Helping Children Thrive Helps Everyone: Investments in Early Childhood Pay Off Over Time

One of the most effective ways to build broad-based prosperity in America is to invest in future generations. By fully funding programs that benefit children — including nutrition assistance, affordable, high-quality childcare and universal pre-k, and tax policy that supports families — we can improve Americans' lives in the short and long term while strengthening our economy. On July 20th, the House Budget Committee held a hearing with experts testifying on the ways that investments in children are one of the best choices we can make for their well-being and for society as a whole.

"Supporting our youngest Americans is one of the most concrete ways we can set our nation up for success. We call these programs investments because they pay off — literally — for children, for their families, for our society, and for our economy," said Chairman John Yarmuth.

Why are Investments in Children Important?

Investing in children provides benefits in the immediate term and over the course of their lives. Devoting collective resources to children across a variety of programs delivers a high return-on-investment. For example, researchers at Columbia University and Open Sky Policy Institute estimate that expanding the Child Tax Credit (CTC) permanently to a "near-universal" child allowance would cost about $97 billion annually. That would be offset, however, by societal benefits worth around $982 billion yearly, including improved health and longevity for kids, which researchers value at $424 billion alone. They also estimate that children who would benefit from this policy would see their collective future earnings increase by a total of $270 billion in their lifetimes, benefitting those children as well as increasing tax revenue and improving our nation's fiscal standing. In other words, making an up-front investment in children, such as through an expanded CTC, is one of the most productive investments the government can make.

For children living in poverty, investments early in life are even more important and may have even greater returns. Decades of high-quality research have found that poverty hurts children both in the immediate term and over the course of their lives. For example, poverty can lead to a phenomenon known as "toxic stress." Toxic stress can disrupt brain development in children and lead to impaired cognitive, social, and emotional development. Impaired development in these key areas lead to poor emotional and behavioral self-control in early childhood, which leads to problems in school, and that leads to delinquency throughout childhood, feeding the "school-to-prison pipeline." These effects last into adulthood, exacerbating the cycle of generational poverty and inequality.

But investments when children are young can counter these effects. The National Academy of Sciences has determined that the economic costs of child poverty (estimates range from 4 to 5.4 percent of GDP, or $800 billion to $1.1 trillion annually) far exceed the costs of reducing child poverty via productive and pro-growth investments. And because these policies disproportionately benefit children from the most disadvantaged backgrounds, over time they may help to close racial and economic gaps.

What kinds of policies most benefit children?

Tax Policy that Supports Families

The CTC is proven to benefit children. A critical part of the American Rescue Plan (ARP) was the expansion and enhancement of the CTC, which increased the maximum available benefit from $2,000 a year to up to $3,600 a year for each child under age 6 and $3,000 a year for older children. Importantly, half of the credit was offered as monthly payments to families, allowing them flexibility to spread the benefits out throughout the year instead of getting just a large lump sum at tax time. This expansion also made more low-income families eligible because the credit became fully refundable, allowing more children living in poverty to receive the credit. The impact of this expanded credit was both immediate and impressive, reducing the child poverty rate by almost 30 percent in just one year.

As Chairman Yarmuth noted, "The expanded Child Tax Credit, which Democrats enacted last year as part of the American Rescue Plan and did so without a single Republican vote, lifted 3.7 million children out of poverty in 2021 alone." Research found that most low-income families used the expanded credit to pay for necessities like education, food, utilities, clothing, and shelter. Historical evidence from the CTC and other child tax allowances around the world suggests that these payments help children lead healthier lives, and that the poverty-reduction components of these policies pay for themselves over the long run.

Ultimately the CTC expansion was hugely successful, as Dr. Hilary Hoynes, Professor of Economics and Public Policy and the Haas Distinguished Chair in Economic Disparities at the University of California Berkeley, explained: "What we saw from that expansion was essentially the largest reduction in child poverty…what we know from the available evidence thus far is that reduction in poverty was greater than any single act, any single policy change that we've engaged in since the United States since we started measuring poverty in the 1960s."

