President Trump Has Failed the American Economy

President Trump's unwillingness to contain the COVID-19 pandemic constitutes one of the most catastrophic failures of leadership in our nation's history. His brazenlies about the virus' lethality and spread, shamefulefforts to hide critical information from the American people andslander public health experts, and his reprehensible convenings of his very own superspreaderevents across the country collectively illustrate the degree to which he has abdicated responsibility for our nation's safety and security. President Trump's refusal to develop a national strategy to defeat – let alone contain – the virus has resulted in thousands of avoidabledeaths and the most severe economic crisis in a generation.

In the face of this colossal failure, small businesses across the country are closing their doors for good, families are facing hunger and eviction, and millions of Americans are still having to make the impossible choice between their health and a paycheck. But taking stock of President Trump's record even before the pandemic makes clear that he was mismanaging the economy from the beginning. Despite inheriting a growing economy with low unemployment from the previous Democratic administration, President Trump squandered countless opportunities to address longstanding economic challenges, strengthen families' economic security, and invest in our future prosperity. Instead, his record during the first three years of his presidency, prior to the pandemic, is one of recklessness, bluster, and the prioritization of the wealthy and well-connected over everyone else. President Trump has failed the American people and the economy again and again.

The Economy Remains in a Massive Hole

Seven months into the crisis, COVID-19 and the Trump Administration's failure to control it continue to constrain the recovery. While the economy, with the help of the CARES Act, has made critical progress since Spring 2020, output and employment are still extremely depressed relative to their levels before the pandemic. And with labor market gains slowing and economic hardship on the rise, a brutally uneven and needlessly slow recovery will be all but guaranteed unless more fiscal support is delivered immediately.

