REPORT: Divisive GOP Tea Party Budget Massively Disinvests in America, Rewards the Wealthy, and Punishes Everyone Else

FY17 Republican Budget – March 2016

Summary and Analysis of the 2017 House Republican Budget

The 2017 House Republican budget resolution is a deeply divisive plan to protect wealthy and powerful interests at the expense of everybody else and of America's competitiveness. Instead of presenting a positive, constructive plan for the country, this budget merely serves as a vessel for the extreme Tea Party agenda. It relies on the continued failed theory of trickle-down economics, which holds that giving tax breaks to the people at the top of the economic ladder will somehow lift everybody else up. But the record is clear: that does not work. The Republican budget puts the entire burden of deficit reduction squarely on the middle class and those working their way into the middle class, while refusing to close a single special interest tax break to cut the deficit. It dramatically undermines American competitiveness by gutting crucial investments such as education, research, and transportation. This country needs to unite to address the challenges we face. Instead, this Republican budget divides America. It is a great budget for those who are already doing very well. But for everybody else – a struggling working family, a senior on Medicare, a student trying to afford college – this budget offers nothing but unnecessary hardship. Finally, the Republican claim that this budget reaches balance is fiction that relies on accounting gimmicks.

Disinvests In America and Dismantles Ladders of Opportunity

In the aftermath of the economic crisis of 2008, a Democratic Congress rejected the advice of those who pushed for a European-style austerity program to slash federal investments. The Democratic approach worked. The economy has created 14.3 million jobs over the past six years, despite a drag caused by Republican austerity efforts. In contrast, other advanced economies followed the austerity model and saw weaker growth – and today, many of these countries have abandoned their failed approach. The Republican budget unfortunately doubles down on that approach instead of following the Democratic success. It guts investments critical to generating broad-based prosperity and sharpening America's competitive edge in a global economy. A recent report by the Congressional Budget Office(CBO) notes that the Republican fiscal path will actually reduce economic growth over the next three years.

Reduces the deficit on the backs of the most vulnerable — The budget takes a totally unbalanced approach to deficit reduction. It does not achieve one penny of deficit reduction by closing tax loopholes; instead, it slashes spending programs, particularly those helping the most vulnerable Americans. The budget assumes $6.5 trillion in spending cuts, excluding war savings. Nearly $5 trillion of that total comes from the mandatory side of the budget, with the bulk – $3.5 trillion – coming from repeal of the Affordable Care Act and cuts to Medicare, Medicaid, and other health programs. Among other cuts, the largest mandatory reduction – almost $0.8 trillion – is to income security programs, such as nutrition assistance for the most vulnerable.

Supports Tea Party appeasement plan of $140 billion in cuts — In an attempt to placate Tea Party Members who want to renege on last fall's budget agreement, this Republican budget calls for special procedures for passing a package of mandatory spending cuts totaling $30 billion in 2017-2018 and $140 billion over ten years. The purpose of this package supposedly is to "pay for" increasing the 2017 discretionary funding caps by $30 billion above the woefully inadequate Budget Control Act sequester level, even though this cap increase has already been enacted into law and was already fully paid for in the 2015 Bipartisan Budget Act. House authorizing committees have already marked up bills to meet the resolution's new requirement. Unfortunately, the bills pile more hardships on families with low to moderate incomes or shift the costs of helping these families to the states. For example, one bill eliminates the Social Services Block Grant, taking away services from abused children, frail seniors, and other vulnerable populations. Another bill takes away the refundable portion of the Child Tax Credit from 3 million children.

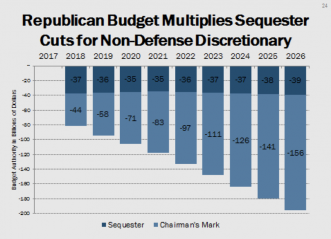

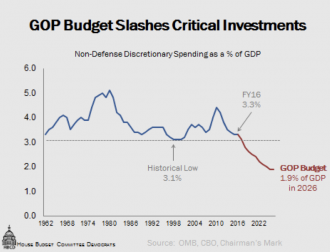

Disinvests in America by cutting non-defense discretionary (NDD) programs to absurdly low levels — For 2017, the Republican budget honors the bipartisan budget agreement by assuming $519 billion for non-defense appropriations. But for 2018 and beyond, the budget slashes NDD funding to preposterously low levels – freezing it at $472 billion for each year, with no adjustment for inflation or population growth. This means that for 2018, the budget cuts NDD by more than twice the amount of the already-deep sequester cut. By 2026, the NDD cut is five times larger than the cut under the austerity-level sequester. For 2018 through 2026, the Republican approach amounts to an additional cut of $887 billion below the already-low NDD levels set under current law, and more than $1 trillion below the amounts in the President's budget. NDD funding supports a wide variety of services and programs, such as research at the National Institutes of Health, food assistance provided through WIC, veterans' health care, and job training. Instead of finding a reasonable path forward to fund the nation's top priorities, this budget slashes funding to unrealistic levels, shortchanging investment and economic growth to reach arbitrary deficit targets. At the same time, the budget increases defense funding by $267 billion from current-law levels.

