Report: The President's 2016 Budget

Supporting Working Families, Growing the Middle Class, and Creating Opportunity

Yesterday President Obama submitted his fiscal year 2016 budget that will accelerate job growth and boost the take-home pay of all Americans – especially hard-working middle-class Americans and those working to join the middle class. The President's budget accomplishes these goals in a fiscally responsible way that will reduce the ten-year deficit by about $2 trillion through a combination of targeted spending cuts and the elimination of many special interest tax breaks and loopholes.

As more Americans go back to work during the ongoing economic recovery, the President's budget focuses on growing workers' paychecks, helping working families afford quality child care, and expanding access to education and job training. It builds on the expanded health coverage and budget savings provided by the Affordable Care Act, offers a simpler and fairer tax code that invests in middle-class families, and provides critical investments in innovation, infrastructure, defense, and other services that will grow the economy. To accommodate these investments, the budget replaces arbitrary spending cuts under sequestration with savings from a smarter, more balanced approach to deficit reduction. All told, the President's budget puts the nation on a sustainable fiscal path with debt declining as a share of the economy.

| President's 2016 Budget Totals in Billions of Dollars | |||||||||||

| (OMB Estimates) | |||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Receipts | 3,176 | 3,525 | 3,755 | 3,944 | 4,135 | 4,332 | 4,525 | 4,746 | 4,986 | 5,236 | 5,478 |

| Outlays | 3,759 | 3,999 | 4,218 | 4,423 | 4,653 | 4,886 | 5,126 | 5,372 | 5,621 | 5,875 | 6,165 |

| Deficit | 583 | 474 | 463 | 479 | 518 | 554 | 600 | 626 | 635 | 639 | 687 |

| as % of GDP: | |||||||||||

| Deficit | 3.2% | 2.5% | 2.3% | 2.3% | 2.4% | 2.5% | 2.6% | 2.6% | 2.5% | 2.4% | 2.5% |

| Debt held by the public | 75.1% | 75.0% | 74.6% | 74.3% | 74.1% | 74.0% | 74.0% | 73.9% | 73.7% | 73.5% | 73.3% |

Investments

The budget builds ladders of opportunity to grow the middle class through tax reform and investments that support working families and strengthen the economy.

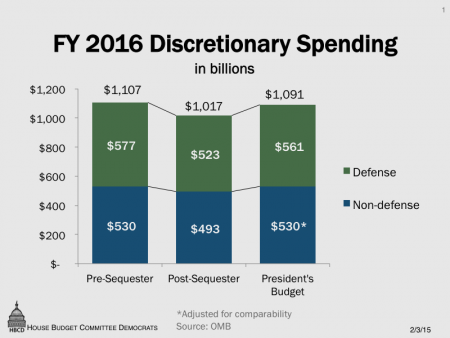

Replace the sequester ― The budget eliminates all future sequestration cuts to mandatory spending and raises appropriations above the low, post-sequester spending caps – by $74 billion for 2016 – with the increase split almost evenly between defense and non-defense programs each year of the sequester. For 2016, the additional appropriations eliminate the non-defense sequester entirely. Replacing the sequester provides funding for strategic investments that strengthen security and sharpen the nation's competitive edge in the 21st century global economy.

Education ― The President's budget makes a major commitment to increasing access to high quality education and training from preschool through college, aiding schools and students with new services and tax breaks.

- Early childhood education – To help ensure that all children enter school ready to learn and succeed, the budget targets new and increased funding for early learning. The Preschool for All initiative provides $75 billion over ten years to help states offer universal preschool for all 4‑year-olds from low- and moderate-income families. The budget lays the groundwork for this new program with $750 million for Preschool Development Grants for 2016, which is a $500 million increase. The budget also increases funding for Head Start and Early Head Start by $1.5 billion, up to a total of $10 billion.

