Republican Budget Abandons American Families

The Republican 2018 budget resolution vividly shows that Congressional Republicans, just like President Trump, are not working on behalf of everyday Americans. Like the President's budget, the Republican budget takes away hope and opportunity from millions of families while showering millionaires, billionaires, and wealthy corporations with irresponsible tax cuts. It undermines national security by narrowly focusing on boosting defense spending while severely undervaluing other sources of national security, such as diplomacy, economic opportunity, and safe and healthy communities. Ultimately, the House Republican budget cruelly betrays American families in favor of wealthy individuals and powerful corporations. It will make life much harder for millions of Americans struggling to get ahead or just to get by.

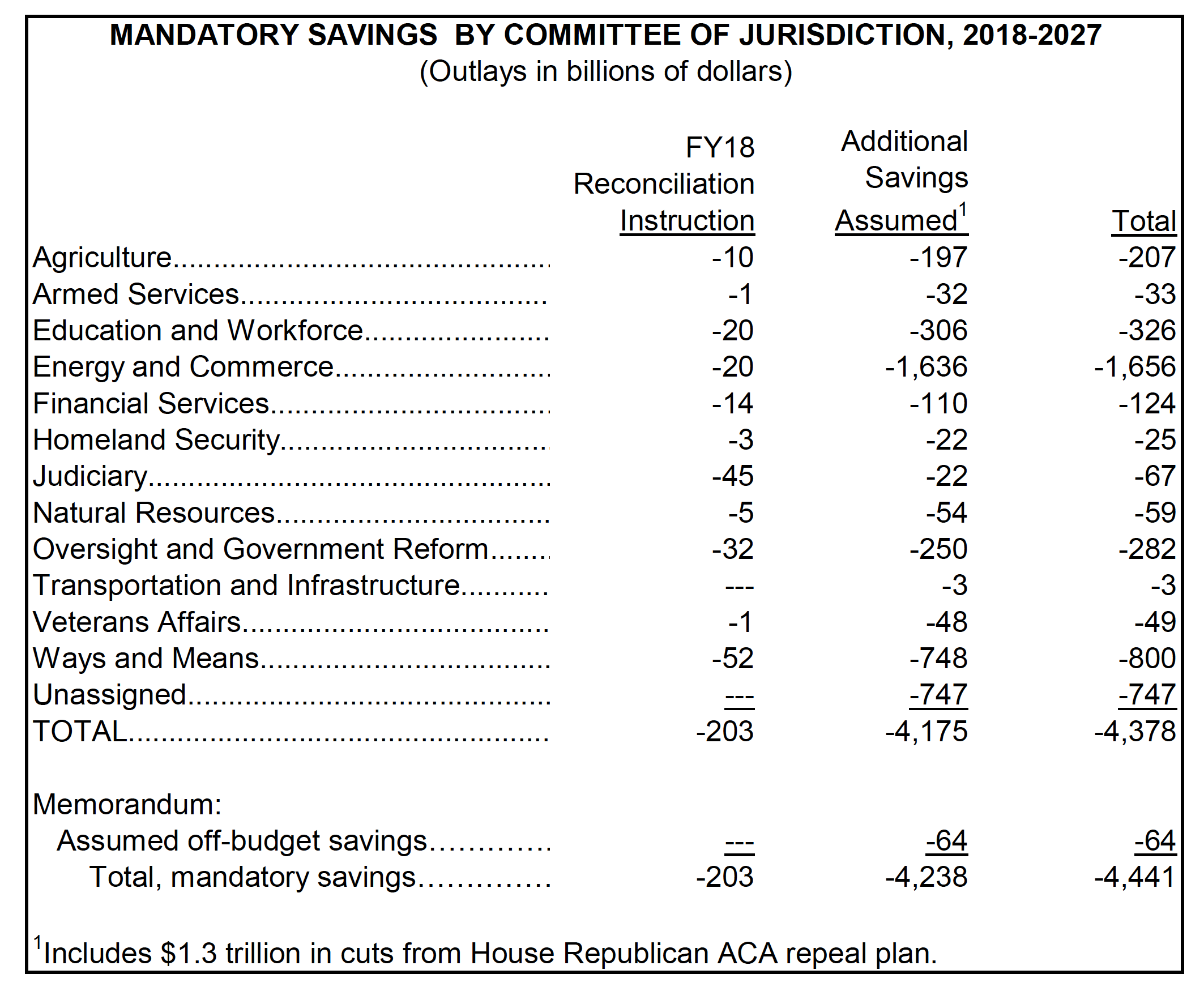

Puts the entire burden of deficit reduction on the middle class and struggling families — The budget does not achieve one penny of deficit reduction by closing tax loopholes that benefit billionaires and corporations. Instead, it drains resources from programs the American people need and strongly support, particularly those helping the most vulnerable Americans. The budget assumes $5.4 trillion in spending cuts over ten years, including $4.4 trillion in cuts to mandatory programs. Almost half of the mandatory cuts come from health care – half a trillion dollars in cuts to Medicare, and another $1.5 trillion from dismantling the Affordable Care Act and cutting Medicaid and other health programs. Among other mandatory programs, the largest reduction – nearly a trillion dollars ($892 billion) – hits the part of the budget that provides basic living standards for struggling families. Even Social Security is not spared. The budget assumes a cut in the program's disability benefits, which it describes as "a first step" to Social Security reform.

Guts investments critical to expanding economic opportunity — Non-defense discretionary (NDD) investments include homeland security, education, research, veterans' health care, transportation, environmental protection, and much more. However, NDD programs currently face austerity-level spending caps deliberately set at unreasonably low levels in the Budget Control Act of 2011 (BCA) to compel agreement on alternative deficit-reduction policies. The Republican budget fails to address these looming NDD cuts and instead lowers the already inadequate austerity-level NDD spending caps by an additional $5 billion in 2018 and by much greater amounts in subsequent years. Under this budget, NDD funding will decline from $511 billion in 2018 to $424 billion in 2027. Relative to the size of the economy, NDD outlays for 2018 will be 3.1 percent of GDP under the existing cap, matching the lowest levels since this category has been tracked. The budget reduces these programs even further, jeopardizing the safety, health, and well-being of American families and communities and undermining the nation's economic competitiveness.

