Retirement Security for an Aging Population Requires Higher Federal Spending

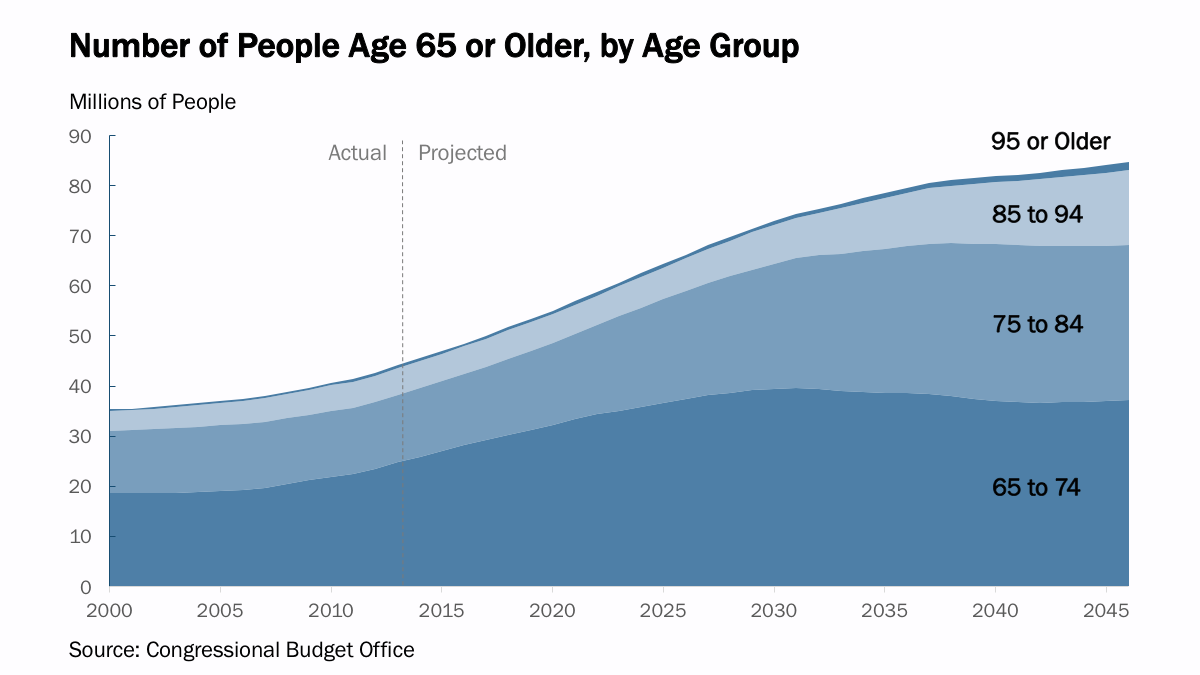

The United States has a fast-growing population of senior citizens, which has major implications for the long-term budget outlook. The number of people aged 65 and older in the United States – 52 million today – is projected to increase by more than 60 percent over the next three decades, reaching 84 million in 2047. [1] This will mean more people turning to Social Security, Medicare, and long-term care services financed by Medicaid – programs that are crucial to the economic and health security of Americans during their retirement years. Ensuring retirement security for the American middle class will mean providing these programs with additional resources.

Despite this well-known, well-documented, decades-in-the making demographic reality, Congressional Republicans repeatedly assert that future federal spending and revenues should and can easily stay close to their historical levels, measured as a share of the economy (usually expressed as a percentage of Gross Domestic Product, or GDP). Since 1967, federal revenues have averaged 17 percent of GDP, and spending has averaged 20 percent. The Republican position ignores the ongoing impact of the dominant demographic trend of the last 70 years – the baby-boom generation – and other demographic changes that will dramatically reshape our economy and increase demand for federal spending for decades to come. In fact, the GOP is implementing policies that will make this situation far worse. The recently enacted tax law is Exhibit A: it squanders $1.5 trillion over the coming decade on tax cuts that largely benefit corporations and the wealthy – while CBO projects the number of people age 65 or older will increase by more than one-third over that same period. [2]

The U.S. Population Is Getting Older

Budget analysts have long forecast a rise in Federal spending as the baby-boom generation leaves the workforce and enters retirement. This retirement wave is well underway: the oldest baby boomers turned 71 this year, and the youngest ones are now only nine years away from becoming eligible to claim Social Security benefits.

The U.S. population is getting older, but the aging of the large baby-boom generation is just one factor contributing to this trend. People are also living longer. The Congressional Budget Office (CBO) projects that a 65-year-old in 2047 can expect to live another 21.5 years, two years longer than the life expectancy for a 65-year-old today. Meanwhile, fertility rates have fallen steadily in recent decades, dropping from well above three births per woman during the baby boom years to an average of two over the past 30 years. CBO projects it to average less than two births per woman over the next decade. Together, these trends mean a long-term increase in the average age of the population and a growing share of senior citizens within the population. CBO estimates that by 2047, 22 percent of the population will be age 65 or older, compared to 15 percent today. The aging of the population is not just a temporary phenomenon that reverses itself with the passage of time. Declining fertility and the fact that senior citizens are living longer means that the population will be older for the foreseeable future, absent a massive new baby boom or dramatic increase in immigration. This will also mean the ratio of working-age adults to senior citizens will fall from about 4 to 1 in 2016 to 2.6 to 1 in 2050, according to the Social Security Administration. It was about 8 to 1 in 1945.

These trends are not limited to the United States. Japan for several decades has experienced the impact of an aging population much like that expected in the United States. Much of Western Europe has similar issues, in many cases more severe than what we face here. While the United States faces future economic challenges due to an aging population, we may be in a better position than many other countries, particularly if we retain the advantage of being more open to immigration than other countries, helping to offset some of the impact of declining fertility rates.

