Default On America Act is a Ruinous Ransom Note, Not a Real Solution

The Republican Default on America (DOA) Act presents an impossible choice: either Republicans wreck the economy by forcing America to default for the first time in history — or they inflict cruel cuts at the expense of working Americans as they prioritize big corporations and billionaires.

Congress must lift the debt ceiling. But instead of ensuring this necessary and basic task is accomplished, House Republicans are holding our economy hostage as they target programs Americans rely on and pursue policies that will cripple economic growth for years to come. Moody's Analytics finds that the Republican agenda "would meaningfully increase the likelihood" of a recession and result in almost 800,000 fewer jobs by the end of 2024 compared to a clean debt ceiling bill.

Republicans want to disinvest in America as they continue to threaten default. In exchange for upholding their obligation to protect the full faith and credit of the United States, Republicans are demanding ten years of devastating cuts that will hurt millions of people, damage our economy, and undermine our national security and global standing. Only then will they agree to avert default – but just for less than a year, until they can force another crisis and try to extort additional extreme demands.

Republicans' game of brinksmanship is dangerous and has real costs. Even approaching the debt limit increases costs for Americans and thegovernment and can create market uncertainty that lasts for months. But the consequences of default would be even more catastrophic for families and the larger economy. Moody's Analytics estimates that default would result in more than 7 million jobs lost, an unemployment rate over 8 percent, and a wipeout of $10 trillion in household wealth. Mortgage rates and consumer borrowing rates would increase, and the status of the dollar as a reserve currency of the world would be at risk.

The threat of default is looming, and our nation needs decisive action and responsible leadership. The Republican Default on America Act accomplishes neither.

Slashes Discretionary Investments

The DOA Act follows through on House Republicans' threat to gut nondefense discretionary (NDD) programs and enshrine these cuts with caps on future spending. This bill amounts to ten years of devastating caps and cuts at the expense of families and our nation's most vulnerable in exchange for delaying Republicans' threat of default for less than one year.

The DOA Act sets the total discretionary level for 2024 at $1,471 billion, a cut of at least $142 billion from the 2023 level, and allows for only one percent annual growth through 2033. While the bill does not explicitly protect defense or veterans spending from being cut, Republicans have made it clear they will apply most - if not all - of these cuts to NDD programs. This would be the biggest cut to these programs on record, and would endanger public safety, increase costs for families, undermine American workers, hurt seniors, weaken our national security, and shrink our economy.

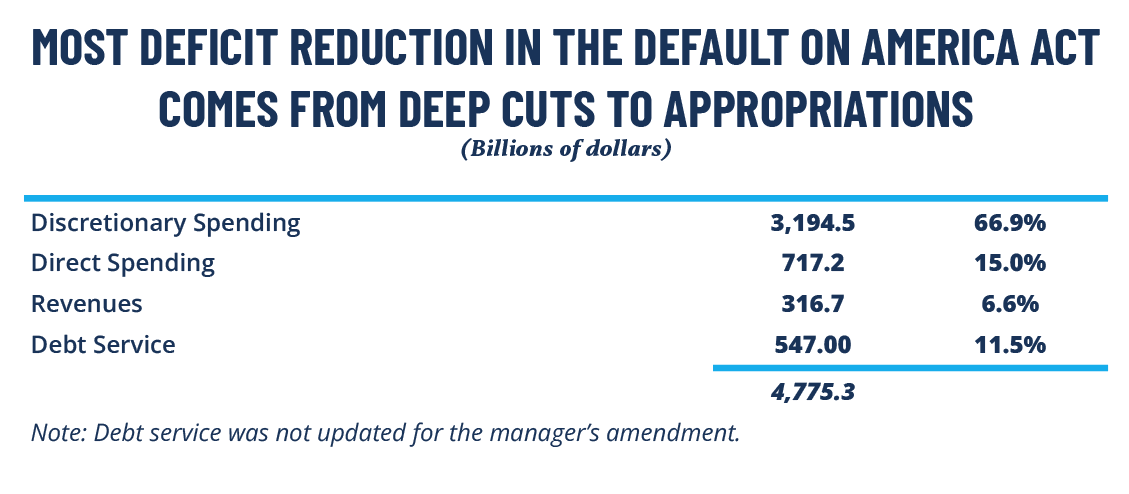

The Congressional Budget Office (CBO) indicates that discretionary spending will be cut by $3.2 trillion over the ten-year budget window, and by a half trillion dollars (23.8 percent) in 2033 alone. These cuts to appropriations make up two-thirds of the total reductions in the DOA Act, three-quarters of the total when interest costs are excluded.

As we saw during the ten-year era of the Budget Control Act of 2011 (BCA), caps are cuts. And the human costs of House Republicans' cuts would be devastating for our country and for American families. The BCA caps locked in the unnecessary and self-austerity sought by House Republicans, and this period was plagued by constant brinksmanship, delays in final appropriations, and threats of shutdown as America fell further and further behind our peer nations and global competitors.

