NEW REPORT: Budget Committee Democrats Release Report on Biden Budget for FY24

WASHINGTON, DC — Today, the House Budget Committee released a new report on President Biden's Fiscal Year 2024 Budget proposal, a fiscally and socially responsible blueprint to invest in America, lower costs for working families, protect and strengthen Medicare and Social Security, and reduce the deficit by nearly $3 trillion. The President's Budget would not raise taxes by a penny on anyone making less than $400,000 a year.

The new report provides a detailed summary of each pillar of President Biden's budget, outlining the budget's investments — from investing in education and lowering health care costs to increasing affordable housing and making our communities safer — and how they are paid for by making the wealthy and corporations pay their fair share, cracking down on fraud, and cutting wasteful spending on Big Pharma, Big Oil, and other special interests.

"The investments in President Biden's budget will build on Democrats' historic progress so we can keep making a real difference in people's lives," said Ranking Member Boyle. "Democrats' economic strategy to grow our economy from the bottom up and middle out is working. We've added a record 12 million jobs and the unemployment rate is at its lowest level in over half a century. Americans are opening small businesses in record numbers. Wages are up and inflation is down. Manufacturing is booming and the economy is growing. Now, the President has laid out the next steps in his plan to deliver for the American people and finish the job."

"Our plan is out in the open and Democrats are ready to get to work on behalf of the working Americans who built this country and count on their country to have their back. It's time for Congressional Republicans to bring their budget out of the shadows so the American people can see exactly which programs they want to gut so they can keep subsidizing the wealthy and big corporations with wasteful tax breaks."

The text of the full report is below, and a PDF of the report can be found HERE.

Biden Budget Builds a Better, Brighter Future for All Americans

President Biden's budget request for 2024 continues Democrats' consequential work to grow the economy from the bottom up and middle out. Over the past two years, Democrats have enacted historic pro-growth investments so the U.S. could emerge from the COVID crisis stronger and better prepared for the future – all while reducing the deficit. President Biden's budget builds on our progress and improves our fiscal outlook by investing in America, lowering costs for families, protecting and strengthening Social Security and Medicare, reducing the deficit with commonsense reforms, and more.

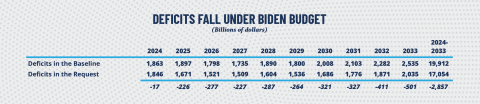

The budget sets a total discretionary level of $1.7 trillion in 2024 for annually funded programs, an increase of $77 billion, or about 5 percent, over the 2023 enacted level. The budget also includes $2.5 trillion in new mandatory initiatives over ten years. President Biden honors his commitment to meet the needs of American families without sacrificing fiscal responsibility – his plan pays for important initiatives and reduces the deficit by nearly $3 trillion over ten years.

The President's budget shows how making smart investments in our country and our people sets us up for economic success over the long run. The President's budget predicts that GDP will be 0.6 percent in 2023, increasing to 2.3 percent by 2025 and remaining between 2 and 2.2 percent thereafter. The labor market will remain strong, with unemployment at 4.3 percent in 2023, and a flat unemployment rate of 3.8 percent in the end years of the decade. Inflation will abate, falling from 4.3 percent in 2023 to 2.4 percent in 2024 and then remaining at target levels of 2.3 percent across the rest of the decade.

Major Mandatory and Revenue Proposals

President Biden's budget prioritizes fiscally responsible, pro-growth investments in areas like education and housing. Coupled with policies to lower costs for the American people and make our tax code more fair, this budget builds an inclusive and productive economy while achieving meaningful deficit reduction.

Lowers Everyday Costs for the American People

Invests in K-12 Education and College Affordability —This budget recognizes that educating our children is the key to a flexible and dynamic workforce in the future. It sets up our littlest learners for a lifetime of success by investing $600 billion to expand affordable childcare for low- and middle-income families and to provide two years of universal pre-k, reducing costs for families. It expands access to higher education by making college more affordable, investing $96 billion over the decade to double the maximum Pell grant by 2029 and another $90 billion to make two years of community college free for students enrolled in high-quality programs that lead to a 4-year degree or good paying jobs.

Lowers Health Care Costs — The budget invests $385 billion to expand access to affordable health care coverage and lower health care costs for families. This investment includes $183 billion to permanently extend the enhanced Affordable Care Act (ACA) premium tax credits enacted in the American Rescue Plan Act. The Rescue Plan increased the tax credit amounts and expanded the eligibility to people with incomes above 400 percent of the federal poverty level for 2021 and 2022, lowering premiums for ACA coverage by an average of $800 per person per year. The Inflation Reduction Act extended these enhanced tax credits for three more years through 2025, preventing approximately 3.1 million people from losing coverage. The investment also includes $200 billion to close the Medicaid coverage gap by permanently extending health care coverage to low-income individuals in states that have not expanded Medicaid.