Growing Need for Social Security, Medicare, and Medicaid

Social Security, Medicare, and Medicaid play vital roles in American retirement security. Social Security provides direct financial benefits for older Americans (as well as many disabled younger Americans). Medicare provides senior citizens with health insurance coverage, financing most of senior citizens' health care, and Medicaid is the main source of funding for seniors who need long-term care services.

Simply put, an older population means the United States will need to spend more money on these programs to ensure adequate retirement security. CBO estimates that federal spending for Social Security and the major federal health care programs will increase by 3.5 percent of GDP over the next 30 years, solely due to the aging of the population. (Rising health care costs per enrollee are projected to increase spending by an additional 2.9 percent of GDP, primarily for Medicare.)

It is not realistic to contend that federal spending and revenues can remain at their historical levels indefinitely, when the aging of the population will increase federal spending by 3.5 percent of GDP. Offsetting this increase by massively cutting spending in other areas is also not realistic. Federal spending on all other programs (not including interest on the debt) has already fallen from 14.6 percent of GDP 50 years ago to 8.9 percent today, and CBO projects it to drop to 7.6 percent over the next 30 years. The United States is already underinvesting in infrastructure, education, research, and other areas that are crucial to a strong economic future and broad-based prosperity.

Cutting Social Security, Medicare, and Medicaid benefits to keep federal spending at historical levels is also not a viable answer. The people who will become seniors within the next 30 years are already of working age; many of them are near retirement now and are counting on these benefits. Even if Congress were to respond to the fiscal challenge of an aging population by cutting benefits, these costs would not go away. Reducing federal support for older Americans would not save resources for the nation as a whole. Instead, costs would shift to other levels of government, families, charities, and seniors themselves. There is no reason to believe these other sources would be better able to absorb the costs than the federal government. A more likely outcome is increased hardship and economic insecurity for many seniors and their families.

The Republican Congressional budget resolutions of the last few years ignore the serious demographic realities facing our nation, and irresponsibly embrace policies that threaten the economic security of retirees and their families, as well as our as our nation as a whole. The 2017 budget was a case in point. In addition to fast-tracking $1.5 trillion in tax cuts that mostly benefit the wealthy and corporations, the budget called for $5 trillion in spending cuts over ten years. This extreme austerity will lead to a grim future of severely underinvesting in our country and jeopardizing the future of seniors and families struggling to get by.

Ensuring Adequate Retirement Security Going Forward Will Require Revenue

Ensuring that Social Security, Medicare, and Medicaid can meet the needs of future generations of senior citizens means spending must increase above historical levels, and that means revenues must go up as well. Without new revenues, rising levels of federal deficits and debt will become economically unsustainable at some point.

Over the last 50 years, the federal debt held by the public has averaged 40 percent of GDP, and in 2017 it was 77 percent of GDP. To keep the debt at its current level in 2047 without raising revenues, Congress would have to cut noninterest spending dramatically. For example, Congress could cut spending by 9 percent across the board every year, starting this year, to achieve this fiscal goal. For an average worker filing for Social Security this year, that would mean a $1,700 benefit cut. [3] That is the magnitude of spending cuts required if new revenues are not part of the long-term fiscal discussion. If Social Security were exempt from cuts, other programs would have to be cut to devastatingly inadequate levels.

Achieving Our Fiscal and Economic Goals, Given Demographic Realities

The aging of the population presents not only a fiscal challenge, but also an economic one. CBO projects inflation-adjusted potential GDP growth rates to average 1.9 percent per year over the next 30 years, compared to 2.9 percent over the past 50 years. The biggest reasons behind this projected slowdown are demographic. CBO projects the labor force will grow much more slowly in the future than it has over the past five decades, due to the aging of the population and the stability of female workforce participation (the increased entry of women in the workforce helped fuel economic growth in the later decades of the last century).

Therefore, the aging of the population is simultaneously increasing federal spending and slowing the rate of potential economic growth (which in turn slows revenue growth). This combination makes it all but inevitable that spending will increase as a share of the economy. Arguing that Congress should keep federal spending and revenues at their historical levels as a share of GDP is essentially the same as advocating that Congress either dramatically shift the costs of an aging population to state and local governments and to seniors and their families themselves, or massively reduce spending on children, defense, and federal investments like infrastructure and scientific research. Either of these options would face a major backlash from the American people.

Instead, meeting the fiscal and economic challenges of an aging population will require a comprehensive strategy, one that supports policies to promote economic growth, while recognizing that federal spending and revenues will still need to rise as a share of the economy. A comprehensive approach should also include immigration reform. This will not only bring clear and just rules for those seeking citizenship and help secure the U.S. borders, it will also boost the economy by expanding the labor force, which in turn will extend the solvency of Social Security and reduce budget deficits. Another key to economic growth is boosting public investment in infrastructure, research, education, and other areas to improve productivity. On the fiscal side, opportunities exist for Congress to achieve savings in federal health care programs through efficiency improvements and reducing wasteful overpayments, without cutting benefits or taking coverage away from American families. But this country will not be able to provide adequate retirement security to a growing population of seniors and keep debt and deficits at sustainable levels unless and until Congressional Republicans recognize that higher federal spending is essential.

[1] CBO, Long-Term Budget Projections (March 2017) , Figure 3.

[2] CBO, The Budget and Economic Outlook: 2017 to 2027 , p. 24 (print version).

[3] CBO, The 2017 Long-Term Budget Outlook , p. 23.