Targeted Relief to Americans and Businesses Hurting from the COVID-19 Crisis Is Needed Now—Not More Tax Cuts for the Rich

Learn more in the Budget Committee's Coronavirus Resource Center

While the COVID-19 pandemic rages on and threatens the health and well-being of the American people, President Trump is once again pushing for more tax cuts for the rich. Just like his 2017 GOP tax scam that showered benefits on the very wealthy and big corporations, this is the wrong policy at the wrong time. President Trump's push to scale back capital gains and payroll taxes as part of the next COVID-19 relief bill, as well as to increase the deduction for business meals and entertainment and permanently extend full expensing for big corporations, does not address the urgent needs of the American people. Even Republican lawmakers who hastily voted for the 2017 tax law are hesitant to support him. This new round of tax cuts would mostly benefit the wealthy, when the hardship caused by the pandemic has fallen primarily on low-wage workers and their families. As we work to build a strong recovery, we must prioritize targeted relief for the working Americans and Main Street businesses that are fighting to survive now. The last thing our nation needs right now is more tax cuts that primarily benefit the rich.

Capital Gains Tax Cut Does Nothing for Workers and Small Businesses Struggling to Survive the COVID-19 Pandemic

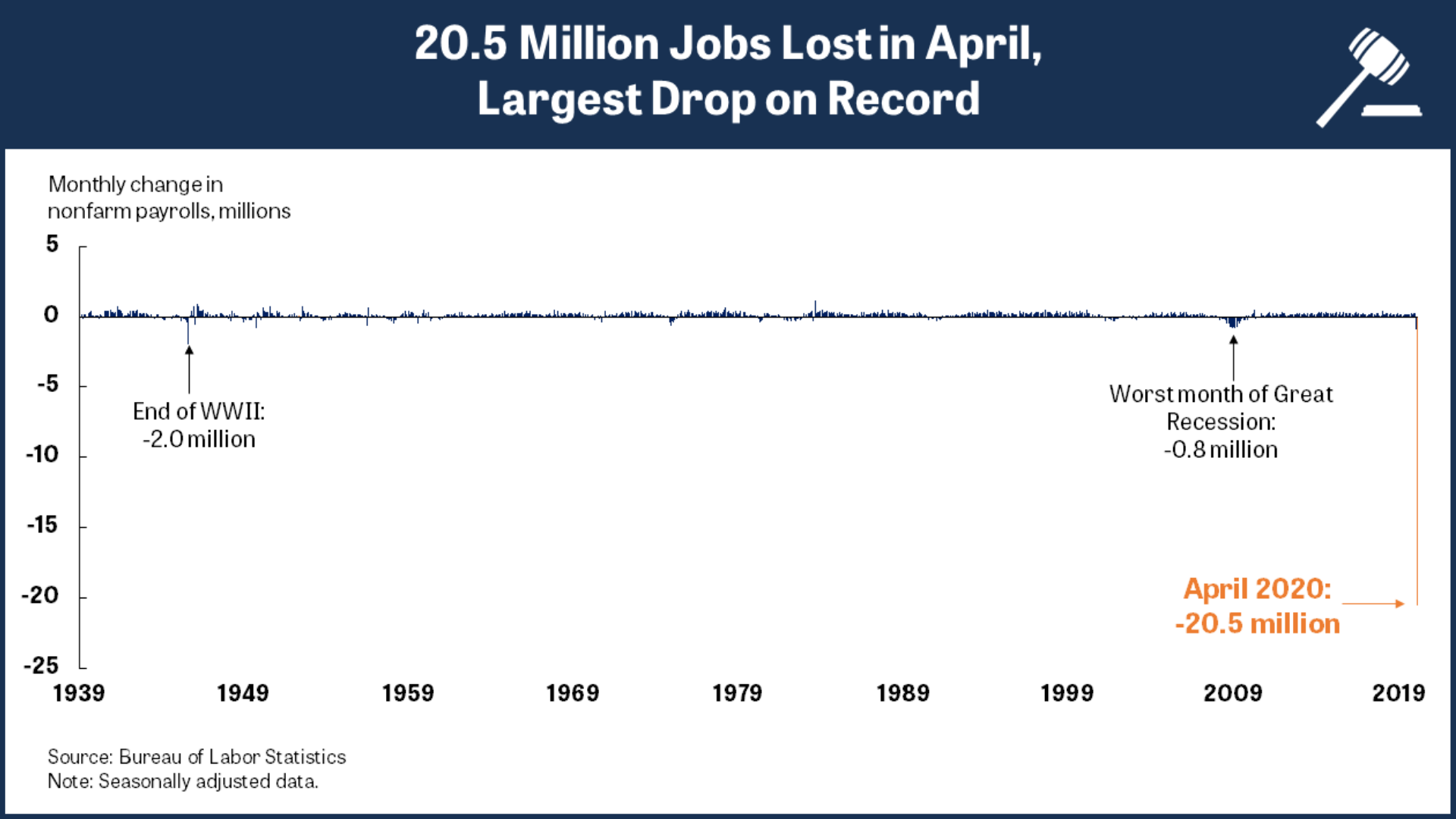

American workers and Main Street businesses are fighting for their lives and livelihoods now. More than 20 million Americans lost their jobs in April alone, sending the unemployment rate to 14.7 percent—devastation unseen since the Great Depression. Nearly 7.5 million small businesses are at risk of closing their doors permanently over the next several months if the COVID-19 pandemic persists. Despite this dire situation, President Trump is pushing for a capital gains tax cut in the next COVID-19 relief bill. While he tried to get Congress to enact this tax cut many times before, his push this time is especially egregious. The capital gains tax cut does nothing for the American workers and small businesses that need help now.