Our Economy Is Smaller Than It Was Last Year

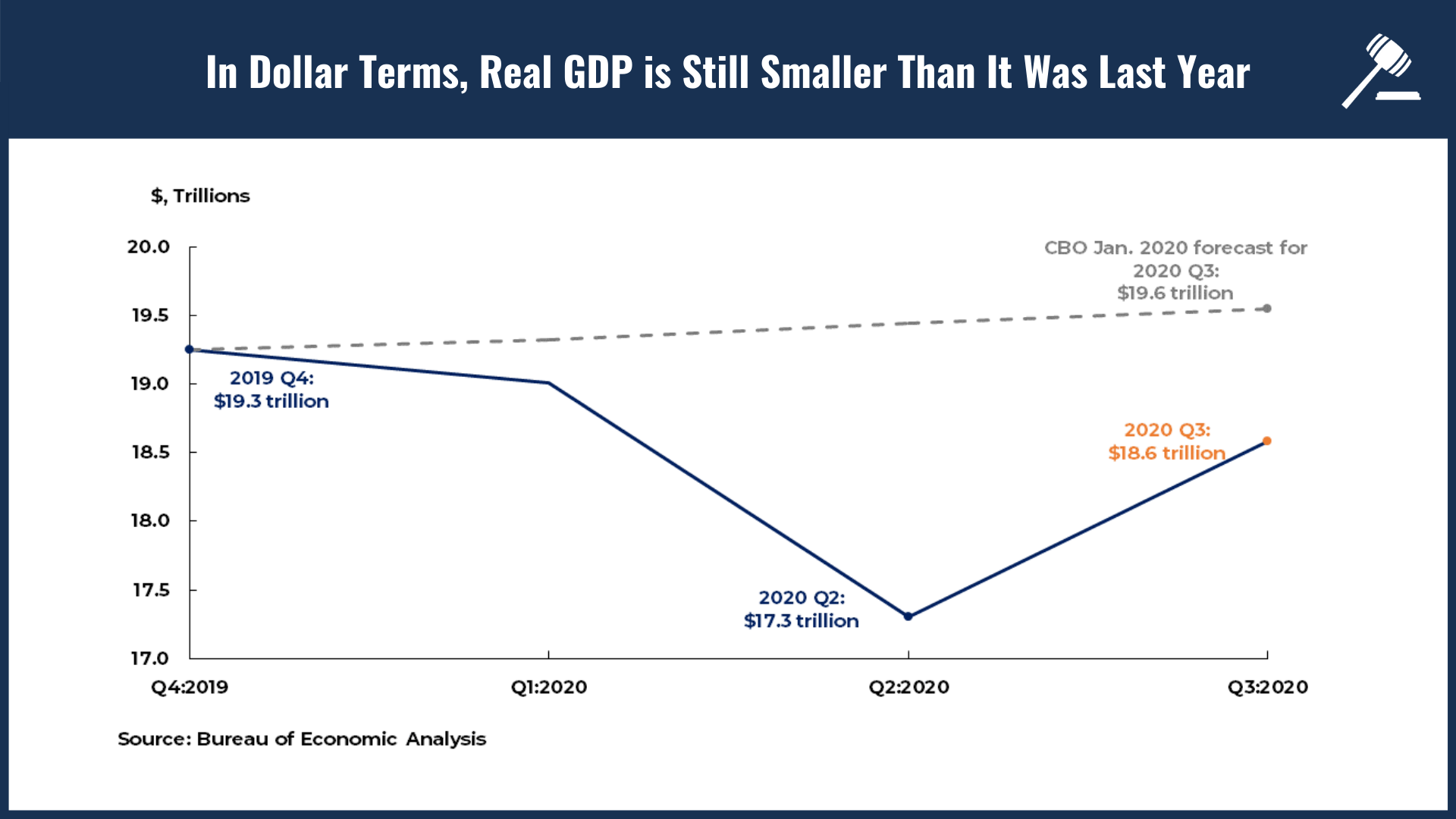

Real GDP grew by 7.4 percent (equivalent to a 33.1 percent annual rate of growth) in the third quarter of this year.[1] While this is the fastest quarter of growth on record, this was nearly inevitable as it follows the steepest collapse on record in the second quarter, when real GDP fell by 9 percent (equivalent to a 31.4 percent annualized decline). Given the sheer magnitude of the second-quarter contraction – which wiped away five years of growth in just three months – even a modest rebound was guaranteed to generate record-breaking growth rates in the third quarter.

Even so, growth last quarter was not nearly enough to return our economy to where it was at the end of last year. Real GDP is still 3.5 percent lower than its level in the fourth quarter of 2019 – a hole about as deep as the Great Recession. Indeed, returning our economy to its size at the end of last year would have required real GDP growth of more than 53 percent on an annualized basis. The economy remains in an even deeper hole when considering our pre-pandemic trajectory: compared to what the Congressional Budget Office (CBO) expected in January, real GDP in the third quarter was 5 percent lower.

Looking ahead, the outlook is dim. Forecasters have lowered their expectations for fourth-quarter growth in light of President Trump's failure to lead Republicans to a deal on a new fiscal relief package. Absent additional fiscal support, CBO does not expect the economy will fully recover even by the end of the decade, with cumulative real GDP projected to be nearly $8 trillion lower than projected at the beginning of the year. Accounting for the economic effects of pandemic-related deaths, disease, and mental illness in addition to lost economic output, it is estimated that COVID-19 will cost the United States $16 trillion.