- Elementary and secondary education – The budget increases funding for elementary and secondary education by $2.7 billion (12 percent), of which $1.0 billion is targeted for additional services to low-income students under Title I (providing a total of $15.4 billion). Another $425 million of the increase funds three new competitive grant programs to help teachers use technology effectively, to improve achievement in high school, and to support the use of evidence-based teaching strategies. A third part of the increase is $180 million to leverage non-federal matching funds to support proven, innovative approaches to address persistent educational challenges (providing a total of $300 million). Special education programs separately receive an increase of $300 million, with state grants funded at $11.7 billion.

- College affordability – Because a college degree is increasingly a requirement for a good-paying job, the budget increases access to postsecondary education in several ways. It makes two years of high-quality community college free to responsible students through a new $60 billion ten-year America's College Promise program, saving up to 9 million students an average of $3,800 in tuition per year. It also makes permanent the American Opportunity Tax Credit and expands both number of years one can claim the credit (from four to five years, for a total of $12,500) and the amount that is refundable (from $1,000 to $1,500). The budget more than triples funding for First in the World, providing $200 million for competitive grants to find and share evidence-based strategies to improve college completion rates. Finally, the maximum Pell grant will increase to $5,915 next year, and the budget uses nearly $30 billion in savings from reforming both Perkins Loans and income-based-repayment plans to ensure that the Pell grant will continue to grow with inflation beyond 2017.

Job training ― To make workers more competitive in the 21st century global economy and to serve the more than 8 million unemployed Americans, the budget creates several job training programs focused on developing apprenticeships and other pathways into fields with growing numbers of middle-class jobs. It provides $16 billion over ten years to double the number of workers who receive job training services. To double the number of apprenticeships nationwide it provides $2 billion in mandatory funding over four years plus $100 million in appropriations for 2016 to expand existing apprenticeship programs. It also provides $3 billion over four years to help disconnected youth with summer and year-round jobs.

Research and development and clean energy ― The budget invests $146 billion for research and development across the federal government, which is 6 percent ($8 billion) above the 2015 enacted level. The budget provides over $7 billion in clean energy funding throughout the federal government and $2.4 billion to further advanced manufacturing technologies. This funding improves our scientific knowledgebase, creates technologies with widespread benefits to society, and strengthens U.S. global competitiveness.

Manufacturing institutes ―The budget expands the National Network for Manufacturing Innovation by providing funding for seven new institutes. This builds on the nine institutes already funded and towards the ultimate goal of a network of 45 institutes. This network would help manufacturers create jobs, continue industry growth, and strengthen American leadership in advanced manufacturing technology.

Infrastructure ― The budget includes a $478 billion 6-year highway bill to make critical new investments in our roads, bridges, transit systems, and freight networks. This bill would ensure the health of the Highway Trust Fund for six years while allowing for increased funding to upgrade and modernize our infrastructure. It finances this investment by using transition revenues from business tax reform.

The budget also features a Rebuild America Partnership proposal to boost private investment in infrastructure. It creates a National Infrastructure Bank to leverage public and private capital to support significant infrastructure projects. It also creates America Fast Forward Bonds, based on the Build America Bond program, to attract capital from investors who do not benefit from traditional tax-exempt bonds. Finally, it creates a new Qualified Public Infrastructure Bond that allows private-public partnerships to make use of municipal bonds to raise capital. These initiatives would attract more private capital to help finance needed infrastructure investments.

Child care ― Child care is one of the most significant expenses for working families and federal assistance misses many families. The budget includes an additional $82 billion in funding (that results in $78 billion in outlays) over ten years to ensure that low-income families with young children can get subsidies to help afford child care while parents work or are in school. By 2025, more than 1 million additional young children would be served. The budget also provides discretionary funding to implement the Child Care and Development Block Grant Act of 2014, which is designed to improve the safety and quality of care. It also streamlines and enhances existing child care tax benefits, helping millions of middle-class families, particularly those with young children whose care is most expensive. The budget would triple the maximum Child and Dependent Care Tax Credit for families with children under five and make the full credit available to many more taxpayers.

