FAQs on Sequester: An Update for 2020

1. What sequester mechanisms are currently in play?

There are two separate areas of law that either mandate or could lead to automatic reductions in spending, commonly referred to as "sequestration."

The Statutory Pay-As-You-Go (PAYGO) Act of 2010 aims to ensure that, on net, enacted legislation affecting direct spending or revenues does not increase projected deficits. If the requirements of the law are not met, the executive branch is required to implement automatic spending reductions. Statutory PAYGO sequestration has never occurred – when automatic reductions would have been triggered, Congress has always waived or delayed them from taking effect.

The Budget Control Act of 2011 (BCA), which amended the Budget Control and Emergency Deficit Control Act of 1985 (BBEDCA), created a Joint Select Committee on Deficit Reduction, which was tasked with reaching agreement on a comprehensive deficit reduction package. When the Committee failed, backup procedures in the law created an enforcement mechanism of automatic cuts. This mechanism originally required nine annual "sequestrations" (in each of the fiscal years 2013-2021) of $109 billion, affecting both mandatory and discretionary spending.

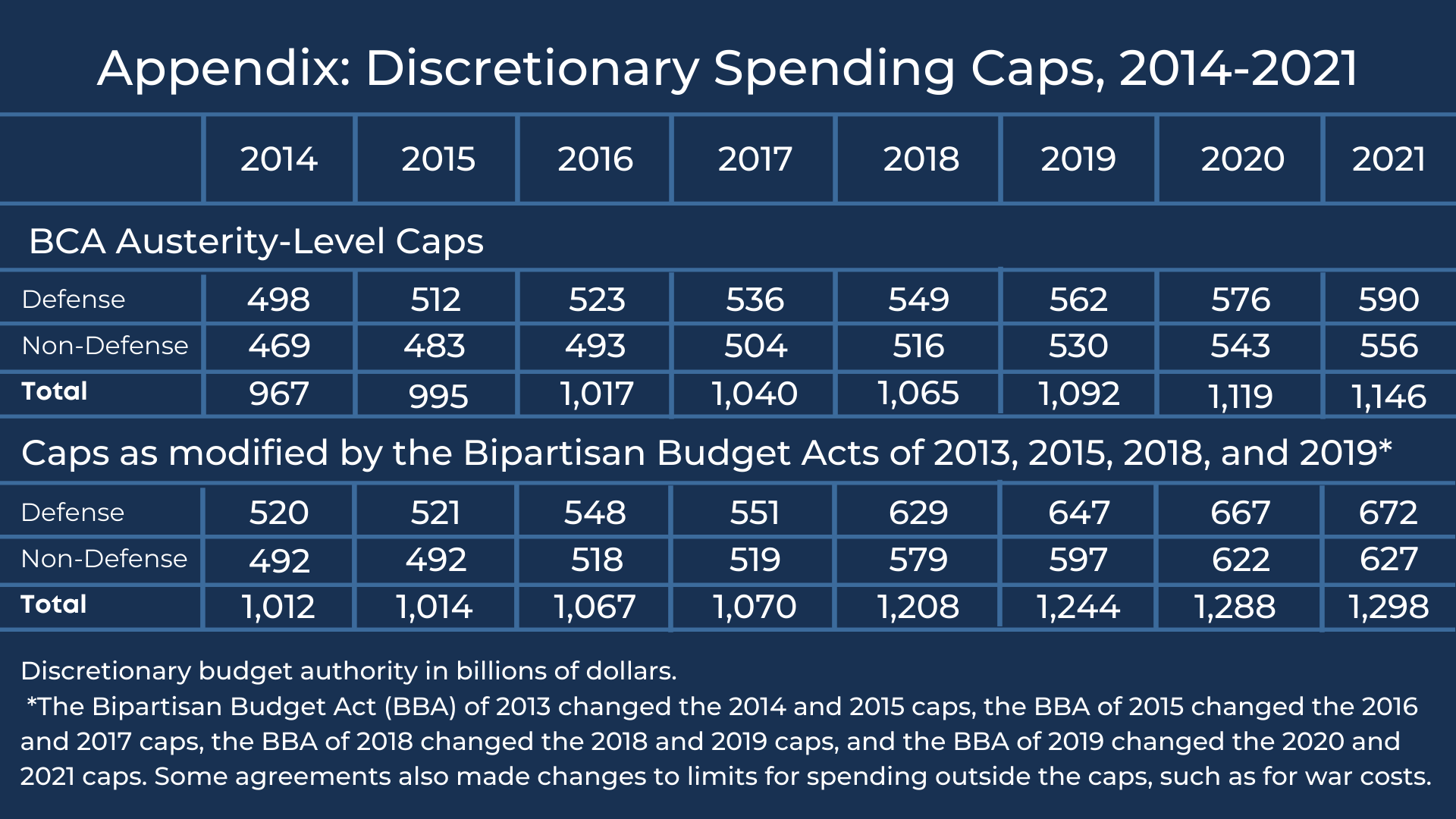

On the discretionary side, starting in 2014, the BCA put into place extremely tight spending caps through 2021, with separate caps for defense and non-defense. But Congress never allowed the BCA's unrealistically low funding caps to take effect. Instead, Congress passed legislation raising the caps four times: most recently in August, when the Bipartisan Budget Act (BBA) of 2019 raised the discretionary caps for 2020 and 2021 and suspended the debt limit for two years. The discretionary caps are enforceable through across-the-board cuts – also referred to as sequestration – if Congress enacts appropriations that exceed the caps. (For a table that compares the BCA austerity-level discretionary caps and the caps as modified by the Bipartisan Budget Acts of 2013, 2015, 2018, and 2019 see the Appendix.)