Abandons the nation's crumbling infrastructure —The budget cuts $184 billion, about 19 percent, from transportation funding over the coming decade, just when the country urgently needs to make significant investments in infrastructure. Many of our roads, bridges, and transit systems are in disrepair and fail to move as many goods and people as the economy demands. It makes no sense to defer these investments when infrastructure is falling apart and to forgo the many jobs and economic opportunities that would have been created in the interim.

Puts college out of reach for millions of students — The Republican budget slashes federal support for higher education by $185 billion over ten years. It freezes the maximum Pell grant forever, eliminating the already-paid-for $120 increase scheduled for next year as part of a $78 billion specific cut in Pell grant funding. The budget also makes student loans more expensive for needy undergraduates and eliminates loan repayment options that help students manage their debt. Instead of working to lower student loan debt – which already exceeds $1.3 trillion – the Republican budget cuts the very assistance that helps make college more affordable and accessible for millions of students.

Exposes veterans to cuts in benefits — The budget spares no one from its avalanche of cuts, not even veterans. It cuts funding below the President's request for veterans' health care and other discretionary programs by a total of $2.4 billion over 2017 and 2018, making it more challenging for the Department of Veterans Affairs to meet the growing demand for services. But that is just the tip of the iceberg as the Republican budget's nearly $887 billion in NDD cuts below sequestration levels for 2018-2026 will squeeze veterans' discretionary programs further. On the mandatory side of the veterans' budget, the outlook is just as dim. Republicans cut the portion of the budget that funds veterans' pensions, education, and other benefits by $46 billion over ten years. They claim that these savings can be achieved through efficiencies alone. However, it is hard to imagine how savings of this magnitude can be achieved without scaling back benefits.

Ignores immigration reform — Once again, the Republican budget rejects comprehensive immigration reform, despite widespread agreement that our immigration system is broken. Immigration reform would expand the size of the U.S. workforce, and in turn would increase the size of the economy and reduce deficits. By rejecting reform, the budget squanders an opportunity to reduce deficits by an estimated $900 billion over the next two decades, boost the economy by 5.4 percent, and extend the solvency of Social Security.

Continues Republican obsession with repealing the Affordable Care Act — The budget dismantles the Affordable Care Act (ACA), a law that has expanded health care coverage to 20 million Americans and reduced the uninsured rate to less than 10 percent, the lowest level on record. The budget eliminates tax credits to make insurance premiums more affordable, repeals the Medicaid expansion which has been taken up by 31 states and the District of Columbia so far, and cuts off young adults from their parents' plans. By claiming to repeal the ACA in full, the budget also rolls back important consumer protections like requiring insurance companies to cover people with pre-existing conditions, and it increases prescription drug costs for seniors with Medicare. CBO estimated that last year's reconciliation bill, which also repealed key provisions of the ACA, would cause 22 million Americans to lose coverage after 2017. For more than five years, Republicans have promised to "replace" the ACA, but their words have not translated into action.

Undermines financial oversight — The budget renews the Republican Congress's fight against the regulations put in place after the financial crisis that triggered a recession whose effects linger today. The budget seeks to end independent financing of the Consumer Financial Protection Bureau so Republicans can use the appropriations process to cut the Bureau's budget and limit its activities. The Bureau's efforts have already recovered $11.2 billion on behalf of more than 25.5 million consumers and service members. Republicans would also repeal regulators' ability to address the problems of a large financial institution before it fails. This means that a large "too-big-to-fail" bank could again take excessive risks and leave taxpayers potentially on the hook for massive losses. The budget also calls for the elimination of Fannie Mae and Freddie Mac. These entities provide critical support to the housing sector, helping make it possible for many hard-working Americans to obtain a mortgage and buy a home.

Continues to target federal employees for savings — Federal employees provide vital services to our nation on a daily basis. They include those who patrol and secure our borders, protect us from terrorists, take care of our veterans, help run our airports, counter cyber-attacks, and find cures to deadly diseases. Instead of thanking federal employees, the Republican budget cuts their pay. Under the Republican budget, federal employees will be required to make higher retirement contributions without receiving any additional benefits. These higher contributions are nothing more than a pay cut, with many federal employees seeing their take-home pay reduced by 6 percent as a result.