Lowers Prescription Drug Costs — The budget lowers prescription drug costs for families in several ways. First, it provides the life-saving protection of a $35 per month insulin cost cap to everyone. Democrats' Inflation Reduction Act created this out-of-pocket cap for Medicare beneficiaries starting this year, but it did not extend to younger Americans who directly purchase their own health insurance or get coverage through parents or an employer. The budget extends this protection to all Americans by requiring commercial plans to adhere to this monthly insulin cost cap. Other proposals to lower prescription drug costs for families include strengthening the Medicare drug price negotiation reforms; capping Medicare Part D cost-sharing on certain generic drugs to $2 per prescription per month; authorizing the Department of Health and Human Services to negotiate Medicaid supplemental rebates on behalf of States; and applying Medicaid drug rebates to separate Children's Health Insurance Programs, for a combined savings of $206 billion.

Increases Affordable Housing Supply — The budget invests $103.8 billion to reduce the cost of housing for homeowners and renters. Nearly $25 billion goes toward increasing housing supply to address a shortage of at least 3.8 million homes. The budget designates $35 billion for first-time homebuyer assistance and housing choice vouchers with a new emphasis on housing youth aging out of foster care and extremely low-income veteran families. Lastly, the budget includes tax proposals, totaling, $51.1 billion, to promote investment in distressed and low-income areas, while encouraging personal investment to improve distressed communities.

Invests in Working Families

Delivers Paid Family Leave — The budget invests in families by providing national, comprehensive paid family and medical leave. The $325 billion investment offers workers up to 12 weeks of paid leave to bond with a new child; care for a seriously ill loved one; heal from their own serious illness; address circumstances arising from a loved one's military deployment; find safety from domestic violence, sexual assault, or stalking; or grieve the death of a loved one.

Expands Child Tax Credit — The budget makes a commitment to our children and families by expanding the Child Tax Credit (CTC) and making it permanently refundable. This increases maximum benefits to $3,000 per child for children six and above and $3,600 per child for children under six, with an option for a monthly benefit. This investment costs $429 billion over the decade and gives families more breathing room and financial flexibility. The budget also makes a $156 billion investment in workers by expanding the Earned Income Tax Credit (EITC) for workers without qualifying children.

Improves Long Term Care and Home Care — The budget invests $150 billion to improve Medicaid services to better assist low-income seniors and people with disabilities live and thrive in home- and community-based settings.

Extends Medicare Solvency

Protects and Strengthens Medicare for Another Generation — The budget extends the life of the Medicare Hospital Insurance (HI) Trust Fund by at least 25 years to make sure millions of Americans can count on Medicare to be there for them when they turn 65. The budget extends Medicare solvency by increasing the Net Investment Income Tax (NIIT) rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent, saving $344 billion; closing loopholes in existing NIIT by requiring all pass-through business income of high-income households to be subject to the same rules as other types of income, saving $306 billion; dedicating all of the NIIT revenues to the HI Trust Fund as originally intended; and building on the Medicare drug reforms enacted in the Inflation Reduction Act by allowing Medicare to negotiate prices for more drugs earlier, saving $160 billion, and extending the inflation rebate rule for drug companies to commercial health insurance, saving $40 billion. Strengthening the Medicare drug reforms not only extends the life of Medicare, it also lowers Medicare beneficiaries' out-of-pocket drug costs by billions of dollars.

Rebalances Our Tax Code to Reward Work Not Wealth

The budget is fiscally responsible, reducing the deficit by $3 trillion over the decade. The budget accomplishes this by making the tax system more equitable and ensuring corporations and the very wealthiest individuals pay their fair share. President Biden keeps his pledge to not raise or impose any new taxes on anyone earning less than $400,000 a year. In total, this budget raises $4.7 trillion in revenue over the decade.

Reforms Business Taxation — The budget asks corporations to pay their fair share by raising the corporate tax rate to 28 percent. Before enactment of the 2017 tax law, a corporate tax rate of 35 percent was the standard for the last several decades. Returning the rate to 28 percent will bring corporate tax revenue as a share of the economy to approximately the 21st century average before the 2017 tax law. This change alone will raise $1.3 trillion over the decade and will turn some of the record corporate profits into investments in the economy.

