Frequently Asked Questions about the Federal Budget

Watch our video series on this topic here.

Frequently Asked Questions about the Federal Budget:

What are estimated federal revenues, spending, and deficits for 2019?

What is the difference between discretionary and mandatory spending?

What are the discretionary caps?

What is the budget resolution?

What is budget reconciliation?

Does the President have to spend money Congress appropriates?

What is driving up deficits and debt in the future?

What are estimated federal revenues, spending, and deficits for 2019?

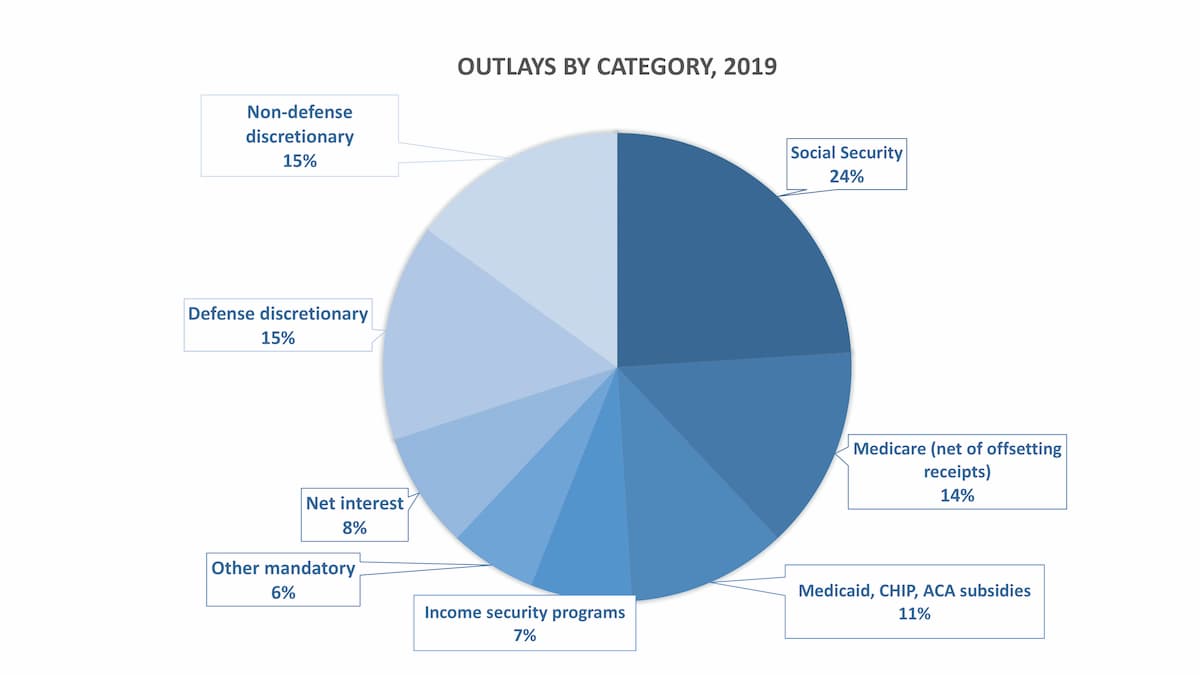

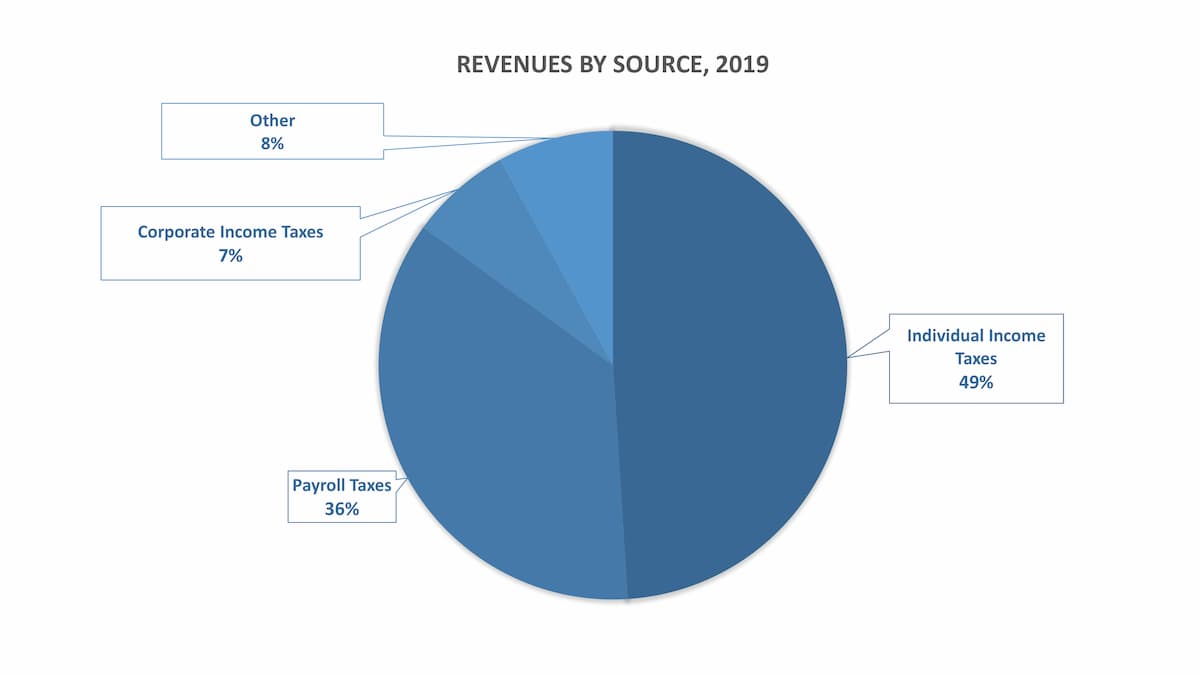

The Congressional Budget Office (CBO) projects federal spending for 2019 will be $4.4 trillion, with Social Security and major health care programs accounting for about half of this total. In addition, CBO estimates federal revenues will be $3.5 trillion, with individual income taxes making up almost one-half of this amount and payroll taxes contributing another one-third.

| 2019 Estimated Federal Budget | ||

| Total Budget | ||

| Revenues: | Spending: | Deficit: |

| $3.451 trillion | $4.411 trillion | $-960 billion |

What is the difference between discretionary and mandatory spending?

Congress controls discretionary spending through the annual appropriations process. This category of spending includes most defense programs, as well as important non-defense investments such as support for elementary and secondary education, veterans' health care, homeland security, workforce training, infrastructure, scientific research, public health, clean energy, advanced manufacturing, public safety, and other programs. In contrast, Congress controls mandatory programs by establishing program rules in permanent law. Rules include such things as who is eligible for benefits, how the benefits should be calculated, and when benefits should be paid. Two of the largest mandatory programs are Social Security and Medicare, which provide retirement security for millions of Americans. Other mandatory programs include Medicaid and the Children's Health Insurance Program (CHIP), subsidies for health insurance purchased through the marketplaces, unemployment compensation, income and nutrition assistance for children and families facing poverty, civilian and military retirement, certain farm programs, and veterans' pensions and education benefits.