Fast-tracks major tax cuts for millionaires, billionaires, and corporations — The Republican budget goes down the same path as the President's budget: massive tax cuts for millionaires and wealthy corporations, while shifting the tax burden onto the middle class. It protects special-interest loopholes, but does nothing to make sure millionaires pay their fair share. The Republican claim that their tax plan will be revenue-neutral is a fallacy, as the tax plans put forward by House Republicans and President Trump lose trillions of dollars. This lost revenue will lead to rising deficits that in turn will increase Republicans' demands for cuts to Medicare, Medicaid, education, and other areas. These massive tax cuts for millionaires and wealthy corporations are the same debunked trickle-down policy that Republicans have been peddling for years. It failed in the 1980s, it failed under President George W. Bush, it just failed spectacularly in Kansas, and it would fail again under the Republican budget.

Ends the Medicare guarantee and makes other cuts to Medicare — The budget calls for replacing Medicare's guaranteed benefits for future retirees with fixed payments toward the purchase of a private health plan or traditional Medicare. This is a cynical plan to reduce federal spending by unloading costs and financial risks onto seniors and disabled workers. It fails to address root problems and causes of health care cost growth, such as unjustified price spikes for prescription drugs. While traditional Medicare technically remains an option, in reality it would wither away. Private plans find ways to "cherry pick" the healthy. Sick and frail seniors remaining in traditional Medicare would face skyrocketing costs. If a similar plan were in effect in 2020, CBO estimates people in traditional Medicare would pay Part B premiums 25 percent higher than current law. In total, the budget cuts Medicare by $487 billion over ten years. More than two-thirds of these savings come from so-called "structural reforms" primarily affecting beneficiaries, such as:

- charging higher Part B and D premiums to higher-income individuals,

- gradually increasing the Medicare eligibility age to 67 (while at the same time making health care much more expensive for 65- and 66-year-olds by dismantling the Affordable Care Act [ACA]), and

- restructuring Part A and Part B cost-sharing by establishing a unified deductible and catastrophic cap on out-of-pocket costs and making changes to Medigap supplemental coverage.