Housing assistance ― The budget includes significant increases for housing assistance. The budget requests $21 billion, an increase of $1.8 billion over the 2015 level, for the Housing Choice Voucher program. This program assists very low-income families, the elderly, and disabled in affording decent housing in the private market. The funding will be sufficient to renew all existing contracts and reinstate contracts that were lost due to the 2013 sequester. The budget also requests a $1.0 billion increase for project-based rental assistance, which provides assistance to low-income families in certain multifamily developments. This level can provide a full 12-month contract for all projects.

Internal Revenue Service (IRS) ― The budget increases funding for the IRS by $2 billion relative to the 2015 level, to a total of $13 billion. In recent years, the IRS has faced significant budget cuts, which are likely to lead to delays in taxpayer services and ultimately could create a long-term risk to our tax system if compliance declines. The new funding will reverse that trend.

National defense ―The national defense budget, excluding overseas contingency operations, totals $561 billion – an amount that is $38 billion above the post-sequester defense discretionary cap for 2016 and $39 billion above the enacted level for 2015. Although the budget increases defense funding above the post-sequester level over ten years, it also includes a number of cost-saving measures to ensure a military that is properly trained and equipped over the longer term. The budget keeps in place plans to reduce military end strength, to eliminate older weapons systems like the A-10 aircraft, and to slow the growth rate of personnel costs.

Overseas Contingency Operations (OCO) ― The budget includes $58 billion of OCO funds, of which $51 billion is for defense and $7 billion is for the State Department and Other International Programs (State/OIP). This reflects a 21 percent decrease from the 2015 enacted level. This total includes $5.3 for the Department of Defense to counter the Islamic State of Iraq and the Levant (ISIL), $1.3 billion of which is for training and equipping Iraqi forces and vetted moderate Syrian opposition. Funding for State/OIP includes $3.5 billion to respond to the threat of ISIL and the crisis in Syria. These resources will go toward strengthening regional partners, providing humanitarian assistance, and strengthening Syria's moderate opposition.

Beyond 2016, the budget includes placeholder estimates of $27 billion per year through 2021 and maintains its $450 billion cap on OCO over the 2013 – 2021 period. However, the budget also announces the Administration's intent to propose a plan early this year to transition costs currently funded in the OCO budget that finance operations that are considered "enduring" to the base budget by 2020. These costs include those associated with supporting our Afghan partners and maintaining a strong forward presence in the Middle East region.

Veterans ― The budget includes $70 billion for discretionary veterans' programs, an 8 percent increase above the level for 2015. Much of the total requested amount – $59 billion – has already been provided for veterans' medical activities in an advance appropriation included in the 2015 appropriations bill. The budget also includes an advance appropriation for these programs for 2017 totaling $63 billion. This robust funding increase, in part, addresses the problem of long wait times in the Veterans Affairs health care system and builds on the $15 billion of mandatory funds that the Veterans Choice Act provided to increase veterans' access to health care. The budget includes $1.4 billion to combat veteran homelessness, and an increase of $85 million to hire 770 new staff to improve claims processing. The budget supports keeping on track the goal of eliminating the benefit claims backlog by the end of 2015 and ensuring veterans get decisions on their claims within 125 days.

International affairs — The budget provides $55 billion for the State Department and other international programs, including the $7 billion for OCO described above. The $48 billion in base funding is increase of $6 billion over the 2015 level. The budget pressures Russia for its aggressive actions in Ukraine with foreign assistance and loan guarantees to neighboring countries and increased assistance for NATO exercises and training. It provides $1 billion in increased support for Central American countries as a part of a historic new program to address the region's underlying economic, security, and governance problems. The budget supports global health with $300 million for a new PEPFAR Impact Fund to help countries realign their national HIV/AIDS programs to focus on the highest-burden areas and sites. To help protect embassy personnel around the world, the budget invests $4.8 billion to support overseas infrastructure security.