We Have a Massive Jobs Crisis

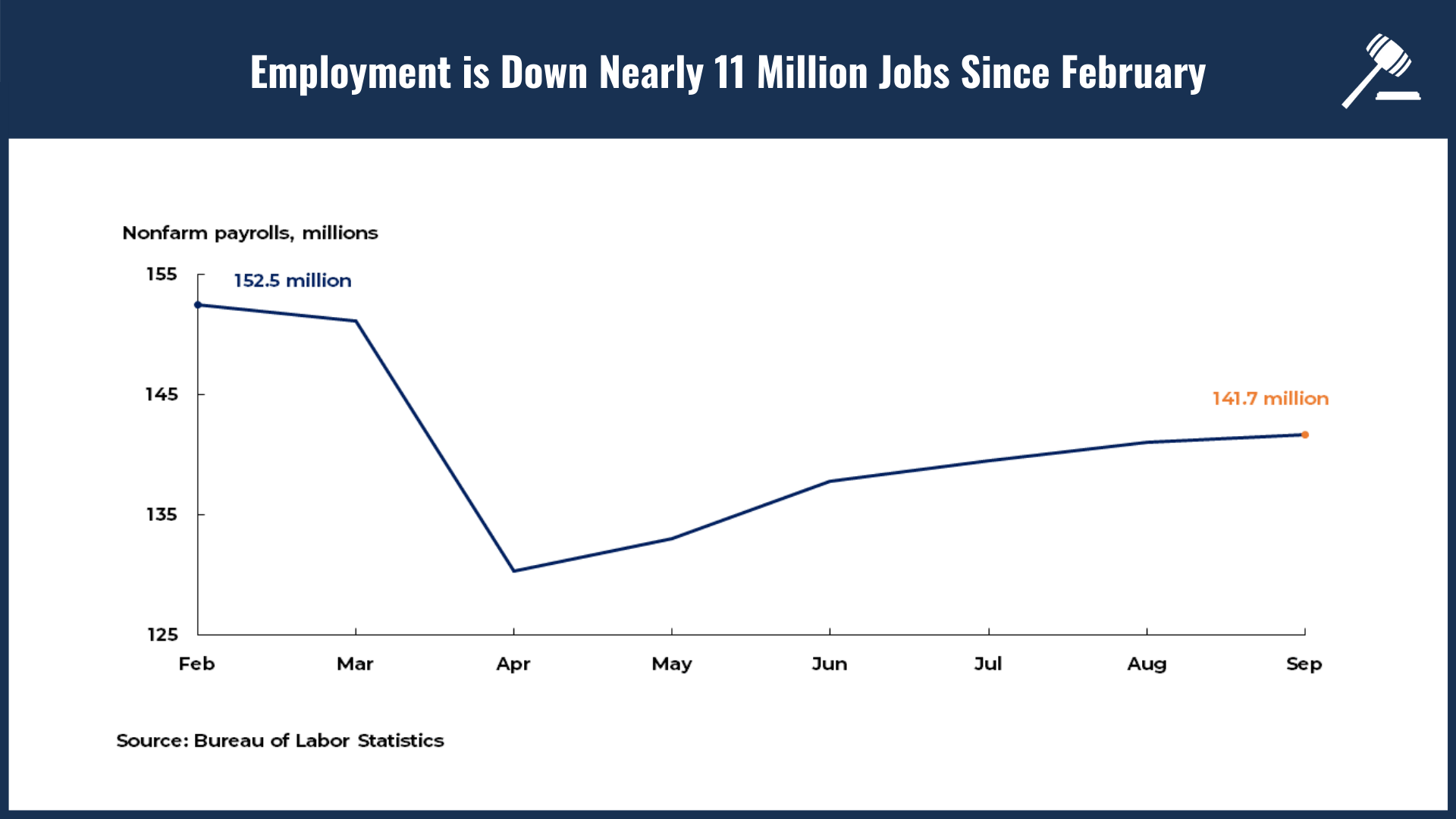

Having only recouped just overhalf of the record 22 million jobs lost in March and April, the economy is still down nearly 11 million jobs since February – an even deeper hole than the nearly 9 million jobs lost during the Great Recession. Yet filling this enormous gap is becoming more difficult amid rising business closures and slowing job growth. The number of jobs added in September was less than half the number added in August: if gains continued at the September pace, it would take us nearly a year and a half to return to February employment levels and more than 2 years to return to our pre-pandemic trajectory.

As payroll employment has slowed, the number of workers permanentlylaid offhas steadily crept up toward Great Recession levels, while many have left the labor force altogether. Nearly 900,000 women – four times the number of men – left the workforce in September alone, threatening to erode years of progress in narrowing gender pay and employment gaps. In total, 4.4 million people have left the labor force since February. Even for those Americans currently working, millions have seen cuts to their hours and pay, and millionsmore are not working from home and may be risking their health on the job.