On the mandatory side, the BCA required across-the-board cuts to non-exempt funding. Congress has extended the mandatory sequester several times. The remainder of these FAQs will focus on the sequestration of mandatory spending required by the BCA.

2. How is the aggregate mandatory sequester determined?

The required spending cuts in the BCA were intended to come half from defense programs and half from non-defense programs. The defense category is the federal budget's national defense function, which includes the Department of Defense, nuclear-weapons related activities at the Department of Energy, and the national security activities of several other agencies (such as the Coast Guard and Federal Bureau of Investigation). Non-defense is everything else. The defense category has few mandatory programs, so nearly all the defense reduction was applied to discretionary programs. On the non-defense side, roughly one-third of the non-defense savings originally came from mandatory spending and the rest from a reduction in discretionary spending.

Within each category, the BCA allocated the savings proportionally across discretionary and non-exempt mandatory programs. The discretionary savings were converted into the BCA's strict caps on discretionary appropriations. On the mandatory side, each year the Office of Management and Budget (OMB) calculates the percentage and dollar amount to be taken from affected programs to achieve the total mandatory cut required by the BCA. When Congress raised the discretionary caps, it directed that the mandatory sequester calculations be made as if the caps had not been raised.

Unlike discretionary spending caps, which expire after 2021, sequestration of mandatory spending has been extended on several occasions. The BBA of 2013 extended the mandatory sequester through 2023, and then a law modifying military retiree benefits extended the sequester through 2024. The BBA of 2015 extended the sequester through 2025; the BBA of 2018 extended the sequester through 2027; the BBA of 2019 extended the sequester through 2029; and the Coronavirus Aid, Relief, and Economic Security (CARES Act) of 2020 extended the sequester through 2030.

