Trump Budget Priorities: Pad Tax Cuts for Corporations And Stiff the Middle Class

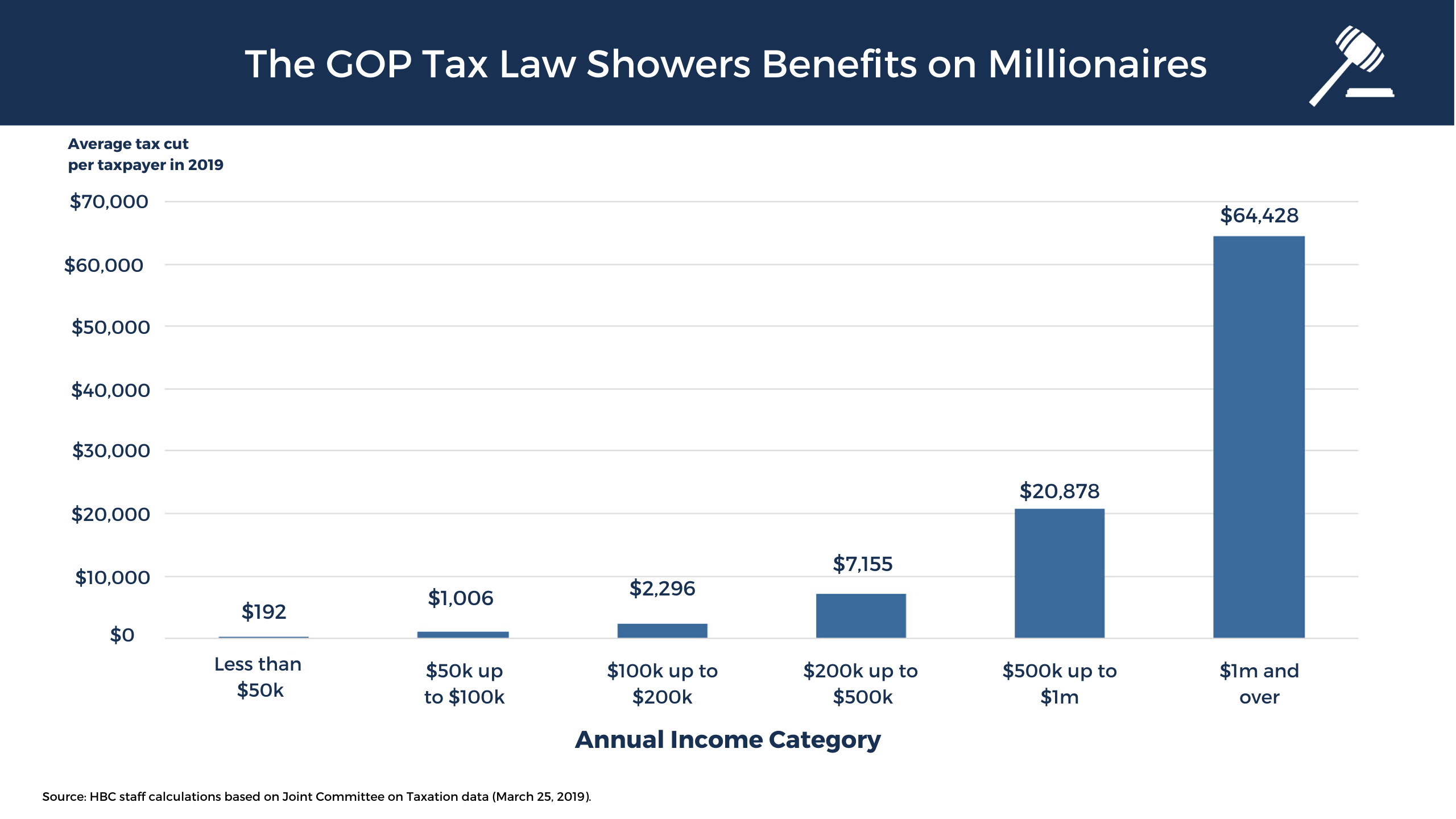

President Trump's destructive and irrational budget leaves working families out in the cold while it doubles down on the failed 2017 GOP tax law, extending expiring provisions and adding $1.5 trillion more to debt over the last six years of the budget window. Most of this extension's tax breaks go to the richest one-fifth of households. Two years in, mounting evidence continues to show the GOP tax scam showered benefits on the rich and large corporations, failed to "supercharge" our economy, worsened income inequality, and left the middle class behind. A few weeks ago, President Trump said he aims to pass a second round of tax cuts – a "very big" middle-class tax cut – which his campaign will unveil ahead of the 2020 election. He has made this same promise before, including right before the 2018 midterm elections, when it seemed to surprise Administration officials who were in the dark. Not surprisingly, the President's budget for 2021 fails to live up to this promise.

