Examining the Powerful Impact of Investments in Early Childhood for Children, Families, and Our Nation’s Economy

One of the most important investments we can make in the future of our nation is investing in children. Ensuring their well-being today will help them grow up to be healthy, productive members of society tomorrow. Yet America, despite our wealth and prosperity, has long underinvested in programs that help children, and has done so in a way that further exacerbates inequities in our society. But by devoting targeted resources to children across a variety of programs, we can improve lives in the immediate term and throughout their future, while also delivering a high return on investment. On July 20, 2022, the House Budget Committee will examine the positive and powerful impacts of federal investments in early childhood for children, families, and our nation's economy.

What kinds of policies most benefit children?

Research finds that investing in children improves health, educational achievement, and future earnings. These policies help to break the cycle of poverty, decrease generational inequality, and reduce crime. And because these policies disproportionately benefit children from the most disadvantaged backgrounds, over time they will help close racial and economic gaps. In short, these investments make a lifetime of difference for children and their families, and they are a net positive for the American economy.

Targeted use of tax credits lifts children out of poverty. The Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC) are refundable tax credits available to workers and working parents that increases with the number of children. These tax credits have lifted millions of people and children out of poverty while positively impacting local economies across the country.

Children in high-quality pre-k and child care programs develop social, emotional, and academic skills that benefit them for the rest of their lives. Study after study has found that enrollment in high-quality programs improves school readiness and college attendance, creates better health outcomes, and reduces the likelihood of future criminal acts. Programs like Head Start have been shown to have benefits for low-income children and set them up for success when they enter elementary school. The enactment of a universal affordable child care program would provide further benefits, helping young children in their formative years, increasing the labor force participation of mothers, and increasing wages for child care workers — all leading to positive effects on the macroeconomy.

A healthy diet is vital to a healthy and productive life. For families in need, the Supplemental Nutrition Assistance Program and the Special Supplemental Nutrition Program for Women, Infants, and Children – more commonly known as SNAP and WIC – are lifelines and pay off over the lifetime of the child. SNAP lifts many people out of poverty each year, with children representing nearly half of those benefiting from this program . WICparticipationresults in longer pregnancies, fewer premature births, lower incidence of moderately low and very low birth weight infants, fewer infant deaths, a greater likelihood of receiving prenatal care, and savings in health care costs. Since its inception in 1974, WIC has stood out as one of the most successful and effective nutrition intervention programs.

The American Rescue Plan Helped Reverse a Troubling Trend of Diminishing Spending on Children Over Time

Since coming into office, President Biden has worked with Congressional Democrats to end the era of chronic underinvestment and put the welfare and futures of America's children first. The American Rescue Plan (ARP) delivered major investments in programs serving children. Democrats knew that investing in children would not only help them and their families get through the pandemic, but would also have positive, lasting effects for decades to come.

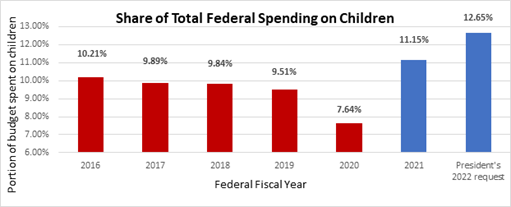

Source: First Focus on Children: Children's Budget 2021

Before the ARP, the share of federal spending on our youngest Americans had been declining, until it rose from 7.6 percent in 2020 to 11.2 percent in 2021. The ARP invested in children in many important ways: the package included extra income to families through the expanded Child Tax Credit and Earned Income Tax Credit; helped families pay for child care and increased support for public education; and, made sure families had access to nutritious food and health care. The striking and positive results of these investments were apparent almost immediately with 3.7 million children lifted out of poverty from the expanded Child Tax Credit; 3.2 million children lifted out of poverty from economic impact payments alone; 5.7 million families protected from eviction because of emergency rental assistance; an extension of SNAP benefits helping millions of American keep food on the table.

Yet despite all the evidence – and moral callings – Congressional Republicans have not supported efforts to help improve children's lives. Not a single Republican voted for the historic pro-child, pro-family American Rescue Plan. In fact, Republicans have proposed cutting, even eliminating, vital programs like Head Start, SNAP, and WIC in favor of tax giveaways to the rich. This short-sighted philosophy would only cause suffering and hinder our economic recovery. Instead, we must build on the success of the ARP and continue to make high-value investments in our children and the next generation.

The House Budget Committee will review these critical investments and the quantitative evidence of their positive effects at its hearing on July 20, 2022, entitled, "Examining the powerful impact of investments in early childhood for children, families, and our nation's economy."

Witnesses will include:

- Dr. Hilary Hoynes, Professor of Economics and Public Policy and the Haas Distinguished Chair in Economic Disparities at the University of California Berkeley

- Dr. Maureen Black, Distinguished Fellow in Early Childhood Development, RTI International, and Professor, Department of Pediatrics, University of Maryland School of Medicine

- Rasheed A. Malik, Director,Early Childhood Policy at the Center for American Progress.

- Additional witness to be announced.