health care and food assistance specific to your community: democrats-budget.house.gov/legislation/biguglylaw