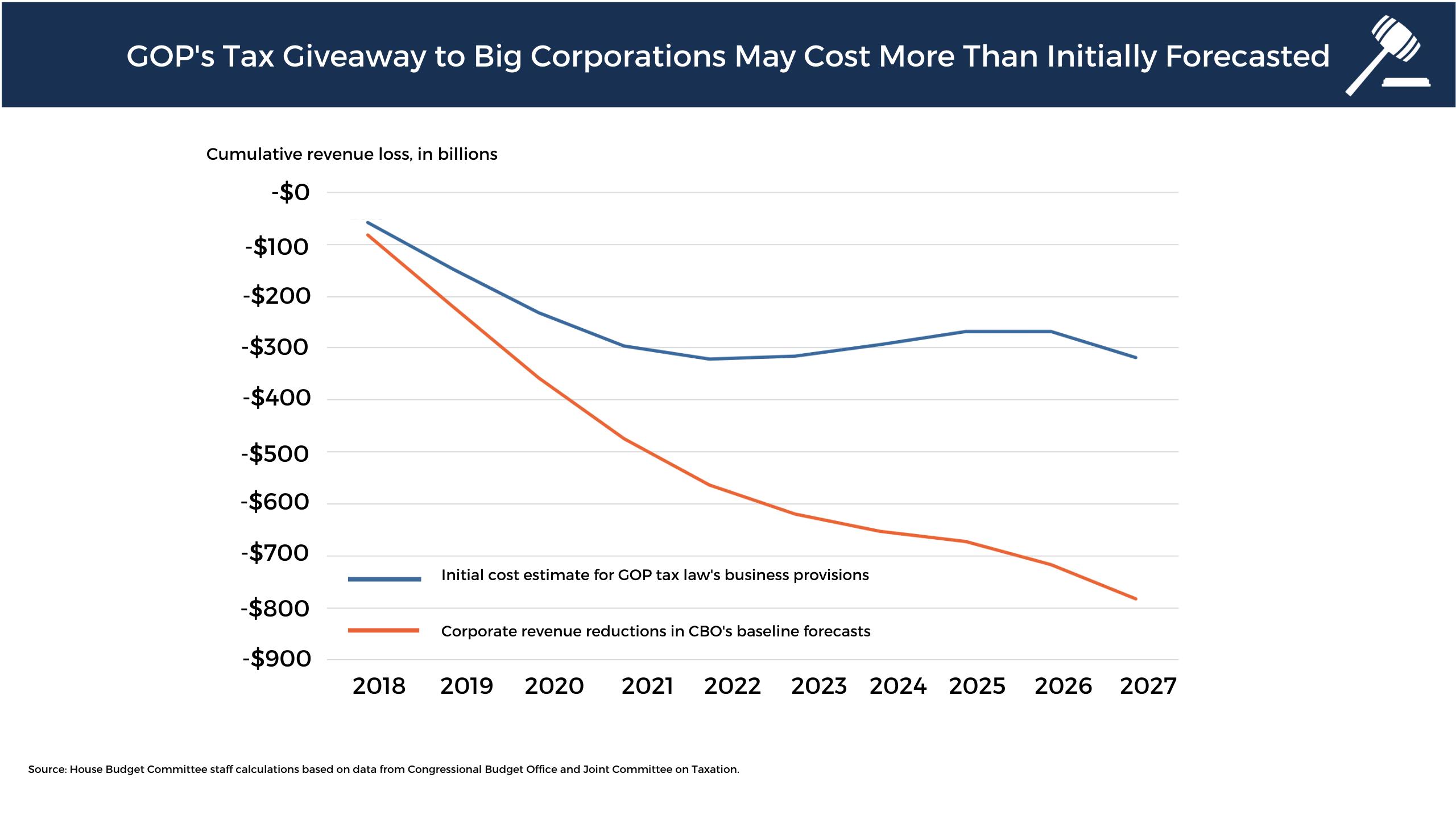

In fact, this President's second round of tax cuts has already begun for big corporations – without Congressional involvement and out of public view. His Administration's regulations to implement the law, some of which experts argue went beyond the Administration's legal authority, are giving even more tax cuts to big corporations – and the Administration is still writing new regulations. The Congressional Budget Office projects the implementation of the law's international provisions will further reduce revenues by a whopping $110 billion. The ultimate impact on revenue could be far worse, with more tax cuts for big corporations occurring out of the public's view. We need real policies that help hardworking Americans, not more tax cuts for big corporations.

Trump's Broken Promises to the Middle Class

The GOP tax law left middle-class Americans behind — President Trump and his Republican allies broke every promise they've made on the GOP tax law, including that it would be a boon for the middle class. Data shows the law primarily benefited the rich and big corporations, did not lead to the promised wage growth, and did not result in an investment boom. Instead, the law's tax giveaways to corporations resulted in record-setting stock buybacks benefitting their investors rather than workers. Two years after the tax law, there is little indication that it is even beginning to help workers like the Administration promised.

Trump has repeatedly broken his promises to the middle class — While President Trump has promised middle-class tax cuts numerous times before, we have yet to see any policy proposals from him. His budgets, which are supposed to be a statement of his priorities, have included ZERO middle-class tax cut proposals. At the same time, his budgets cut entitlement programs that protect retirement security for working families. The President has repeatedly put the wish list of large corporations and the very wealthy ahead of the real needs of middle-class Americans – and his budgets have reflected this order of priorities. In recent months, his economic advisor, Larry Kudlow, said Trump's middle-class tax cuts "will be released as a strategic pro-growth document for the campaign." This is not surprising given President Trump's earlier promise preceded the 2018 midterm elections and dissipated afterward.