Undermines health care — The budget embraces Republican legislation to end health care protections for millions of people by dismantling the ACA and gutting Medicaid, all while cutting taxes for the wealthy and corporations. The Congressional Budget Office has estimated that the Republican health plan would drastically raise costs for older and low-income adults, add more than 20 million Americans to the ranks of the uninsured, and effectively take away protections for people with pre-existing conditions. But the Republican budget goes even further by cutting an additional $114 billion from Medicaid on top of the roughly $1 trillion in Medicaid cuts in the Republican ACA repeal plan. The bulk of the additional cuts come from imposing a work requirement in Medicaid. This would hold health care hostage for millions of Americans searching for work or who are already working but do not have enough hours. Ultimately, the steep Medicaid cuts in the budget will fall on seniors in nursing homes, children with disabilities, and low-income families as cash-strapped states look to reduce services or drop people from coverage altogether.

Makes deep cuts to nutrition assistance — The Republican budget cuts $154 billion from the Supplemental Nutrition Assistance Program (SNAP) over the next ten years by proposing wholesale changes to SNAP's funding structure and imposing duplicative and unnecessary work requirements on recipients. Under the guise of "state flexibility," the budget essentially turns SNAP into a block grant, cutting off funding for eligible individuals and requiring cash-strapped states to either fill in the gap or take away food assistance from millions of working families, children, and seniors. Converting SNAP into a block grant will prevent the program from meeting increased needs during future economic downturns, like the way it was able to respond and prevent millions of people from going hungry during the most recent recession.

Puts U.S. transportation network on the road to ruin — The Republican budget sharply reduces transportation spending, with a cut of $254 billion over ten years, or 25 percent below current estimates. Total spending on transportation programs would drop from $92 billion next year to $65 billion in 2022 and remain below $70 billion thereafter.

Makes higher education more expensive — The budget cuts $211 billion from student financial aid programs over ten years. It puts Pell Grants at risk of cuts by eliminating a mandatory funding stream, and it eliminates subsidized loans, making it difficult for students, particularly low-income students, to afford college. The budget also makes it difficult to repay your student loans once you finish college by eliminating the Public Sector Loan Forgiveness and Teacher Loan Forgiveness programs.

Cuts veterans' benefits — The budget cuts nearly $50 billion in mandatory spending on veterans' benefits over the next ten years. Newly eligible veterans would see cuts in programs that pay for education benefits as well as loan guarantees. The budget also cuts future payments to veterans who have a service-connected disability that leaves them unable to find gainful employment through unspecified reforms to the Individual Unemployability program.

Reduces commitment to affordable housing — The Republican budget once again turns to the idea of "state flexibility" as the solution to the affordable housing crisis currently facing cities large and small all across the country by turning all discretionary spending on affordable housing into a block grant. A recent study found that "71 percent of [extremely low income] renter households are severely cost-burdened, spending more than half their income on housing." With families already facing a housing stock in decline and rising prices, turning affordable housing programs into a block grant will just mean fewer dollars to meet increased need. The Republican budget cites Temporary Assistance for Needy Families (TANF) as the prime example of a successful program. What they fail to mention, however, is that under the TANF block grant structure, not only has the program been flat-funded since its inception two decades ago, but just half of the funding goes to actual assistance for vulnerable Americans. For 99 percent of beneficiaries, the purchasing power of their benefit is less than it was in 1996.