The Earned Income Tax Credit (EITC) also generates large returns. The EITC is a refundable tax credit available to workers and working parents that increases with the number of children. According to the National Conference of State Legislatures, during 2015, the EITC lifted approximately 6.5 million people out of poverty, including 3.3 million children. Additionally, they found that the EITC also benefits local economies because recipients spend their refunds at local businesses. For example, the city of San Antonio, Texas estimates that each additional EITC dollar results in $1.58 in local economic activity. Economists assert this EITC "multiplier effect" is generally between 1.5 and 2 for local economies – a significant boost.

As Dr. Hoynes testified, the impact of receiving EITC is great for three reasons: "First, parental access to the EITC during pregnancy leads to increases in health at birth, including an increase in average birth weight… Second, researchers document that the EITC leads to improvements in test scores of children... Third, studies show that exposure to the EITC leads to an increase in the probability of completing high school, college attendance, and higher employment and higher wages in early adulthood."

High-Quality Child Care and Pre-K

Early childhood is a critical time in the life of a child and their development. Children in high-quality pre-k and child care programs develop social, emotional, and academic skills that benefit them for the rest of their lives. Studies have found that enrollment in these high-quality programs improves school readiness and college attendance, creates better health outcomes, and reduces the likelihood of future criminal acts. Programs like Head Start have been shown to benefit low-income children and set them up for success when they enter elementary school.

These programs also have an immediate positive effect on parents, particularly mothers, and the broader economy. Studies have found that the enactment of a universal affordable child care program would increase the labor force participation of mothers as well as increase the wages for child care workers, leading to positive effects on the macroeconomy. Other studies have found that universal pre-k has substantial effects on increasing labor supply of mothers with young children. Additionally, there may be substantial intergenerational benefits to these programs. Studies have found that the children of previous participants in high-quality pre-k programs are less likely to commit crimes and have more education and employment in the future. Not only do these effects benefit parents and children, but they also result in healthier communities, savings to other government programs, and higher tax revenues.

In sum, high quality early childhood programs can yield a $4 to $9 economic return per $1 invested. A 2009 study of Perry Preschool, a high-quality program for 3- to 5-year-olds developed in Michigan in the 1960s, estimated a return to society of between about $7 to $12 for every $1 invested. In other words, despite the cost at the time these programs are enacted, they are actually cost savers for society over the long run.

Unfortunately, we have not yet ensured access to quality care equally across society, and the market seems ill-equipped to do so on its own absent federal resources. As Mr. Rasheed Malik, Senior Director of Early Childhood Policy at the Center for American Progress, stated during his testimony, "While the positive effects of high-quality child care have been studied for years by economists and other social scientists, little public funding has followed to scale up these models to reach American families. This has resulted in a mostly privately financed market that is highly responsive to the revenue available to child care providers, namely parental fees. In many places, a year of child care costs more than a year of college tuition since quality child care is very costly to provide. It should not surprise us that such a market produces inequities in access to care."