What are the discretionary caps?

Among other things, the Budget Control Act of 2011 (BCA) set annual caps on defense and non-defense discretionary funding through 2021. Congress has since adjusted these limits several times: in 2013, 2015, 2018, and most recently in 2019, to avoid severely underfunding discretionary programs. If these caps are exceeded, an automatic process known as "sequester" would reduce funding to the required level. For more information on the BCA and why the spending limits required adjustments, see: Understanding Sequester: An Update for 2020.

What is the federal debt?

There are different measures used to describe the size of the federal debt. Debt held by the public is generally considered to be the most meaningful measure when looking at the effect of the federal debt on the economy. At the end of 2018, debt held by the public was $15.7 trillion. Another measure, gross federal debt, includes debt held by the public as well as federal debt that is held by agencies in the federal government (such as Social Security), and it stood at $21.5 trillion at the end of 2018.

What is the debt limit?

The debt limit is a ceiling Congress places on the total amount of dollars that the Treasury is authorized to borrow. It generally has no impact on the actual level of federal debt. The actual debt is determined by spending and tax laws previously passed by Congress.

The Treasury regularly issues new debt, not just to finance new borrowing but also to raise the cash to pay off existing debt that is coming due. Refusing to raise the debt limit would not be a decision to stop borrowing; it would prevent the Treasury from paying the bills for previous spending and would place the United States into default. The consequences of default would include higher interest rates for future government borrowing and throughout the economy, and it could well create a financial crisis.