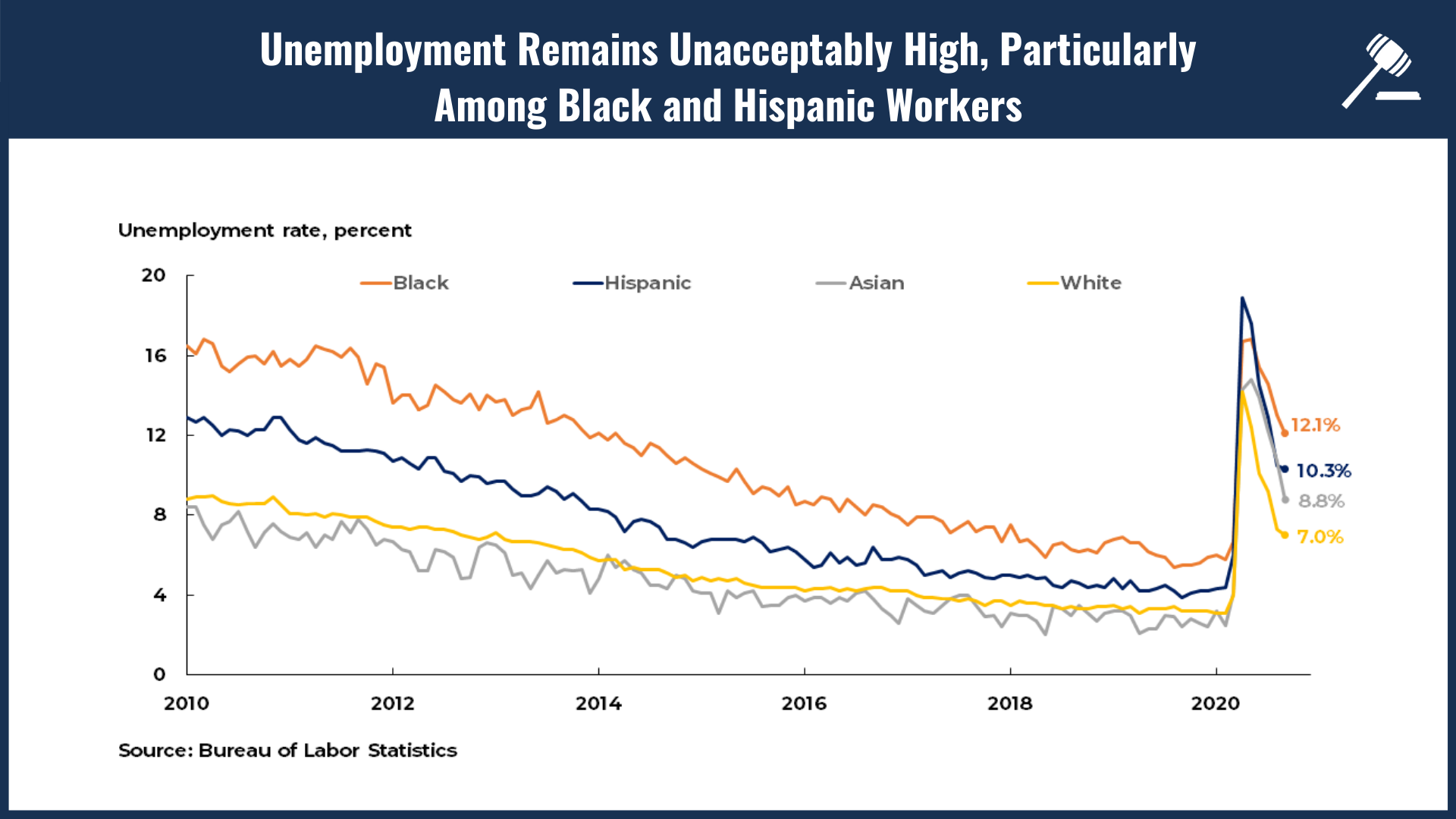

The labor market slowdown is especially troubling given that the recovery to date is the most unequal on record, further exacerbating disparities that plagued the labor market before the pandemic. While white Americans have regained 58 percent of employment lost between February and April, Black Americans have regained just 35 percent. And while the headline unemployment rate remains unacceptably high at 7.9 percent – above the peaks reached during the recessions of the early 1990s and 2000s – it is dwarfed by unemployment rates for Black and Hispanic workers that still exceed 12 and 10 percent, respectively. In addition, employment among workers in low-wage jobs is still down about 20 percent from before the pandemic, whereas employment among people in high-wage jobs has nearly fully recovered.

Economic Hardship Is Elevated Across the Country

Amid this wobbly recovery, millions of Americans are still struggling to meet their basic needs. The CARES Act's core supports – notably the weekly $600 unemployment insurance (UI) supplement and the one-time Economic Impact Payments – cushioned consumer spending and enabled jobless workers to stow away a small amount of savings. But after Republicans allowed the UI supplement to expire in July, and continue to block new relief, these reserves are largely depleted. Consequently:

- Millions are trying to survive on a fraction of their prior wages: More than 20 million Americans were claiming UI benefits in late October. With the expiration of the $600 supplement – and with most states having already exhausted funds for President Trump's too little, too late attempt to provide a supplement via executive order – many workers are trying to make ends meet with less than 40 percent of their previous earnings. Expiration of additional CARES Act UI programs at the end of the year also threatens to push more than 13 million people off UI entirely.

- Families are going hungry: Among households with children, 1 in 7 surveyed in October said they did not have enough to eat in the last week, an increase from early May. Food insufficiency rates were roughly twice as high for Black and Hispanic households compared to white households with children.

- Households are struggling to pay rent: Nearly 1-in-6 adult renters were behind on rent in early October. Millions more are at risk of having their electricity, water, and gas cut as state moratoriums on utility disconnection expire.

- Poverty is up: While the CARES Act directly lifted 18 million people out of poverty in April – lowering the poverty rate relative to pre-pandemic levels – exhaustion of key relief has pushed 8 million Americans into poverty since May.

Even Before the Pandemic, Trump Failed to "Unleash an Economic Miracle"

President Trump's failure to save the economy from the coronavirus is consistent with his record of failure before the pandemic. Upon inheriting a growing economy with low and falling unemployment from the Obama Administration, President Trump's first order of business was to squander $2 trillion on a taxgiveaway that showered unnecessary benefits on corporations and the wealthy with little to show for it. Like his tax scam, progress on the President's other major promises – to eliminate the trade deficit; that China would pay for the costs of his tariffs; that manufacturing would boom; everyone would have health insurance – not only failed to materialize, but in many cases moved in the wrong direction. The share of Americans uninsured has grown every year he has been in office, for instance, reversing six consecutive years of insurance gains prior to his presidency. Rather than put his economic inheritance to good use, President Trump failed to meaningfully change the economy's trajectory or achieve his major economic goals before running the economy further into the ground with his mismanagement of COVID-19.

Economic Growth Was Lackluster

Annual economic growth failed to accelerate under President Trump, denying him of his goal of 3 percent – let alone "4, 5, and maybe even 6" percent – growth each year. Annual economic growth averaged 2.5 percent across President Trump's first three years in office, in line with the average growth rate during President Obama's last three years. And while the economy grew by 3 percent in 2018, the best year of President Trump's term, the last time annual growth actually exceeded 3 percent was in 2015, under President Obama.