Increases defense spending above President's request while weakening other key components of national security — The budget includes $622 billion for base national defense activities, $18 billion above the President's request and $72 billion above the BCA cap. In addition, it includes $75 billion of overseas contingency operations (OCO) funds for defense operations, a $10 billion increase above the President's request. The budget assumes those additional OCO funds will augment base budget activities at the Pentagon. According to military experts, diplomacy and foreign aid are critical components of our national security. Unfortunately, the budget ignores the experts and cuts funding for the State Department and foreign aid agencies by nearly 19 percent below the 2017 enacted level.

Ignores immigration reform — Once again, the Republican budget rejects comprehensive immigration reform that would bring clear and just rules for those seeking citizenship and help secure the nation's borders. In addition, immigration reform would expand the size of the U.S. workforce, and in turn would increase the size of the economy and reduce deficits. By rejecting immigration reform, the budget squanders an opportunity to reduce deficits by an estimated $900 billion over the next two decades, boost the economy by 5.4 percent, and extend the solvency of Social Security.

Forces American taxpayers to foot the bill for President Trump's border wall — The Republican budget burdens American taxpayers with a $1.6 billion bill to begin constructing a costly and ineffective border wall along the U.S. southern border with Mexico. President Trump repeatedly promised that American taxpayers would not have to pay for such a wall. A border wall will not stop unauthorized entry into the country and will not fix our broken immigration system.

Drains resources from communities, even in times of disaster — Like the President's budget, the Republican budget eliminates funding for Community Development Block Grants. This $3 billion program provides flexible grants to local communities for a wide range of unique needs, including Meals on Wheels, housing programs, and community infrastructure improvements. The budget also targets disaster grants made by the Federal Emergency Management Agency, which help families and businesses when their disaster-related property losses are not covered by insurance.

Continues to target federal employees — The Republican budget continues to target federal employees by cutting their compensation and benefits by at least another $163 billion over ten years. This latest proposal comes on top of the $182 billion in cuts federal employees have already absorbed in the form of higher retirement contributions, pay freezes, and furloughs. These new cuts would include even higher retirement contributions, elimination of the FERS supplement (which law enforcement retirees heavily benefit from), lower annuities by changing the retirement calculation, and reduced healthcare benefits. The budget also proposes reducing the G Fund's rate of return in the Thrift Savings Plan and reducing the federal workforce at non-security agencies by 10 percent even though nearly all of the workforce increases since 2001 occurred in security-related agencies.

Hides cuts to military retiree benefitsdeep in the numbers — The Republican budget assumes $33 billion in mandatory spending cuts over ten years from the House Armed Services Committee's portfolio of programs outside of Function 050 (Defense). More than 99 percent of that portfolio consists of Tricare for Life benefits and military retirement. No explanation of this cut is included in the resolution or in its accompanying report, but the numbers speak for themselves.

Pretends it achieves balance by relying on trillions of dollars in budget games and gimmicks — The Republican budget uses several devices to rig its numbers to make it seem like it reaches balance by 2027.

- It counts a dubious $1.8 trillion "economic dividend" from cutting taxes and taking away consumer protections that is not backed up by any credible analysis. The budget assumes $1.5 trillion of this "dividend" will go toward deficit reduction.

- It assumes tax reform will be revenue neutral, including the remaining $300 billion in revenue from the "economic dividend," but Republican tax plans are expected to lose between $3 trillion and $7 trillion.

