Fiscal Year 2019 Budget Results Highlight the Urgent Need for Smart Fiscal Policies that Help All Americans, Not Just the Rich

Fiscal year 2019 budget results released by the Trump Administration this week show that GOP tax policies have led to dramatic reduction in revenues relative to the size of our economy and have helped our nation's deficits and debt to skyrocket.

Since President Trump took office, revenues have declined rapidly as a share of the economy, while spending has remained steady. In 2019, actual revenues were $3.5 trillion or 16.3 percent of GDP, significantly below 17.6 percent in 2016, while actual spending was $4.4 trillion or 20.9 percent of GDP, about the same as 20.8 percent a few years earlier. This is especially troubling, because our nation is in the longest economic expansion in history. Over the past 50 years, revenues averaged much higher at 18.3 percent of GDP during comparable years when the unemployment rate fell below 5 percent[1]. This disconcerting decline in revenue was made far worse by the 2017 GOP tax law.

The latest budget results show the actual 2019 deficit was $984 billion or 4.6 percent of GDP. This is the highest since 2012 in both nominal terms and as a share of our economy, when we were recovering from the last recession. Beyond 2019, the Congressional Budget Office's (CBO) August 2019 baseline projects a darkening fiscal future, with trillion-dollar deficits and record debt levels expected within a decade. CBO projects the deficit will average $1.2 trillion over the next decade and remain a considerably larger share of GDP at 4.7 percent compared to its 2.9 percent average over the past 50 years.

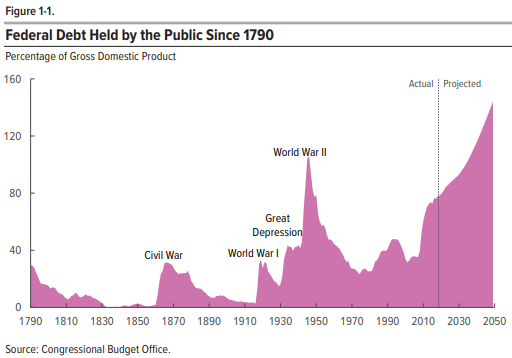

The bottom line is clear. The latest budget results showing a combination of a growing economy, stable spending, weak revenues, and abnormally high deficits demonstrate that we have a revenue problem. Over the long term, CBO projects a worsening fiscal outlook with the nation's debt reaching unprecedented levels—from 78 percent in 2019 to 144 percent by 2049 (see CBO's Figure 1-1). The worsening fiscal future results from spending growing faster than revenue over the next 30 years, causing deficits to increase substantially. The long-term spending growth is primarily due to aging of the U.S. population and rising health care costs per person. Consequently, spending on Social Security, Medicare, other health care programs, and net interest is projected to outpace revenues and rise as a share of the economy. Other spending, in total, is projected to decline as a share of the economy.

Our current fiscal situation underscores the need for smart, sustainable fiscal policies that ensure retirement security, provide cost‑efficient high‑quality health care, invest in our nation's future, and rebalance our tax system to address the nation's long-term fiscal shortfall. Our fiscal policies should promote economic growth and improve the quality of life for all Americans, not just provide more tax cuts to the wealthy few.

Revenue Is Below Historical Average Despite an Expanding Economy

By any measure, the United States government is collecting unusually low levels of revenue, a problem exacerbated by the 2017 GOP tax law. The evidence clearly shows revenues dropped substantially under the 2017 tax law. The tax law is estimated to add $1.9 trillion to the debt through 2028 and has already reduced revenue to 16.3 percent of GDP in 2019. As a share of the economy, the current revenue level is a full percentage point below the 50-year historical average (17.4 percent) and two percentage points below the 50‑year average during comparable years when the unemployment rate fell below 5 percent (18.3 percent).

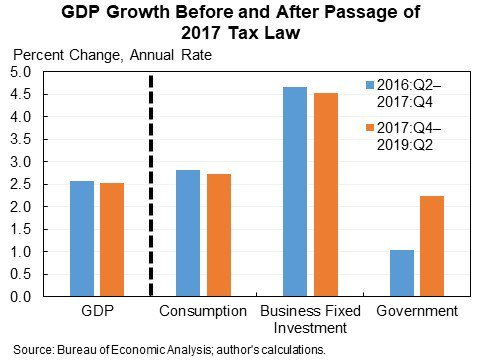

Furthermore, annual revenue growth is far below where it should be, given the strength of the economy. In 2018, the first year after the GOP tax law's passage, annual real GDP grew by 2.5 percent, measuring from the fourth quarter of 2017 to the fourth quarter of 2018, and nominal revenue grew by just 0.4 percent from the previous fiscal year. The last time annual real GDP growth was as high as in 2018 under President Obama was in 2014, when revenue grew by 9 percent from the previous fiscal year.