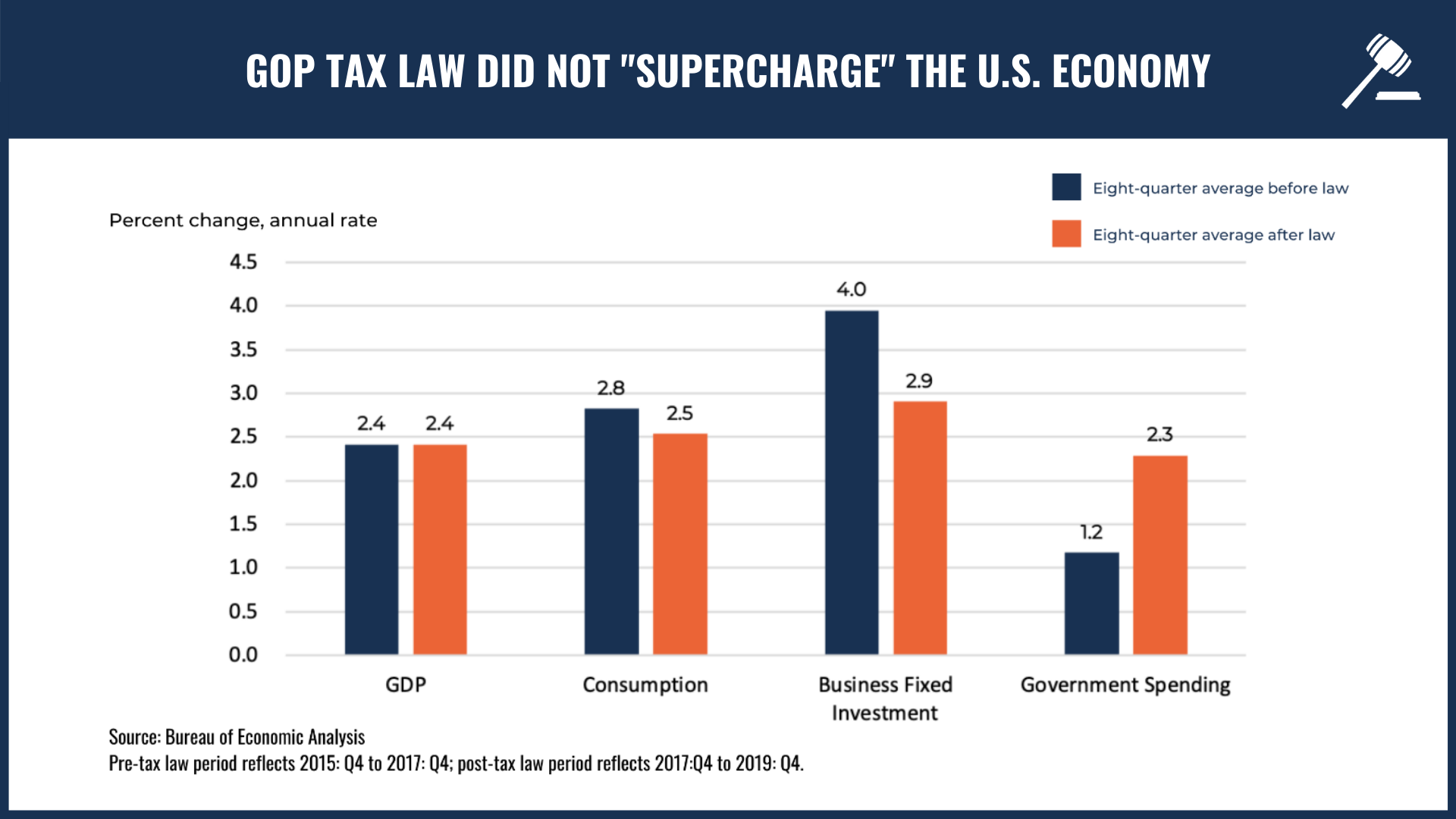

President Trump's failure to "supercharge" the economy is even clearer when narrowing in on his signature policy, the 2017 tax law. Economic growth in the eight quarters after the law was enacted averaged 2.4 percent, the same growth rate as in the eight quarters before the law. Notably, this growth was driven by government spending rather than by business investment or consumption, both of which slowed after enactment.

Ironically, the one area where President Trump has succeeded in meeting one of his stated goals – limiting immigration into the United States – has dangerously weakened our economic outlook. Legal immigration is projected to fall by almost half between fiscal years 2016 and 2021 due to the Trump Administration's policies, reducing annual labor force growth – one of the primary components for economic growth – by nearly 60 percent. Continuing immigration at these reduced levels would translate to 20 million fewer workers in the economy by 2060, exacerbating the demographic trends driving our economic and fiscal challenges over the coming decades. Given that immigrants also play an outsized role in founding new businesses and promoting innovation, these restrictive policies have doubly undermined our economic potential and jeopardized our nation's standing as the most dynamic economy in the world.