Furthermore, in today's economic environment with low inflation and rock-bottom interest rates, the capital gains tax cut would also fail to make a meaningful difference in our long‑term economic growth. Even Karl W. Smith, vice president for federal policy at the Tax Foundation, argues the capital gains tax cut would have a minimal economic impact now and is ill‑timed. President Trump's push for the capital gains tax cut would double down on the 2017 GOP tax scam to shower even more benefits on the rich.

It will NOT create jobs or bring any of the 36 million Americans back to work — Over the past eight weeks, nearly 36.5 million new unemployment insurance (UI) claims were filed. However, this figure likely understates the damage: Overwhelmed state UI systems have been unable to process all claims, administrative barriers have limited the number of people able to file, and some Americans who lost their paychecks still do not qualify for benefits. These jaw-dropping job losses are the result of necessary business closures following stay-at-home orders put in place by states and local governments to curb the spread of the pandemic, as well as people avoiding businesses in fear of contracting the virus. Investing in the American people and their businesses is crucial to successfully restarting and reopening our economy, and a capital gains tax cut does nothing to bring back the jobs lost due to the pandemic or support shuttered businesses.

It DOES NOT address the challenges faced by Main Street businesses — Two-thirds of small business owners believe they may have to close forever if business disruption continues at its current rate for up to five months, according to a survey published last month by Main Street America, a network of more than 1,600 commercial districts comprising 300,000 small businesses. The survey shows that more than half of small businesses have seen revenue drop by more than 75 percent, and nearly eight in 10 have already closed temporarily due to the COVID‑19 crisis. Small businesses face disappearing cash flow and customer foot traffic as consumers avoid public spaces and states and local governments put in place necessary stay‑at‑home orders. Many of these businesses only have cash buffers to last them several weeks. According to a survey by the U.S. Chamber of Commerce and MetLife, more than half of businesses (56 percent) said direct cash payments would be the best way to help. A capital gains tax cut does nothing for these small businesses.

It DOES primarily benefit the rich —Long-term capital gains mostly benefit the wealthy and are already taxed extremely lightly compared to regular income. In 2019, three-quarters of long‑term capital gains went to the richest one percent of tax filers and 85 percent went to the top five percent. According to Steven Hamilton, an economics professor at the George Washington University, capital gains tax cuts would "simply be a windfall to investors" and would be unlikely to help blue-collar and low‑income workers who have been hit hardest by the coronavirus shutdown.

Payroll Tax Cut Does Nothing for More than 36 Million Unemployed Workers

President Trump's push to squander significant budgetary resources by cutting payroll taxes in response to the economic crisis makes no sense as job losses explode. When nearly 36.5 million Americans have filed unemployment claims over the past eight weeks, a payroll tax cut provides zero benefit to them and others who are not on payrolls. Also, a payroll tax cut is unlikely to bring them back to work if consumers are afraid to go out and employers cannot guarantee safe workplaces. President Trump's proposal to suspend payroll taxes would not provide support to those who need it most and is an ineffective way to counter the economic crisis. According to Derek Klock, finance professor at Virginia Tech, "it would give workers that are already faring pretty well a raise, but the hardest hit wouldn't receive any benefit."

It DOES tilt the scales against workers who are disproportionately unemployed — A payroll tax cut, or any employment-contingent relief proposal, would disproportionately leave out low‑wage or black and Hispanic workers who are more likely to be unemployed and hardest hit by the COVID-19 crisis. The Bureau of Labor Statistics' jobs data show some of the industries that pay their workers the least are shedding the most jobs. Over the last three months, the industries with the most job losses were leisure and hospitality (48.3 percent decline), other services (22.0 percent), and private service-providing sector (16.5 percent), where workers already have lower-than-average wages. For lower-income workers who were already stretching their budgets to make ends meet, this crisis has been disastrous. Furthermore, the April jobs data show the unemployment rates for black and Hispanic workers (16.7 percent and 18.9 percent, respectively) were significantly higher than the rate for white workers (14.2 percent). Given that black and Hispanic workers are more likely to be unemployed due to long-standing inequities, a payroll tax cut would only worsen income disparities.

It DOES provide more benefits to high-income earners — "A payroll tax cut is going to provide more benefits to high-income people who don't really need help right now," according to Steve Wamhoff, director for federal tax policy at the Institute of Taxation and Economic Policy. His analysis shows the President's previous proposal to eliminate payroll taxes for the rest of the year would cost $843 billion, and 65 percent of the benefits would go to the richest 20 percent of taxpayers. A quarter of the benefits would go to the wealthiest 1 percent, who have an average annual income of more than $2 million, while only 2 percent of the benefits would go to the poorest 20 percent of Americans, who have an average income of $14,400 and who are among the most financially vulnerable during the COVID-19 crisis.

President Trump's Proposed Tax Cuts Are Irrelevant to Today's Problems

As Americans and Main Street businesses fight for their lives and livelihoods due to the COVID‑19 pandemic, we need thoughtful targeted policies that help them survive and succeed. President Trump's proposed tax cuts do nothing to meet their urgent needs during this unprecedented crisis. His proposals double down on the 2017 GOP tax scam by providing more benefits mostly to the wealthy. We must continue to prioritize emergency relief to address the urgent needs of the American people to safeguard their health and improve their economic future.