Providing Tax Relief for Middle-Class Families

The President's budget includes tax reforms aimed at making the tax code fairer while investing in middle-class families and growing workers' paychecks. In addition to expansions to the Child and Dependent Care Tax Credit discussed above under "child care," and improvements to the American Opportunity Tax Credit discussed under "education," the budget includes the following tax reforms:

Improve the Earned Income Tax Credit (EITC) and the Child Tax Credit — The budget again includes improvements to the EITC provided to workers without children and non-custodial parents. These workers are the only group that can be taxed further into poverty by our current tax system. The budget doubles the EITC for this group. It also expands the age range for eligibility to include workers aged 21 to 24 and workers aged 65 to 66. This would encourage young adults to seek employment and harmonize the EITC rules with Social Security's full retirement age. Improvements to the EITC for this group have been endorsed on a bipartisan basis but Republicans did not include it in their budget or in any of the myriad tax bills they moved during the last session. The budget also makes permanent the improvements in the EITC and CTC that are due to expire after 2017.

Support work and address challenges of dual-earner couples — The budget proposes a credit of up to $500 for two-earner families to help address the additional costs faced by families in which both spouses work.

Expand access to workplace savings opportunities — The budget proposes automatic IRA enrollment for workers whose employers do not already offer retirement plans (employees could opt out if they choose). The budget also strengthens tax incentives for small employers that set up auto-enrollment IRAs, 401(k)s, or other employer plans, or that start automatically enrolling workers in their existing retirement plans.

Other Tax Reform

The pro-work and middle-class tax relief (together with the new investments in child care and community colleges) is paid for by reforming the current tax code, which is skewed in favor of those who make money off of money and against those who make money off of hard work.

Reform capital gains taxation — The budget increases the top tax rate on capital gains and dividends for high-income households to 24.2 percent. When the Medicare tax on net investment income is included, the top rate would be 28 percent – the same as under President Reagan. The budget closes the "trust fund loophole" by providing for realization of capital gains upon gifts and bequests, with various exemptions to protect middle-class households. According to the Treasury Department, 99 percent of the additional revenue from these proposals would come from the highest-income 1 percent.

Financial fee — The budget includes a fee on large, highly leveraged financial institutions to discourage excessive borrowing. The 7 basis point fee (0.07 percent) would apply to the roughly 100 U.S. financial firms with assets over $50 billion.

Additional proposals to limit tax expenditures and loopholes for high-income households — As in past years, the President's budget includes a number of proposals to limit tax expenditures and tax loopholes for high-income households, including the following:

- Limit the additional tax benefits that high-income households derive from tax deductions and exemptions. The budget limits the tax benefit that households in the highest tax brackets receive from "itemized deductions" and certain other tax preferences to 28 cents on the dollar – the same benefit that a household in the 28 percent tax bracket receives.

- Adopt the "Buffett Rule," which requires that millionaires pay an effective tax rate of at least 30 percent of income (after charitable contributions).

- Eliminate the "carried interest loophole," which allows wealthy investment fund managers to pay lower capital gains tax rates on much of their income.

- Close the "Newt Gingrich" loophole that allows some high-income professionals to avoid payroll taxes.

- Prevent very wealthy individuals from accumulating more than about $3.4 million in tax-favored retirement plans by prohibiting contributions and accruals of additional benefits once an account reaches that size.

Business tax reform and investments in infrastructure — As in past years, the President's budget includes a reserve fund for business tax reform that is revenue-neutral in the long-run.

- Revenue-neutral business tax reform – The budget includes corporate and business tax reform that would reduce the corporate tax rate, broaden the tax base, and be revenue-neutral overall over the long-run. It puts forward a number of specific reform proposals, including making permanent the R&D tax credit, clean energy incentives, and small business tax relief in a fiscally responsible way.

- International tax reform – The President's business tax reform plan includes detailed proposals for overhauling the international business tax system. The core of the proposal is a 19 percent minimum tax on the foreign earnings of U.S. companies. Under the proposal, companies would pay U.S. tax on their foreign earnings in the year they are earned (with a credit allowed for foreign taxes), but would pay no additional tax when returning the earnings to the United States. The proposal also prevents corporate "inversions" and puts in place additional safeguards to protect the U.S. tax base.