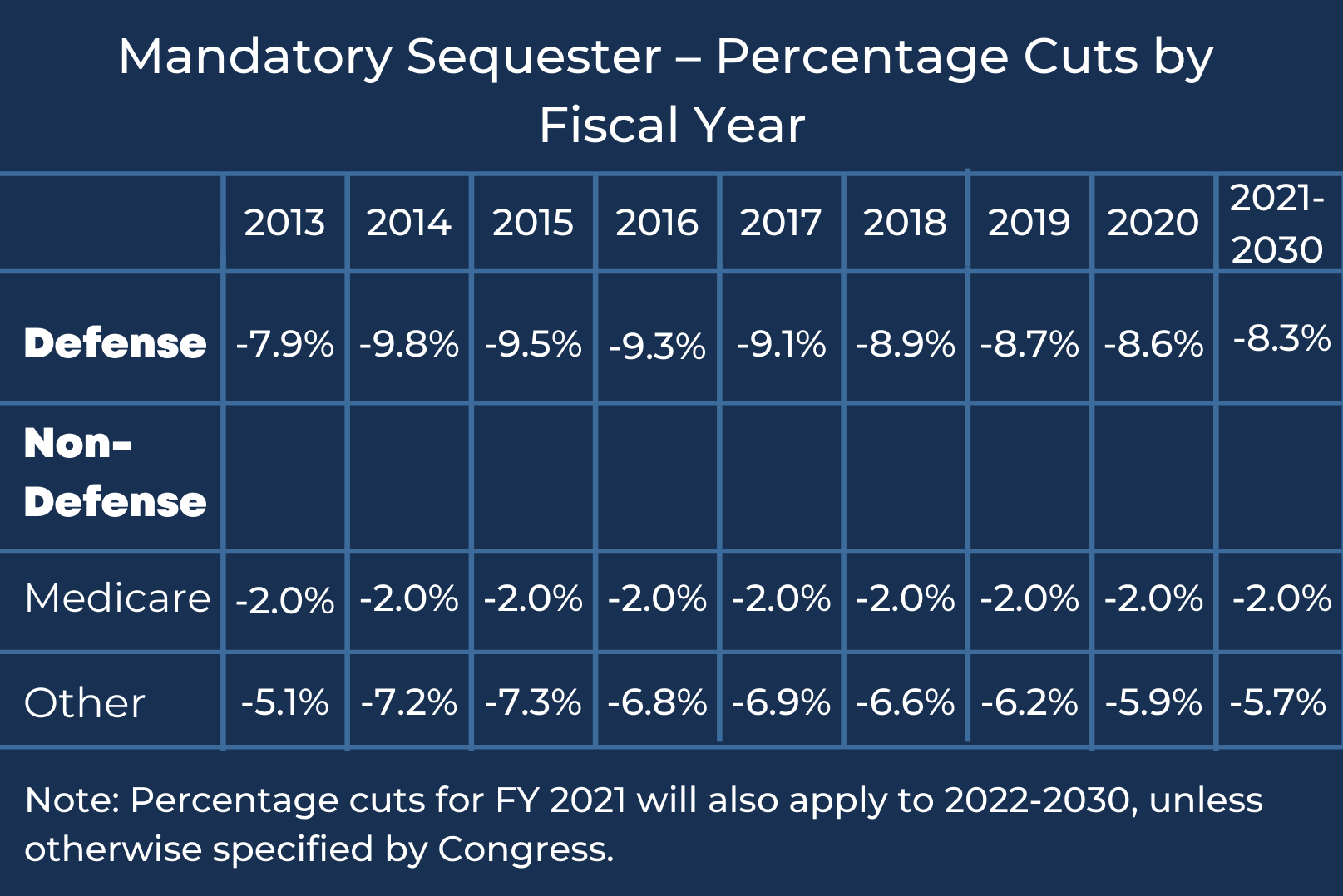

These extensions did not specify the amount of savings that the sequester would need to achieve in fiscal years after FY 2021, but instead directed OMB to apply the percentage reductions calculated for FY 2021 to subsequent fiscal years. Those percentages were released by OMB in February 2020, and are also listed in FAQ #4.

3. How is the mandatory sequester allocated? What programs are exempt?

Under the BCA, across-the-board reductions are made to all mandatory programs that are not specifically exempt. However, most mandatory spending is exempt, including Social Security, veterans' programs, Medicaid and other low-income programs, and net interest. In addition, the cut is limited for certain programs, such as Medicare, which receives cuts to providers that are capped at 2 percent regardless of the size of the sequester.

Even though the Medicare cut is limited, it still comprises about three-quarters of the non-defense mandatory sequester in dollar terms. The remaining reductions come mostly from farm programs, but student loans, the Social Service Block Grant, vocational rehabilitation, and dozens of other programs are also affected.

4. How big are the mandatory sequestration cuts?

Excluding 2013, eligible non-defense non-Medicare mandatory programs have been cut through sequester by about 6 to 7 percent, and defense mandatory programs by about 9 percent. This represents about $20 billion for non-defense and less than $1 billion for defense per year, and are the full cuts called for under the Budget Control Act.

5. How does the Medicare sequestration cut work?

The BCA limits the reduction to Medicare benefit payments and Medicare Integrity Program spending to 2 percent. The cap does not apply to certain Medicare administrative spending classified as mandatory, which is sequestered at the rate that applies to all other non-defense mandatory programs—5.7 percent in FY 2021 and beyond. (Most Medicare administrative spending is discretionary, however, and thus not subject to this sequester.)

The 2 percent cut is a reduction in payments to Medicare providers and plans and has been in place every year since 2013. Beneficiaries see few direct impacts, as the sequester does not affect their benefit structure.

According to OMB's most recent sequestration report, the FY 2021 sequester would reduce Medicare spending by $16.2 billion. That represents 2 percent of the base of $809 billion in Medicare spending that year that is subject to the 2 percent cap.

6. How does the CARES Act affect the sequester?

The Coronavirus Aid, Relief, and Economic Security (CARES Act) of 2020 does two things. First, it temporarily suspends the Medicare sequester from taking effect between May 1, 2020 and December 31, 2020. This means that Medicare plans and providers would receive an increase in payment rates of approximately 2 percent more than what they otherwise would have received during this time.

Second, it extended the mandatory sequester for one additional year. This means that mandatory spending for all non-exempt programs, including Medicare and non-Medicare, will be reduced through 2030.