This revenue shortage is striking in light of the aging of the U.S. population that requires increased support for Social Security, Medicare, and other programs crucial to Americans' retirement security. While the nation's population aged 65 or older – 53 million in 2019 – is almost 3 times larger than it was 50 years ago, revenue collection will be 2.8 percentage points lower as a share of our economy than it was in 1969.

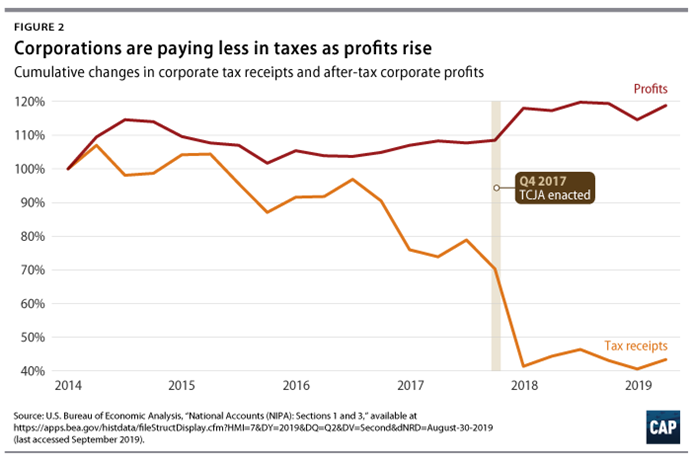

Corporate Taxes Plummet Due to the GOP Tax Law — The GOP tax law permanently and unnecessarily reduced the corporate tax rate from 35 percent to 21 percent and enacted other revenue-losing measures to benefit corporations. As a result, in the first year the GOP tax law was implemented, federal corporate tax revenue fell by nearly one-third, or $92 billion, from $297 billion in 2017 to $205 billion in 2018. This is the largest year-over-year drop in corporate tax revenue outside of a recession since the end of World War II. As a share of total revenues, corporate revenue fell from 9.0 percent in 2017 to 6.1 percent in 2018. Comparing corporate revenue in 2018 to CBO's projection for the year prior to the GOP tax law, the revenue fell by even more — nearly 40 percent. In 2019, corporate tax revenue totaled $230 billion in nominal terms, $67 billion below the level prior to the tax law. Consequently, corporations are paying far less in taxes even as their profits rise (see Figure 2 from the Center for American Progress).

Corporate Tax Savings Did Not Trickle Down to Workers — Corporations used significant tax savings to buy back more than $1.1 trillion of their own stocks in 2018 to benefit their investors (including foreign investors who own about 35 percent) rather than investing in new plants and equipment or paying their workers more. Stock buybacks are estimated to rise even more in 2019. After the GOP tax law, real wages grew more slowly than overall economic output and at a pace consistent with the pre-tax law growth, while worker bonuses slumped 22 percent in the first quarter of 2019. Two years after the tax law, there is little indication that the tax cut is even beginning to trickle down in ways its proponents claimed it would.

Rampant Tax Avoidance by the Rich and Corporations

Our federal tax system allows too many tax cuts and loopholes for the rich to avoid paying their fair share. For the rich, a significant portion of their income comes not from wages, but from capital gains, dividends, and income flowing through business entities, which often have preferential tax rates and are easier to underreport. This provides plenty of opportunities to avoid taxes by shifting income from a high‑tax rate category to a low‑ or zero‑tax rate category. For example, the rich tend to characterize a large share of their labor income as income from business entities, which is subject to much lower tax rates than wage income. In some circumstances, they can also claim their income, including their labor income, as long-term capital gains or dividends, which can lower their top tax rate from 40.8 percent to as low as 23.8 percent. Wealthy taxpayers can often afford to defer realizing capital gains, and if they do so until their death, for some taxpayers, the top tax rate becomes zero due to a provision in the tax code called a "stepped-up basis." This provision allows the market value of assets at the time of inheritance to be used for tax purposes, which eliminates federal taxes on all deferred capital gains until that time.