Job Growth Slowed

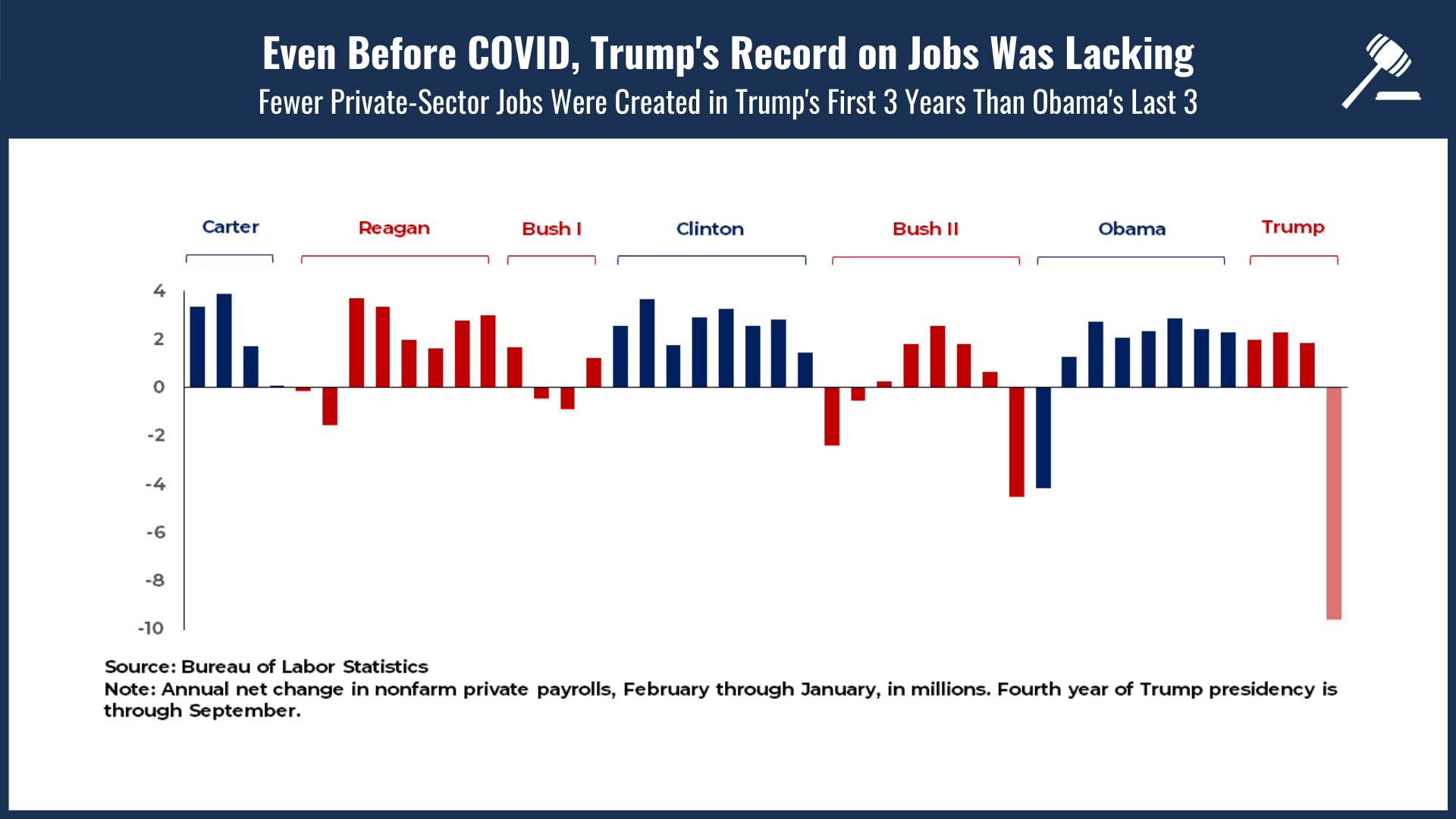

As with economic growth, President Trump's pre-COVID record on the labor market falls wildly short of his claims. Private-sector job creation slowed under his watch, with 1.4 millionfewer jobs added during his first three years in office than during President Obama's final three years. Once again, the 2017 tax law failed to provide a boost: fewer jobs were created after the law's enactment than before it. In fact, contrary to President Trump's promises that he would keep American jobs at home, 12,500 more jobs were shipped overseas under his first term than under President Obama's second – an unsurprising outcome given that the tax law incentivized companies to move jobs and profits offshore.