Makes the Wealthy Pay Their Fair Share — Another important way that the budget increases tax fairness is by making sure that billionaires do not pay lower tax rates than hard-working American families. The budget proposes a minimum tax on the wealthiest earners, meaning that billionaires must pay at least at least 25 percent in taxes on their full income, including unrealized appreciation. It would apply to those in only the top one-hundredth of one percent (0.001%) of earners, or those worth over $100 million, and most of the revenue generated would come from households worth more than $1 billion. This proposal alone will raise $437 billion in revenue over the decade. It also asks the highest earners, or those earning more than $400,000 a year, to pay a top marginal tax rate of 39.6 percent – a policy that will raise $235 billion over the decade. Further reforms to the taxation of capital income will raise an additional $214 billion over the decade.

Closes Loopholes and Levels the Playing Field — The budget also closes tax loopholes by taxing carried interest as ordinary income, raising $6.5 billion over the decade. This, along with other policies to close tax loopholes, will raise a total of nearly $50 billion over the decade. The budget makes additional important tax reforms, including revising the global minimum tax regime, limiting inversions, and related reforms, which will raise $493 billion over the decade. It also proposes quadrupling the tax rate on corporate stock buybacks, which will raise an additional $238 billion.

Discretionary Spending

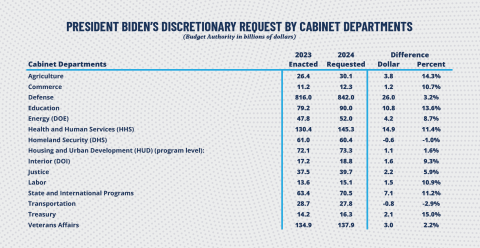

President Biden's 2024 budget sets a discretionary topline of $1.7 trillion – an increase of $77 billion, or about 5 percent, over the 2023 enacted level. The budget again breaks out medical spending for veterans as a separate category within discretionary, allowing for a more accurate comparison that better prioritizes and meets the needs of our veterans. The 2024 base discretionary total includes: $886 billion for defense, $688 billion for non-defense discretionary spending, and $121 billion for veterans' medical care. These essential investments continue to repair the damage done by previous years of chronic underinvestment in everything from health care and infrastructure, to schooling and housing.

Major Discretionary Proposals

The President's discretionary investments fund the vital services and protections that Americans value, need, and deserve. Responsible fiscal policy recognizes that the quality of investments matter, and the budget's proposed increases across Cabinet departments provide for broadly supported investments that make our communities safer, lower household costs, and grow the economy from the bottom up and the middle out. Discretionary investments meet the daily needs of the American people, such as the President's $1.4 billion, or 10%, increase to the Social Security Administration to improve customer service for retirees, individuals with disabilities and their families. The following summary highlights departments with the most significant increases:

Department of Treasury —The budget provides a total of $16.3 billion, an increase of $2.1 billion, or 15 percent, over the 2023 enacted level, including $14.1 billion for the IRS. This includes an increase of $642 million to improve the taxpayer experience and expand customer service outreach to underserved communities and the entire taxpaying public.

Department of Agriculture — The budget includes $30.1 billion in discretionary funding, an increase of $3.8 billion, or 14.3 percent, over the 2023 enacted level. The Special Supplemental Nutrition Program for Women, Infants, and Children receives $6.3 billion, an increase of $300 million, or 5 percent, over the 2023 enacted level, to ensure all 6.5 million eligible individuals receive the benefits they need. The budget builds on the Inflation Reduction Act by providing $30 million for grants and $1 billion for loan guarantees for renewable energy systems and energy efficiency improvements for farmers. An additional $6.5 billion in authority is provided for rural electric loans to support more clean energy projects that create jobs.

Department of Education — The budget provides $90 billion, an increase of $10.8 billion, or 13.6 percent, over the 2023 enacted level. This funding includes $20.5 billion for Title I schools, which serve students in low-income communities. It also supports the expansion of high-quality pre-k, mental health care for students, grants for special education, and addressing educator shortages.

Department of Health and Human Services — The budget includes $145 billion for the Department of Health and Human Services, a $15 billion or 11.4 percent increase above the 2023 enacted level. Major policy priorities include $836 million for the 9-8-8 hotline, a 24/7 National Suicide Prevention Lifeline; $1 billion for the Biomedical Advanced Research and Development Authority to develop innovative medical countermeasures; $2 billion for Maternal and Child Health programs; $13 billion for Head Start; and $716 million for the National Cancer Institute to drive progress on ways to prevent, detect, and treat cancer.

President Biden's FY24 budget underscores Democrats' commitment to fiscal and social responsibility

President Biden and Congressional Democrats have worked to end the era of chronic underinvestment in America's potential and address longstanding and unmet needs in our communities. This economic strategy has not only produced historic progress, it's improved Americans' quality of life and expanded opportunities for families across America. President Biden's budget request for 2024 honors this commitment to fiscal and social responsibility, strengthening our fiscal outlook and achieving meaningful deficit reduction while prioritizing the health, safety, and economic well-being of the American people.

###