More Tax Cuts for Corporations Are Underway

Trump's regulations are giving more tax cuts to big corporations — Soon after the GOP tax law was enacted, lobbyists for big corporations swarmed the Treasury Department to influence the rules and regulations implementing the tax law to lower their companies' tax bills even more. The lobbyists targeted a pair of major new taxes, GILTI and BEAT, which were meant to raise hundreds of billions of dollars from companies earning offshore profits. Ultimately, the President's Treasury Department issued a series of corporation-friendly international tax regulations that shielded many big companies from new taxes on offshore profits. In fact, many corporations paid nothing. According to Bret Wells, a tax law professor at the University of Houston, "Treasury is gutting the new law," and "it is largely the top 1 percent that will disproportionately benefit."

Corporate revenue losses far outweigh the costs initially forecasted — Since the GOP tax law was enacted, CBO's forecasts have lowered corporate revenues by almost $800 billion due to this law and subsequent estimating changes. This is more than double the $320 billion cost initially forecasted for the law's business and international provisions, as shown in the chart below. According to CBO's latest budget outlook, the Trump Administration's implementation of the law's international provisions will further reduce revenue by $110 billion. As President Trump's Treasury writes more regulations behind closed doors to implement the GOP law, big corporations stand to gain even more, while millions of American families are left to pay the price.

Additional Reports on the President's Budget

- Trump Budget Devastates Rural America

- States and Localities Power the Economy, but the Trump Budget Pulls the Plug

- President Trump's Extreme Budget Cuts Hurt Veterans

- Trump Budget Priorities: Vulnerable Families and Communities Sacrificed to Extend Tax Cuts for the Wealthy

- The President's 2021 Health and Human Services Budget

- Trump's Vision for a More Dangerous and Polluted Future

- Trump's Irrational Budget Undercuts Our National Security

- The Destructive and Irrational Trump Budget