The GOP Tax Law Furthered Tax Benefits for the Rich — The tax law lowered the top individual income tax rate to 37 percent, weakened the individual alternative minimum tax, gutted the estate tax, allowed a giveaway to wealthy pass-through business owners, and slashed the statutory corporate tax rate. It also created unprecedented opportunities for tax gaming by introducing new tax loopholes while failing to close existing loopholes. For example, the new deduction for pass-through business income opened the door to more gaming by treating similarly situated taxpayers unequally, adding exceedingly complex and, at times, illogical rules, and introducing mistakes and glitches in the tax code. The newly enacted international tax provisions are poorly designed, encouraging further offshoring and profit shifting by multinational corporations. Under the new law, the tax imposed on foreign income is 10.5 percent—just half of the new 21 percent corporate rate on earnings generated domestically.

In the first tax year under the GOP tax law, corporations used tax breaks and loopholes to avoid paying federal income tax as they made record-breaking profits. In 2018, 60 of America's biggest corporations paid zero federal income taxes on their $79 billion of U.S. profits and instead received a net tax rebate of $4.3 billion. This is twice as many companies paying no taxes as before the GOP tax law. Corporations that paid federal taxes lowered their effective tax rate to just an average of 7 percent—the lowest since 1947 and significantly below the 21 percent statutory rate. The corporate tax breaks and loopholes primarily benefit the rich, because stock ownership is extremely concentrated in the United States. Currently, the wealthiest 0.1 percent and 1 percent of households own 17 percent and 50 percent of total household equities respectively, up significantly over the last few decades. The bottom 90 percent of households own only 8 percent of the total.

Republicans Want Even More Tax Cuts for the Rich — As if the GOP tax scam's massive giveaway to large corporations and the wealthy was not enough, Senate Republicans are now pushing to index capital gains. The Trump Administration has also pushed for indexing capital gains through unilateral, administrative action, which even the President's own Attorney General has previously rejected on legal grounds. In President Trump's own words, indexing capital gains is an "elitist" tax break. It mainly benefits the rich: the top 1 percent of households with the highest income would receive 86 percent of the benefits and the top one‑fifth of households would receive 99 percent of the benefits. It also worsens deficits by $100 billion to $200 billion over ten years in addition to the $2 trillion revenue losses from the 2017 tax law. Furthermore, it spurs "roughly zero net additional economic growth."

The Audit Rate for the Rich Plummets — As opportunities for tax avoidance by the rich explode, the Internal Revenue Service (IRS) has been gutted by years of budget cuts, leading to weaker enforcement of the tax laws governing the rich. The IRS's 2019 budget of $11.3 billion is slightly less than its budget in 2000 after adjusting for inflation and 19 percent below its highest level of funding in 2010. The agency now has 21 percent fewer employees than it did eight years ago and the number of tax examiners has declined by 38 percent. Consequently, millionaires in 2018 were approximately 80 percent less likely to be audited than they were in 2011. The audit rate for the top 1 percent of taxpayers (income of $500,000 or more) also plummeted from 8 percent in 2011 to only 1.6 percent in 2018. According to a new study, budget cuts at the IRS have led to an estimated $34.3 billion in lost tax revenue from large companies alone.

U.S. Tax Revenue is Far Below the OECD Average

The United States is taxed far less than most Organization for Economic Cooperation and Development (OECD) countries. While the U.S. statutory corporate income tax rate (21 percent) is slightly below the OECD average (21.7 percent) in 2019, as a share of the economy, total U.S. tax revenue for all levels of government (federal, state, and local) was far below the OECD average even before the GOP tax law. In 2017, total tax revenue for all levels of government in the United States was 27.1 percent of GDP, compared to the OECD average of 36.1 percent. Of the 36 OECD countries, only five collected less tax as a share of their economy than the United States. At the same time, the United States had the largest federal budget deficit as a share of GDP of any OECD country, at 4.1 percent. The OECD average was a deficit of only 0.3 percent of GDP, with one-third of the OECD countries running surpluses. Compared with similar countries, the United States collects far less revenue relative to our needs for public benefits and services.

Conclusion

The fiscal year 2019 budget results and our current fiscal outlook are alarming wakeup calls to return our country to a sustainable fiscal path. This will require cost‑effective, pro‑growth investments and progressive revenue policies that reduce economic disparities and ensure the wealthy pay their fair share. As Chairman Yarmuth stated at a recent House Budget Committee hearing, "We have a responsibility to support policies that give all hard-working Americans the opportunity to succeed, no matter where they started out."

[1] Average for fiscal years 1969-1970, 1974, 1998-2001, 2006-2007, and 2016-2018 using actual receipts data provided in Table 1.2 of the 2020 President's Budget, Historical Tables.