- Devote one-time savings from international tax reform to infrastructure investment – As part of the transition to a reformed international tax system, the President's budget proposes a one-time transition toll charge of 14 percent on the up to $2 trillion of untaxed overseas earnings that U.S. companies have accumulated overseas. This transition revenue would be dedicated to ensuring solvency of the transportation trust fund and to supporting new surface transportation investments under the President's six-year $478 billion highway bill.

Health Care

The budget achieves net health care savings of $402 billion over ten years through numerous provisions primarily affecting Medicare and Medicaid. The budget also includes $152 billion for reform of the Medicare physician payment Sustainable Growth Rate formula – $108 billion of which is assumed in the baseline to reflect the cost of preventing steep rate cuts for physicians, and $44 billion of which is included in the net $402 billion figure to reflect additional formula improvements consistent with bipartisan, bicameral legislation developed in Congress last year. Separately, the budget also provides $12 billion to extend the Children's Health Insurance Program (CHIP) through 2019.

Medicare ― The budget reduces Medicare program spending by a net $423 billion over ten years (excluding the $108 billion cost of preventing physician rate cuts assumed in the baseline). This figure includes $350 billion in savings from policies affecting Medicare provider payments and $84 billion in savings from policies affecting beneficiaries, before interactions. A new provision in this year's budget addresses the trend of ambulatory services shifting from physicians' offices to hospital outpatient departments, which bill at higher rates. The provision saves $30 billion by reducing payments for services provided in off-campus hospital outpatient departments. The budget improves behavioral health parity in Medicare by eliminating the 190-day lifetime limit on inpatient psychiatric facility services, at a cost of $5 billion. Major savings provisions repeated from last year's budget include requiring Part D drug rebates ($116 billion), reducing post-acute care payment updates ($102 billion), improving Medicare Advantage payment accuracy ($36 billion), and increasing income-related premiums beginning in 2019 ($66 billion). In addition to the $423 billion figure, the budget includes "non-scoreable" Medicare savings from increased investment in program integrity activities. Counting these savings, the budget reduces net Medicare spending by $431 billion over ten years. Altogether, the policies in the budget extend the solvency of the Medicare Hospital Insurance Trust Fund by about five years.

Medicaid and CHIP ― The budget includes several proposals to strengthen Medicaid and CHIP for American families. The budget increases net Medicaid spending by $27 billion over 10 years. This figure includes $14 billion to expand home and community-based services and other benefits, $4.7 billion to encourage states to provide 12-month continuous enrollment for adults, and $6.3 billion to restore the Affordable Care Act's Medicaid primary care rate increase through calendar year 2016. It also includes $15 billion in savings from proposals to improve Medicaid efficiency, including provisions to lower drug costs and reduce waste, fraud and abuse in the program. The budget also provides $12 billion to extend CHIP through 2019, paid for with an increase in the tobacco tax.

Public health investments ― The budget makes key investments in improving the public's health, including $31 billion for the National Institutes of Health, a $1 billion increase the over 2015 level. The budget also provides $1.2 billion across several agencies to combat antibiotic resistant bacteria, $215 million to advance precision medicine and targeted therapies for patients, and additional funding to respond to infectious diseases and global health threats.

Other Key Proposals

Immigration reform ― The budget assumes savings from enactment of the bipartisan Senate-passed immigration bill, which will shrink the deficit by about $160 billion over ten years and by nearly $1 trillion over the next two decades.

Wall Street reform ―The budget provides funds to implement the financial reforms passed in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. These funds include $1.7 billion for the Securities and Exchange Commission, a 15 percent increase, and $322 million for the Commodity Futures Trading Commission, a 29 percent increase.

Social Security ― The budget includes funding to improve Social Security's customer service. It also calls for increased funding of program integrity efforts to assess beneficiaries' continued eligibility. The budget also replaces the current discretionary cap adjustment for program integrity funds with a stream of mandatory funding beginning in fiscal year 2017.