In 2019, Congress suspended the debt limit until August 1, 2021, and called for it to increase to the level of debt outstanding on that date. Treasury has the authority to create some room for new borrowing after that date, so a default would not take place immediately. However, that authority is limited; a future Congress will have to act to avoid placing the country in default. The precise date is uncertain because the timing and amount of actual levels of federal spending and tax collection are uncertain.

What is the budget resolution?

The budget resolution is Congress' budget plan. By itself, it does not approve any spending or make changes to revenues coming into the government. It lays out a vision for spending by major functional category as well as revenues and the resulting deficits and debt. As part of the process, the budget resolution allocates spending across Congressional committees. The allocation to the Appropriations Committee sets the level of discretionary spending for the budget year. The resolution can also include reconciliation instructions, which can instruct Committees to make changes in mandatory programs or revenues.

For more information, see: Focus on Function: An Introduction

What is budget reconciliation?

In its budget resolution, Congress may include reconciliation instructions directing one or more committees to change existing law affecting spending, revenues, and/or the debt limit. Instructed committees can comply with their targets using any of the programs under their jurisdiction. In the Senate, the resulting reconciliation bill incorporating those proposals is considered under expedited procedures that limit debate and amendments. Like the budget resolution, a reconciliation bill cannot be filibustered in the Senate and therefore needs only a simple majority to move to a final vote. However, there are limitations on the substance of what can be included in a reconciliation bill, although a 60-vote majority in the Senate can override any objections.

For more information, see: Budget Reconciliation: The Basics

Does the President have to spend money Congress appropriates?

Yes, federal agencies must prudently plan to spend money during its period of availability, but the President can request that Congress cancel or rescind some of this funding. The Congressional Budget and Impoundment Control Act (Impoundment Control Act) of 1974 outlines a fast-track procedure for legislation responding to a President's rescission request. Upon submitting a proposal to Congress, the President can withhold the funds targeted for rescission for up to 45 days or until a withholding would prevent the funding from being prudently obligated. If Congress has not enacted legislation by the end of that period, the funds must be released, and they cannot be proposed for rescission again under the Impoundment Control Act. Until 2018, a president had not proposed a rescission under this process since 2000. In May 2018, President Trump sent a package of proposed rescissions to Congress for consideration. Congress did not act on that request to approve any of the proposed reductions under the fast-track procedure, and the funding was released.

How does the government ensure that agencies don't spend more than Congress approves? What is an apportionment?

In general, the Antideficiency Act requires the President to apportion, in writing, all appropriations enacted into law for the executive branch. An apportionment is a legally binding document that allows an agency to spend its enacted appropriations. The overarching purpose of the apportionment process is to prevent deficiencies—i.e., to make sure agencies use time-limited appropriations at an appropriate pace (so that, for example, a program does not run out of money before the fiscal year is over) and use appropriations available for an indefinite time period effectively and economically. The Office of Management and Budget, via delegation from the President, approves all apportionments for the executive branch.

Apportionments generally divide amounts by specific time period or among projects or activities. They may contain footnotes, which provide additional direction to agencies and are also legally binding. After funding has been apportioned, agencies decide how to further allocate it, provided that such decisions are consistent with the apportionment and enacted law.

What is driving up deficits and debt in the future?

Most close observers of the federal budget agree that over the long term if there are no changes in government policies, deficits will grow, pushing debt to unsustainable levels. Deficits are projected to roughly double relative to the size of the economy from 2019 to 2049, as growth in spending for Social Security and major health care programs outpaces growth in revenues. The projected growth in spending for Social Security and health care programs, mostly Medicare, is driven largely by an aging population and growth in health care costs per capita. It is important to note that spending is not growing across the board. Outside of Social Security and health care, all other mandatory spending – including safety-net programs such as nutrition assistance and unemployment compensation – is expected to decline as a percentage of GDP over the next decade. Discretionary spending is expected to decline as a percentage of GDP as well. On the other side of the ledger, federal revenues are projected to grow much more slowly than spending over the next three decades. CBO now projects that revenues will increase by about half as much as spending over the next 30 years. That gap would widen further if Congress chooses to extend certain temporary tax cuts that were enacted in 2017.