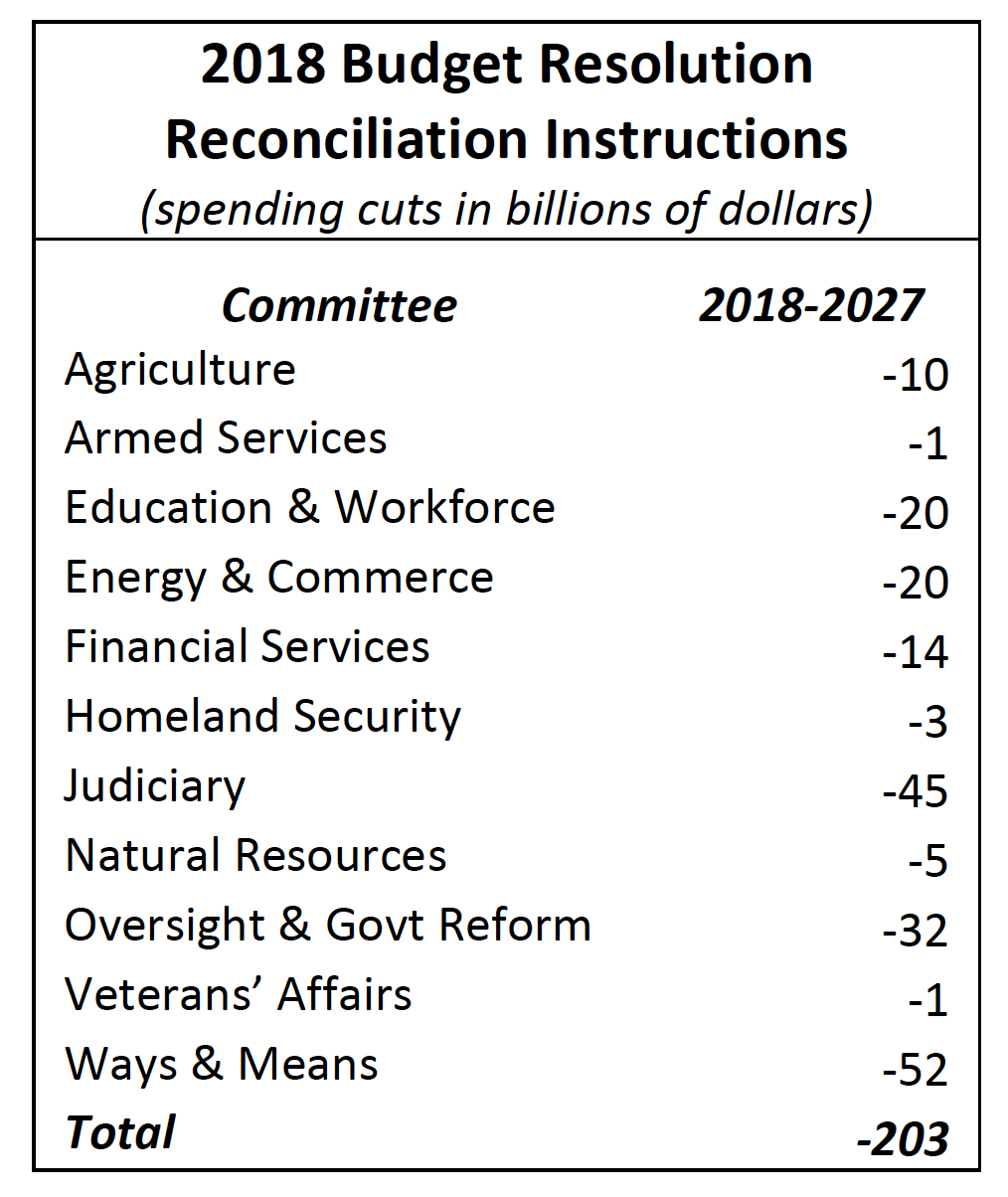

- It includes nearly $3 trillion in mandatory spending cuts (excluding the cuts related to the Republican health care repeal legislation) beyond the $203 billion in cuts subject to the fast-track spending reconciliation process. This raises the question: are Republicans afraid to include all of their spending cuts in the reconciliation process because they know the American people will resoundingly reject such extreme and irresponsible cuts? After all, the purpose of reconciliation is to provide a fast-track process to "reconcile" policy with the numbers assumed in the budget.

- Within that $3 trillion, the budget credits itself with $0.7 trillion in savings from a plan to reduce improper payments that does not exist.

- The budget relies on unspecified NDD cuts totaling $893 billion over ten years. The fact that Republicans declined to allocate these cuts to specific government activities such as veterans' benefits and services, transportation, income security, health care, or any other important government functions shows how unrealistic these cuts actually are.