Redistributes Income to Top 1 Percent from Middle-Class and Poor Families

The Republican budget punishes people with the least power in Washington to provide favors to those with the most. Today, those at the top are doing great – CEOs make 300 times what their workers make, incomes of the top 1 percent have skyrocketed, and their share of total wealth is nearing all-time highs. At the same time, everyone else is working harder than ever, but feels like they are barely getting by. And yet this budget continues the failed trickle-down economics of more tax breaks for the wealthy at the expense of everyone else. It fails to close a single special interest tax break to reduce the deficit. It slashes the social safety net for struggling families, children, and senior citizens. Its intentionally vague tax policies should also be seen for what they really are – a smokescreen to push the radical Trump-Cruz tax agenda to give massive tax cuts to the wealthy.

Protects special interest tax breaks, but does nothing to help workers and families — The Republican budget continues to favor wealth over hard work and refuses to close a single special interest tax loophole to reduce the deficit, whether for corporate jets, big oil, hedge fund managers, or companies that shift jobs or profits overseas. While protecting those at the top, it does nothing to boost workers' paychecks, provide tax relief to help with the rising cost of childcare, or help Americans to save more. It even refuses to take the broadly bipartisan step of increasing the Earned Income Tax Credit for working adults without children.

Reflects the radical Trump-Cruz Tea Party tax agenda — The Republican budget is intentionally vague on its tax policies, but we should see it for what it is – a smokescreen to pass the radical Trump-Cruz Tea Party tax agenda that gives trillions of dollars in tax cuts to the wealthy. Republican presidential candidates all support the same approach – deficit-exploding tax plans that give massive tax cuts to those at the top while doing little to nothing for families struggling to get ahead. Nonpartisan analyses of the Trump and Cruz tax plans found that the top 1 percent get average tax cuts of over $340,000, while the very richest – the top 0.1 percent – get an average tax cut of over $1.6 million.

Slashes programs that help the most vulnerable Americans — Under the guise of enhancing "state flexibility," the budget makes steep cuts in the Supplemental Nutrition Assistance Program (SNAP) and Medicaid and converts them into block grants. This does nothing more than shift burdens on to states or leave vulnerable people without the assistance they need. Just as troubling, the budget does not include any of the evidence-based program enhancements proposed by the President, which could make a real difference in people's lives.

- Guts SNAP — The budget cuts $157 billion from SNAP over ten years, with $125 billion coming from the shift to a block grant. The vast majority of SNAP beneficiaries are children, elderly, or disabled. Research shows that access to SNAP has long-term benefits for the children it serves. The budget also proposes to tighten work requirements in SNAP for able-bodied adults without children. However, SNAP already has strict work requirements – this group can only receive benefits for three months in any three-year period unless they are employed or in job training for at least 20 hours per week. States can waive this requirement for areas of high unemployment, and many did during the downturn. Most of these waivers have ended, and up to 1 million people could lose their benefits this year under current law.

- Guts Medicaid — The budget cuts roughly $1 trillion from Medicaid and other health programs over ten years (in addition to cutting almost $1 trillion by repealing the ACA Medicaid expansion). Converting Medicaid into a block grant to states accounts for roughly $850 billion of this cut. The budget is vague on where the rest of the $1 trillion non-ACA cut comes from, but if it is all from Medicaid, this means the base Medicaid program is cut by up to one-third in 2026. An effort to block-grant Medicaid will severely undermine the health care safety net for 70 million vulnerable Americans, including children, low-income seniors, and people with disabilities. In 2012, CBO analyzed a block grant proposal and found that for states to manage their Medicaid programs at reduced funding levels, they would have to limit Medicaid eligibility, reduce benefits, cut payment rates, or increase out-of-pocket costs for beneficiaries.

- Shortchanges evidence-based programs — The Republican budget ignores the President's budget enhancements to key programs that have proven effective at improving low-income children's outcomes. The President's proposals include extending and expanding home-visiting and making permanent a program for child nutrition electronic benefits transfer in the summer to help students who lose access to school meals during the summer.

Makes It Harder to Have a Secure and Dignified Retirement

Ends the Medicare guarantee for future retirees — Once again, the budget endorses shifting the risks of growing health care costs onto seniors by converting Medicare into a premium support or voucher program in which people enrolling in Medicare in 2024 or later receive fixed payments toward the purchase of a private health plan or traditional Medicare.