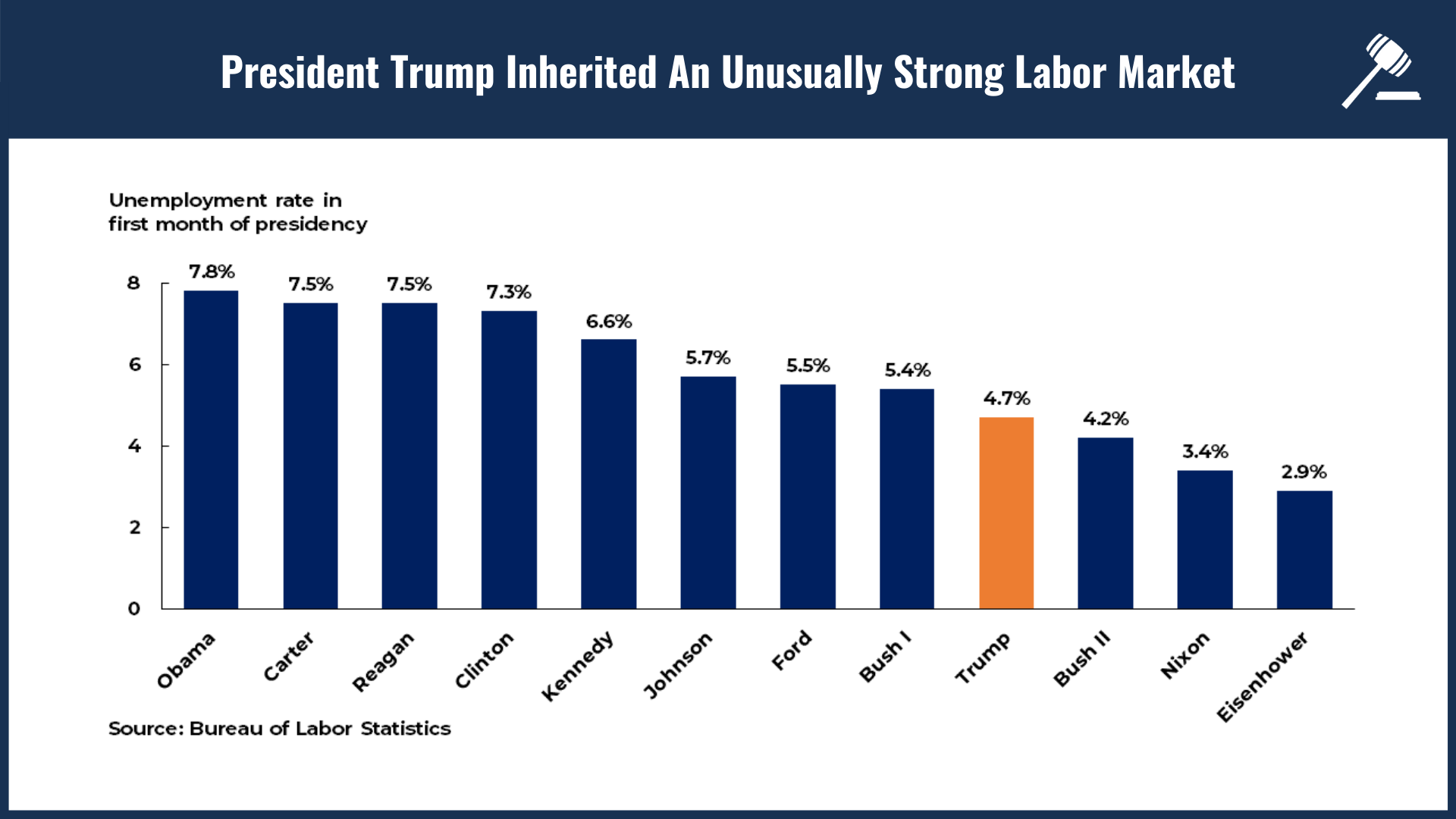

President Trump's lackluster jobs performance undermines his attempts to claim credit for an "economic turnaround of historic proportions." While unemployment was just 3.5 percent before the pandemic hit, President Trump came into office when unemployment had been falling steadily for seven years, from its Great Recession peak of 10 percent to 4.7 percent. In fact, compared to previous administrations, President Trump inherited an unusually low rate of unemployment: in the last 70 years, only three presidents entered office with lower unemployment rates than he enjoyed. If anyone could credibly claim an economic turnaround, it would be President Obama, who came into office with the highest unemployment rate of any president since records began in 1948 (and likely since Roosevelt in 1933).

There was also no improvement in workers' take-home pay under President Trump. Inflation-adjusted average hourly earnings for production and nonsupervisory workers (who account for 80 percent of the workforce) grew by 1.2 percent, on average, in his first three years, compared to 1.3 percent inPresident Obama's last three years. Real median annual earnings, moreover, grew a percentage point slower under President Trump than under his predecessor.