Nutrition Assistance and Healthy Habits

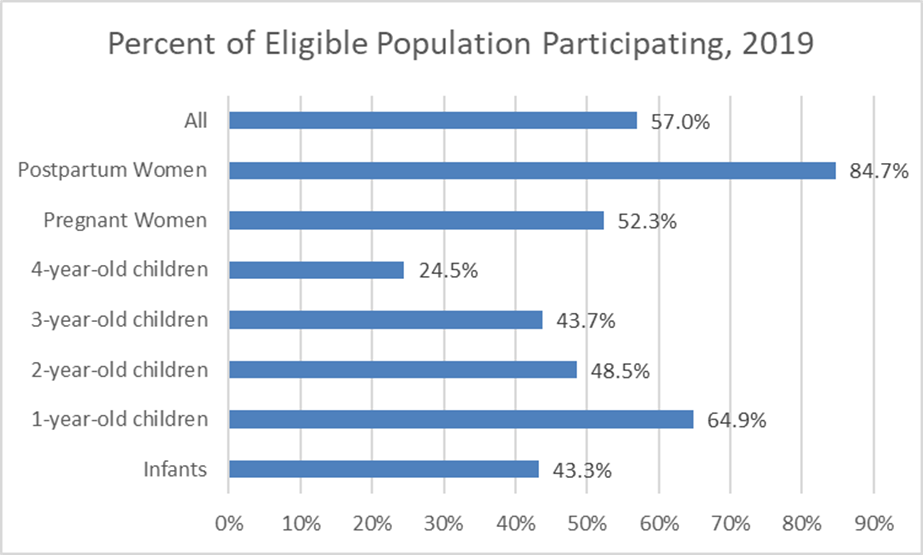

A healthy diet is vital to a healthy and productive life. For families in need, the Special Supplemental Nutrition Program for Women, Infants, and Children – more commonly known as WIC – is a lifeline. WIC stands out as one of the most successful and effective nutrition intervention programs. In 2019, 11 million people were eligible for WIC, and 6.3 million people participated, or 57 percent of all those eligible.

Since its inception in 1974, the WIC program has been evaluated and improved to provide the greatest nutritional support to pregnant and postpartum women, infants, and children. WICparticipationresults in longer pregnancies, fewer premature births, lower incidence of moderately low and very low birth weight infants, fewer infant deaths, a greater likelihood of receiving prenatal care, and savings in health care costs. All of these outcomes support children's health and well-being at the time of the benefits, but also over the course of their lives.

Source: WIC 2019 Eligibility and Coverage Rates

WIC also improves the diet of children by increasing the intake of key vitamins and nutrients and reducing iron deficiency anemia. Studieshave also found that WIC increases the prevalence of breastfeeding for new mothers, which has positive impacts for their babies. Furthermore, WIC participation increases immunization rates and regular access to health care for mothers and their children. Not only does WIC support physical health, but it also improves cognitive development, which influences school achievement and behavior. Specifically, WIC has been found to improve vocabulary scores for children whose mothers participated in WIC prenatally, and it significantly improves memory for numbers for children enrolled in WIC after their first year of life.

Research has shown that WIC has a strong return on federal investment and pays off over the lifetime of the child. For every dollar spent, WIC returns about $2.48 in medical savings and greater productivity. Put more simply by Dr. Maureen Black, Distinguished Fellow in Early Childhood Development, RTI International, and Professor, Department of Pediatrics at University of Maryland School of Medicine, during her testimony, "WIC is a cost-effective public health program that improves the human condition by ensuring that infants are born healthy and that young children thrive and contribute to the larger society as they become healthy, well-adjusted, productive adults."

The Supplemental Nutrition Assistance Program, or SNAP, is also a critical investment in children that generates significant returns. Due to its reach – 82 percent of those eligible participated in 2019 – it lifts many people out of poverty each year. The Census Bureau saw through the Supplemental Poverty Measure that the enhanced SNAP benefits in 2020 lifted 3 million people out of poverty alone. SNAP also serves many children: in 2019, 43 percent of the participants in SNAP were children, and two-thirds of those children were school-aged. Economists consider SNAP one of the most effective forms of economic stimulus. According to one Moody's estimate, each SNAP dollar translates to over $1.70 of economic activity, with that money going to local communities promoting local jobs. Dr. Hoynes looked at this a little differently. She stated, "For SNAP, providing benefits to children yields $56 of benefits to families for every dollar of net costs." In other words, spending on SNAP from conception to age 5 leads to higher earnings, lower mortality, and reductions in government spending, such that on net families, the government and society in total saves $56 for each dollar spent.

Conclusion

Since coming into office, President Biden and Congressional Democrats have worked to end the era of chronic underinvestment and put the welfare and futures of America's children first. The American Rescue Plan delivered major investments in programs serving children, like the ones mentioned above. Democrats knew that investing in children would not only help them and their families get through the pandemic, but would also have positive, lasting effects for decades to come.

They knew this because research finds that investing in children pays off over time. As Chairman Yarmuth stated during the hearing, "Investing in our children is the right thing to do. It's the smart thing to do. And it's the most important investment we can make in the future of our country." Dr. Hoynes underscored the budgetary savings of these programs, stating: "These results show that spending more now means spending less later. Higher adult earnings mean higher future tax revenue. Improved health and reductions in criminal activity mean lower future government spending." These investments improve health, educational achievement, and future earnings. They help break the cycle of poverty, reduce crime, and all the while, pay for themselves over time. In short, investments in children make a lifetime of difference for them, their families, their communities, and our country.