Hurts Families and Students, Halts Job Creation, Helps Tax Cheats

Snatches Back COVID Funds

The bill aims to recapture what Republicans characterize as "unspent" pandemic funding. The U.S. Government Accountability Office reported that, at the end of January, about $90 billion (2 percent) of the $4.6 trillion in enacted COVID funding remained unobligated and unexpired. The Office of Management and Budget recently tallied about $73 billion in funding from the American Rescue Plan that remained unobligated. Both estimates represent a point in time for the Administration's ongoing efforts to carry out the spending Congress enacted; for a variety of reasons, some programs use funding more slowly than others. The pace does not reflect mismanagement and does not suggest the funding is unnecessary or unimportant. Moreover, not all COVID funding that is currently unobligated can be rescinded, and some rescissions would not reduce the deficit if enacted. CBO estimates that the rescissions reduce the deficit by $39 billion, including the manager's amendment.

Blocks Student Loan Forgiveness

The DOA Act nullifies the Administration's executive actions on student loan forgiveness and income driven repayment and prohibits the Secretary of Education from implementing any future similar executive orders without Congressional permission. CBO estimates that this provision will reduce direct spending by $460 billion over the decade.

Eliminates Green Tax Credits

The measure kills jobs and worsens the climate crisis. It repeals or ends several tax provisions that promote renewable energy, build energy security, and foster environmental resilience. While attacking wind, solar, hydrogen and biodiesel, it also ends multiple credits for efficiency and clean fuels. The Joint Committee on Taxation estimates this provision reduces the deficit by $531 billion, including the changes in the manager's amendment.

Encourages Tax Cheats

The bill slashes approximately $71 billion from the Internal Revenue Service (IRS) by rescinding long overdue IRS investments included in the Inflation Reduction Act. This undermines the agency and its ability to ensure everyone – including billionaires and big corporations – pays the taxes they owe. Slashing these IRS funds and protecting wealthy tax evaders ultimately hurts American families, hardworking and honest taxpayers, and small businesses. CBO estimates this provision will increase the deficit by $120 billion.

Punishes the Most Vulnerable and Obstructs Administrative Actions

Kicks People Off TANF, SNAP, and Medicaid

The DOA Act changes current work requirements for Temporary Assistance to Needy Families (TANF), Supplemental Nutrition Assistance Program (SNAP), and Medicaid.

The TANF provisions reduce direct spending by about $6 million over the next ten years, but it's done by creating barriers that make it harder for families to access the program and by financially incentivizing states to cut families from the program.

The SNAP changes strip states' autonomy and flexibility to provide benefits to more people in times when unemployment levels are high, and jobs are scarce. The DOA Act also expands work requirements to include 50- to 55-year-olds, which does nothing to help more people find work and instead simply increases hunger in America. CBO estimates that denying Americans these lifeline supports reduces direct spending by $11 billion over ten years. CBO also estimates that around 275,000 people will lose benefits in an average month, and another 19,000 people will see reduced monthly benefits.

The Medicaid provisions require certain enrollees aged 19 to 55 to be working, looking for work, or participating in community service for at least 80 hours per month. CBO estimates the Medicaid proposal will decrease federal spending by $109 billion over the ten-year period and cause roughly 600,000 individuals to lose their health coverage. Work requirements are solely a backdoor way to kick people off Medicaid, and more people would become uninsured under the DOA Act if it weren't for the cost burden that is being shifted to the states. CBO estimates that 1.5 million people will lose federal coverage, but 900,000 could remain insured if states picked up the tab, resulting in the 600,000 figure cited above.

Throws Unnecessary Obstacles in the Administration's Path

The DOA Act requires congressional approval of all major rules issued by federal agencies. Congress lacks the time and resources to provide meaningful review and approval of all rules, and this effectively opens the door to special interests further influencing the rulemaking process. Further, this will significantly slow the implementation of new regulations designed to keep the American public safe. CBO could not provide an estimate of this provision.

Puts Polluters Over People

The DOA Act includes the text of H.R. 1, the "Polluters Over People" Act, which walks back the remarkable strides Democrats have made to lower costs, increase efficiency, and create good jobs. H.R. 1 protects polluters, undercuts public health, and abandons the environment – while raising prices for American families and padding the pockets of Big Oil and Gas. CBO's estimates show a deficit reduction of $3 billion at the expense of Americans' health and clean air and water.

Raises the Debt Ceiling

The DOA Act suspends the debt ceiling until March 31, 2024 or until the national debt increases by $1.5 trillion (meaning the total debt subject to the limit reaches $32.9 trillion), whichever comes first. This could happen in a matter of months, giving Republicans another chance to hold our economy hostage and make additional demands.

Conclusion

Republicans will claim they are being "fiscally responsible," but there never has been and never will be anything fiscally responsible about refusing to pay America's bills. Killing millions of jobs is not fiscally responsible. Neither is knowingly unleashing a recession or kneecapping our nation's potential. It's time House Republicans ended their manufactured crisis and put the well-being of Americans over the wishes of billionaires and big corporations.