- Shifts costs to seniors — Voucherizing Medicare is really just an exercise in unloading costs and financial risks onto people with Medicare. The budget claims this plan will "save" Medicare for the long term, but it does not say how. A CBO analysis of similar plans found the magnitude of future savings to be "highly uncertain." Yet the Republican budget claims to achieve significant long-term reductions in federal spending – at the same time that a growing population of retirees will put upward pressure on spending for Medicare, Medicaid, and Social Security. This is either an exercise in wishful thinking, or they are concealing certain features of their plan. The CBO analysis indicated that a Medicare voucher program can be reliably estimated to reduce federal Medicare spending significantly only if it also markedly increases costs to beneficiaries.

- Traditional Medicare withers away — Voucherizing Medicare would worsen private plans' tendencies to "cherry pick" the healthy. Sick and frail seniors tend to prefer traditional Medicare. They would face skyrocketing costs as the traditional Medicare patient pool becomes sicker over time. If a similar voucher plan were in effect in 2020, CBO found that people in traditional Medicare would pay Part B premiums 25 percent higher than current law – in essence forcing frail seniors to pay a premium surcharge to use the option they think best meets their needs.

Hurts current retirees in Medicare — The budget increases costs to current seniors by repealing Medicare benefit improvements in the ACA. Since 2010, 10.7 million Medicare beneficiaries have saved more than $20.8 billion on prescription drugs thanks to an ACA provision closing the Part D coverage gap ("donut hole") – an average savings of $1,945 per beneficiary. But the budget repeals this provision. If Republicans had succeeded in one of their numerous prior repeal attempts, nearly 5.2 million people with Medicare would have paid an additional $5.4 billion for their drugs – an average increase in out-of-pocket expenses of $1,054 per affected beneficiary – in 2015 alone. Overall, the budget cuts Medicare by $487 billion over ten years ($449 billion excluding ACA repeal), apparently through policies primarily affecting beneficiaries. This total includes:

- roughly $38 billion from repealing the ACA Medicare benefit improvements;

- unspecified savings from voucherizing Medicare starting in 2024;

- unspecified savings from gradually increasing the Medicare eligibility age to align with the Social Security normal retirement age, which is scheduled to rise to 67;

- unspecified savings from restructuring Part A and Part B cost-sharing, including establishing a unified deductible and catastrophic cap on out-of-pocket costs, and making changes to Medigap supplemental coverage;

- unspecified savings from changes to medical malpractice law; and

- unspecified savings from increasing Part B and Part D income-related premiums.

Includes Fast-Track Procedures to Push through Controversial Policies and Gimmicks to Mask the Budget's True Deficits

Calls for reconciliation savings from twelve committees — Budget reconciliation procedures can be a useful tool to enforce budget policies. They provide a fast-track approach, with limited time and ability to amend underlying language. Reconciliation has been used effectively in the past and undoubtedly will be called on in the future to make important changes that reflect American values. Unfortunately, that is unlikely to be the result from the Republican budget. Policies in this budget that could be moved through reconciliation would protect tax breaks for the wealthy at the expense of students, seniors, and everyone else.

Fast-tracks Social Security changes — The budget calls for a fast-track process for Congress to consider Social Security reform. This process could be used by Republicans to force passage of Social Security privatization or other benefit cuts. The process even requires the President to submit Social Security reform proposals that are supported by a Republican political appointee.

Counts ACA savings that the budget claims to repeal — While the budget claims to repeal the ACA entirely, its numbers assume that all of the law's roughly $2 trillion of revenues and Medicare savings remain in place. The budget numbers only reflect repeal of the ACA coverage expansion. Honestly reflecting the true, full cost of repeal would mean showing a deficit of several hundred billion dollars in 2026 instead of a small surplus.

Counts on unrealistic non-defense funding cuts — Republican budgets have assumed huge NDD funding cuts before, only to have their own appropriators reject the absurd levels when it came to passing funding bills. Congress was unable to pass spending bills at the austerity-level sequester cap last year, yet this budget cuts future funding well below those levels. Republicans are willing to flirt with shutdown-bait non-defense levels that their own colleagues cannot support, to reach fictional deficit targets on paper that are unlikely to materialize in reality.

So-called "balanced" budget is a bait-and-switch for trillion-dollar deficit increases — This so-called "balanced" budget is a classic bait-and-switch. If past is prologue, instead of achieving real balance, expect Republicans to pursue trillions of dollars of unpaid-for tax cuts for the top 1 percent. Then, when deficits predictably increase as a result of the tax cuts, Republicans will demand more spending cuts that hit seniors, students, and struggling families.

Still abuses the Overseas Contingency Operations (OCO) — The budget turns its back on the budget agreement by assuming $23 billion of the $74 billion OCO funding provided in the budget deal for 2017 is for base budget activities at the Pentagon. If that assumption is true, then the budget either underfunds the President's OCO request, likely in both the international and defense budgets, or it understates how much OCO will ultimately be provided.