Report: Bipartisan Budget Act of 2015

Faced with looming crises in the government's ability to meet its obligations and continue to function, Congress crafted a bipartisan budget agreement that the President signed into law on November 2. The Bipartisan Budget Act of 2015 raises the austerity-level sequester caps for two years – allowing government funding bills to proceed before the current short-term extension ends on December 11 – and suspends the debt limit, allowing the government to continue to fulfill its obligations. It also prevents a spike in Medicare Part B premiums and deductibles, and it extends the solvency of the Social Security Disability Insurance Trust Fund. The deal more than offsets its increased cost with deficit reduction from getting greater efficiency in federal health and pension programs and greater tax compliance from hedge funds and other large partnerships, selling federal assets, and other provisions that will not cut benefits to American families.

This Bipartisan Budget Act of 2015 represents the first step in a rational budget process for 2016. The next step is to pass appropriations bills at the full level allowed in the agreement. This will accommodate removal of the most egregious cuts in the pending bills, and allow important priorities to be funded. In order to have bipartisan support and avoid a government shutdown, "poison pill" policy riders must be avoided.

Sequester Relief

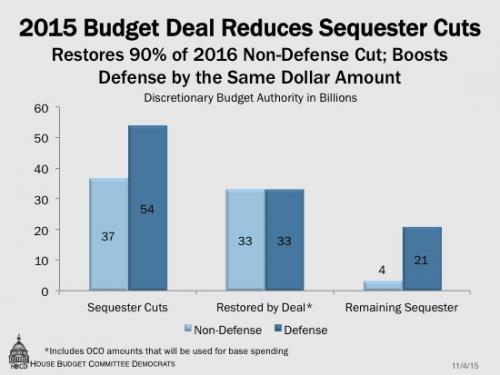

The budget deal raises the sequester-level discretionary spending caps for fiscal years 2016 and 2017 by $80 billion and provides additional spending outside the caps, paving the way to restart the appropriations process in time to avoid a government shutdown in December. The agreement eliminates significantly more of the sequester than the previous renegotiation of the Budget Control Act, which raised the discretionary caps for 2014 and 2015 by a total of $63 billion, evenly split between defense and non-defense. The new budget deal provides $66 billion more for 2016, evenly split between defense and non-defense spending, by raising the cap on each category of spending by $25 billion plus providing each with an additional $8 billion in Overseas Contingency Operations (OCO) funding. This eliminates 90 percent of the Budget Control Act's sequester on non-defense discretionary spending for 2016 while providing the same $33 billion increase in spending for defense programs. This deal represents close to the complete sequester relief that Democrats have been seeking for 2016, and represents a huge win for American families, our economy, and national security. For 2017, the deal provides $30 billion of sequester relief by raising each cap by $15 billion, and allows for the same amount of OCO funding as in 2016. The mandatory sequester stays in place at the levels already calculated and is extended one more year, through 2025.

- More jobs – The White House estimates this law will result in 340,000 additional jobs in 2016, and a total of 500,000 job-years added in 2016 and 2017. Democrats have long argued that the most effective deficit reduction plan is to create jobs and get the economy working better.

- Sequester relief evenly split between defense and non-defense – The Budget Control Act set up the principle that deficit reduction should come evenly from defense and non-defense spending, and this deal reflects the continued balance by providing equal increases to both categories of spending.

Debt Limit Suspension

The country had once again come close to the brink of defaulting on its obligations; the Treasury had estimated that absent congressional action, the government would have exhausted its ability to meet its commitments in early November and would begin to default on its obligations. This deal protects against that catastrophe by temporarily suspending the debt limit through March 15, 2017. Suspending the debt ceiling does not reflect the need to spend more, merely to make good on obligations that were already approved and put in place.

Medicare Part B Premium and Deductible Relief and Other Beneficiary Savings

The budget deal prevents a steep spike in Medicare Part B premiums and deductibles for 2016. Without Congressional action, base monthly premiums for about 30 percent of Medicare beneficiaries would have increased by more than 50 percent next year, to $159. The Part B deductible for all beneficiaries also would have increased by more than 50 percent, to $223. The Centers for Medicare and Medicaid Services announced November 10 that under the terms of the budget deal, the base 2016 Part B premium for that 30 percent of beneficiaries will instead be $121.80. These beneficiaries will pay $450 less in premiums next year than the Medicare Trustees projected over the summer. The other roughly 70 percent of beneficiaries will see no premium increase in 2016 because of a pre-existing "hold-harmless" law that protects beneficiaries from experiencing a decrease in their Social Security benefits if Part B premiums go up by more than their annual Social Security cost-of-living adjustment. The 2016 Part B deductible will be $166 instead of $223. The general fund of the Treasury will provide a loan to the Medicare trust fund to cover the cost of this premium and deductible relief. The loan will be repaid over the next several years through a $3 surcharge on Part B premiums.

The budget deal also includes a provision to prevent overpayments for certain physician and surgical services provided outside of the hospital. People with Medicare will save roughly $3 billion through reduced premiums and cost sharing as a result of this provision.

Social Security

The agreement includes a package of Social Security provisions that would block a possible 20 percent cut in disability benefits in 2017. Without action, Social Security's Disability Insurance Trust Fund was projected to become insolvent near the end of 2016. This would have forced deep cuts in disability benefits. Preventing these benefit cuts was a priority and major victory for Democrats in the agreement. The final legislation included a number of Social Security provisions that will extend the solvency of Social Security's trust funds, strengthening the financing of both disability and retirement benefits.

Savings

The Congressional Budget Office estimates that the law will decrease the deficit by a net of $1.6 billion over ten years (not including the excess OCO funding that is authorized). The deal has scoreable savings of $80 billion over ten years from changes in direct spending and revenue, plus another $1 billion in non-scoreable savings from program integrity activities in Supplemental Security Income and Medicaid. Outlays under the caps increase by $79 billion over the same ten years. The savings come from changes to federal health care program provider payments and other health care system rules ($18 billion in savings), extending the mandatory sequester one year to 2025 ($14 billion), greater tax compliance from hedge funds and other large partnerships ($11 billion), selling federal assets ($9 billion), rescissions ($2 billion), and other provisions that will not cut benefits to American families.