Inequality Was Growing

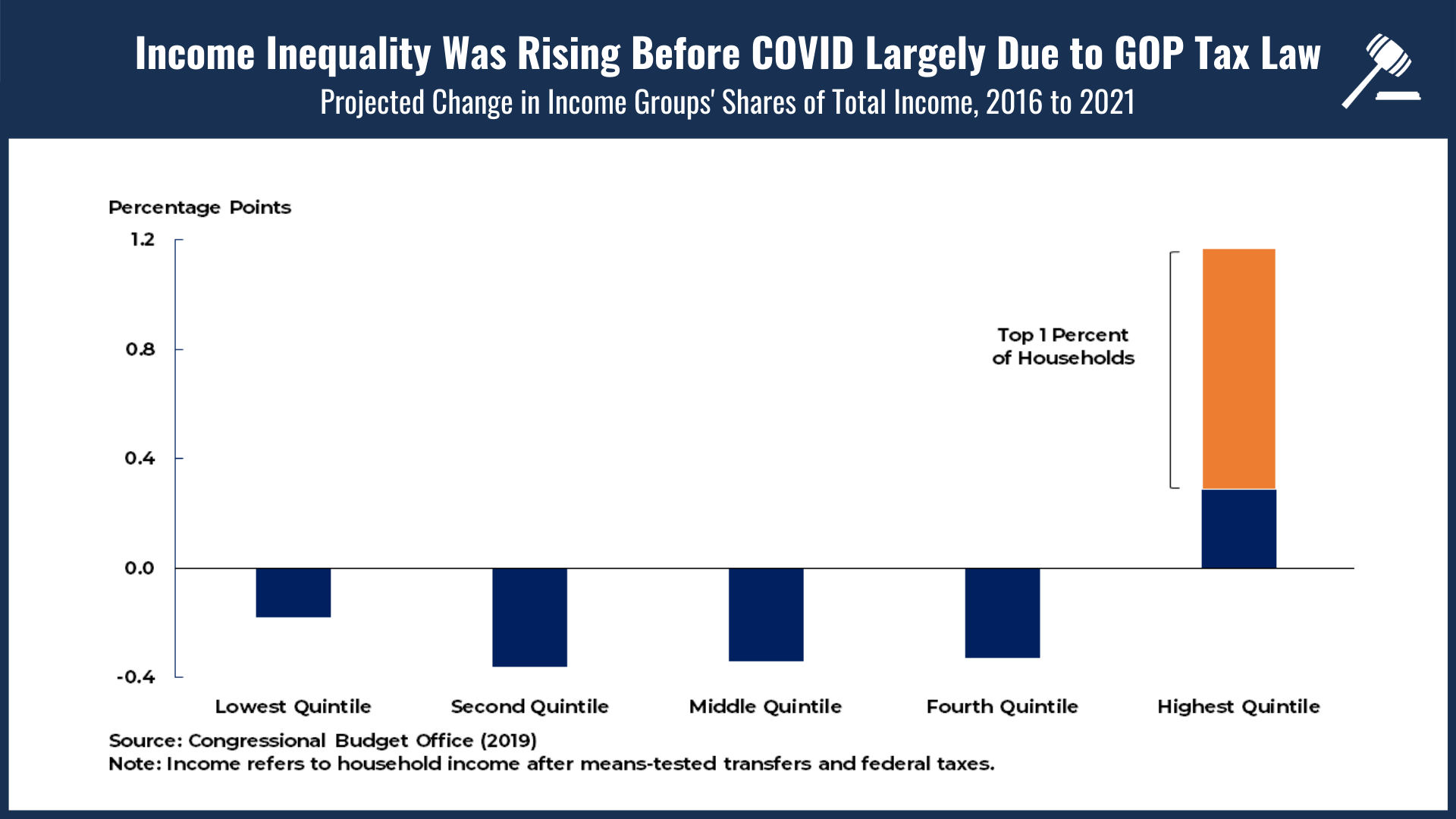

While COVID-19 threatens to severely worsen longstanding economic inequities, President Trump's policies were increasing inequality before the pandemic hit. In a report released last December, CBO projected that total real household income would be more concentrated at the top in 2021 than it was in 2016. The average income (after taxes and transfers) of the top 1 percent of households was expected to grow at an average annual rate of 3.1 percent between 2016 and 2021 – about three times as fast as income growth for the bottom 60 percent. By 2021, the bottom 80 percent of households would see their shares of total income shrink relative to 2016, while the top 1 percent would see their share rise from 12.5 percent to 13.4 percent.

As the CBO report notes, "the change affecting the distribution of household income most significantly is the implementation of the 2017 tax act." Indeed, according to one estimate, the richest fifth of Americans received nearly two-thirds of the total benefits of the tax law in 2018; by 2027, the top 1 percent alone would receive 83 percent of the total benefits. This tilt toward the wealthy is also widening racial inequities, with Black and Latino Americans reaping disproportionately fewer benefits from the tax law relative to the share of total income they earn. President Trump's failure to control COVID-19 and ensure an equitable economic recovery is accelerating trends that his tax law worsened.

Rebuilding the Economy Will Require Sustained Fiscal Support

Salvaging a thriving and equitable economy from the wreckage of the Trump Administration's failures will require aggressive fiscal relief in the near term and a bold program of sustained public investment over the longer term. To defeat COVID-19 and support a broader-based recovery, Congress mustprovidewhatever resources are needed to contain the virus and keep families, small businesses, and state and local governments afloat. This is necessary not only to alleviate suffering but also to save jobs, cushion consumer spending, and buoy economic growth – speeding our recovery by years. The updated version of the Heroes Act, which House Democrats passed earlier this month and which congressional Republicans continue to block, is the right place to start.

In the years ahead, we will also need to correct for decades of public underinvestment – in infrastructure, health, education, and more – that has undermined our collective prosperity, weakened families' economic security, and further entrenched economic disparities. Addressing these real deficits will lay the groundwork for a more productive, dynamic, and equitable economy for generations to come.

[1] Real GDP growth is usually reported as an annual rate, which shows how the economy would grow or shrink if the pace of change over the quarter continued through the whole year. But annual rates can be misleading when applied to extreme short-term swings in the economy since we do not expect those changes to persist. Given that annualized figures exaggerate the (already significant) swings in GDP we have seen during the pandemic, the simple percent change in output across quarters is a better interpretation of the data in our current environment.