The budget also reallocates Social Security payroll taxes to shift revenues from the Old Age and Survivors Insurance account to the Disability Insurance account. This shift aligns the insolvency dates of the two accounts. It has no impact on Social Security's overall health and solvency, and gives Congress and the Administration more time to develop a solution to Social Security's long-term financing issues.

The budget also extends Social Security spousal benefits to all married couples, regardless of where they live. Spousal benefits currently are not available to same-sex couples who live in a state that does not recognize their marriage. Consequently, couples can lose rights to benefits simply by moving from one state to another.

Crop insurance ― The budget reduces spending for crop insurance by $16 billion over ten years. It reduces premium subsidies to farmers for policies that include a harvest price option, and reforms prevented planting coverage. The budget also includes a few fee proposals that have been included in previous years.

Economic Assumptions

The budget is based on economic projections that are in line with the Blue Chip consensus and other forecasts. It assumes a healthy recovery over this year and next year, with the economy then gradually slowing to its long-term growth rates. The budget projects that Gross Domestic Product (GDP) will grow at a 3.1 percent rate this year, 3.0 percent next year, and 2.8 percent in 2017. GDP growth will taper to a 2.3 percent out-year rate. Inflation will dip slightly this year and then gradually rise in later years, settling at long-term rates of 2.0 percent (using the GDP deflator measure preferred by the Federal Reserve) and 2.3 percent (using the Consumer Price Index).

The unemployment rate is projected to average 5.4 percent this year, 5.1 percent in 2016, and 4.9 percent in 2017 and 2018. The budget assumes that interest rates will rise slightly this year and by larger amounts in the next few years, eventually reaching rates of 3.5 percent for three-month Treasuries and 4.5 percent for 10-year Treasuries.

| Proposals in the 2016 Budget (in billions of dollars) | |||

| Total | |||

| 2015 | 2016 | 2016-25 | |

| Projected deficits in the adjusted baseline 1/ | 578 | 535 | 7,880 |

| Proposals in the 2016 Budget: | |||

| Support working families, grow the middle class and create opportunity: | |||

| Middle-class and pro-work tax reforms | 3 | 10 | 277 |

| Child care for all low- and moderate-income families with young children | --- | 3 | 78 |

| Partner with States to provide tuition-free quality community college | --- | * | 60 |

| Surface transportation reauthorization | --- | 3 | 116 |

| Investments in early education and children's health | --- | * | 88 |

| Additional investments in education, innovation, infrastructure, and security | -1 | 37 | 96 |

| Making the tax code fairer, paying for investments, and reducing the deficit: | |||

| Capital gains tax reform | -4 | -9 | -208 |

| Financial fee | --- | -6 | -112 |

| Proposals to address high-income tax avoidance | --- | -6 | -101 |

| Transition revenue from business tax reform | --- | -35 | -268 |

| Tobacco tax financing | --- | -8 | -95 |

| Additional mandatory and tax proposals | 1 | -30 | -322 |

| Additional deficit reduction: | |||

| Health savings | 5 | 6 | -402 |

| Reforms to high-income tax expenditures | --- | -35 | -638 |

| Immigration reform | --- | 6 | -158 |

| Debt service | * | -* | -220 |

| Subtotal | 4 | -63 | -1,809 |

| Other changes to the deficit: | |||

| Reductions in Overseas Contingency Operations | -0 | -11 | -557 |

| Replacement of mandatory sequestration | --- | 11 | 185 |

| Proposed Budget Control Act cap adjustment for disaster relief and wildfires | * | 2 | 18 |

| Debt service and indirect interest effects | * | * | -43 |

| Total proposals in the 2016 Budget | 4 | -61 | -2,206 |

| Resulting deficits in 2016 Budget | 583 | 474 | 5,674 |

| *$500 million or less. | |||

| 1/ The adjusted baseline assumes extension of tax benefits for individuals and families due to expire in 2017, a freeze for the Medicare physician update, a Postal default on payments for retiree health benefits, a placeholder for disaster funding, and regular discretionary spending at the post-sequester level. | |||