The Destructive and Irrational Trump Budget

President Trump's latest budget fails the American people and takes a wrecking ball to America's economic future. This President and his Congressional Republican allies have always prioritized special interests and the rich and powerful over the health, safety, and economic security of American families, and this budget continues their misplaced allegiance. The President's deficit-financed tax cuts for the wealthy are on track to cost nearly $2 trillion and did little except blow up the deficit to heights not usually seen outside of recessions and major world wars. Meanwhile, America's real economy also faces serious deficits: aging infrastructure, skyrocketing health care costs, widening student achievement gaps, and a warming climate. It is clear we must make bolder investments in American families and our nation's future – especially now, while interest rates are low. But the President refuses to let facts and evidence sway him. Instead, once again, his budget squanders opportunities to lay the groundwork for a more productive and equitable economy.

This President has repeatedly shown he will go around Congress and twist our laws to suit his agenda. Therefore, the American people should view this budget as a road map of what he plans to do, with or without Congressional approval – a road map that will send our country spiraling.

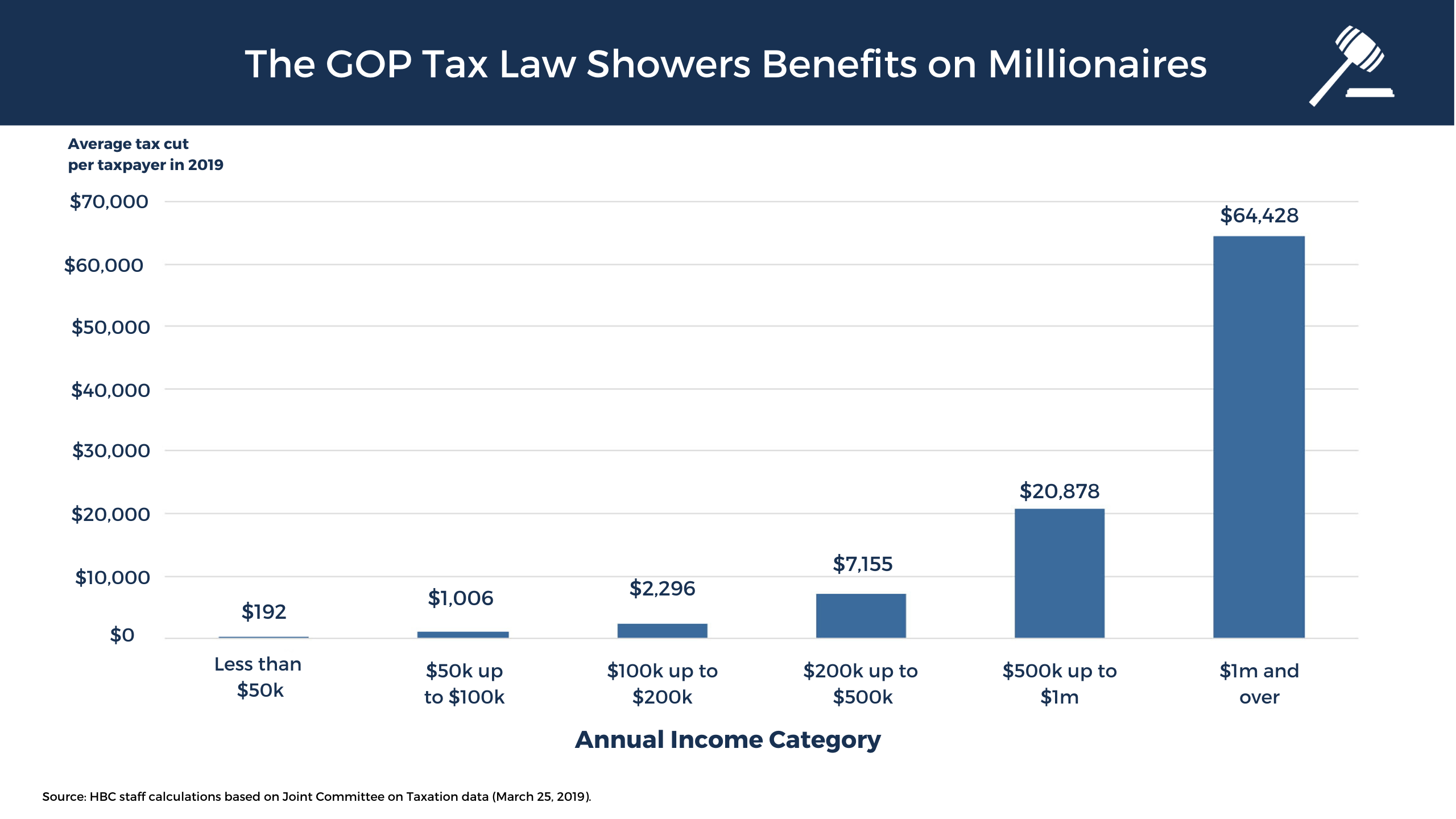

Showers more tax cuts on big corporations and the wealthy —The President's budget doubles down on the failed 2017 GOP tax law, extending expiring provisions and adding $1.5 trillion more to debt over the last six years of the budget window. Most of the extension benefits – 65 percent – go to the richest one-fifth of households; and each of President Trump's budgets have included these extensions since the GOP tax scam became law – there is nothing new here. The President has repeatedly promised a middle-class tax cut but has failed to deliver. Two years in, mounting evidence continues to show the GOP tax scam showered benefits on the rich and large corporations, failed to "supercharge" our economy, worsened income inequality, and left the middle class behind. In fact, this President's second round of tax cuts has already begun for big corporations – without Congressional involvement and out of public view. His Administration's regulations to implement the law, some of which experts argue went beyond the Administration's legal authority, are giving even more tax cuts to big corporations – and the Administration is still writing new regulations. The Congressional Budget Office projects the implementation of the law's international provisions will further reduce revenues by a whopping $110 billion. The ultimate impact on revenue could be far worse, with more tax cuts for big corporations occurring out of the public's view.

Makes steep and destructive cuts to health care — On net, the budget cuts $1.6 trillion from health care programs over 10 years. This includes a more than $900 billion cut to Medicaid, a half a trillion-dollar cut to Medicare, and more than $200 billion in cuts to other health programs. Instead of putting forth specific policies to strengthen the Affordable Care Act, the budget includes vague platitudes about how the President's vision for health care would be "great." The budget does state that the President's "vision" would cut $844 billion from health care programs over 10 years, which would almost certainly take away meaningful health coverage from millions of Americans. Similarly, the budget parrots the President's campaign rhetoric to lower the cost of prescription drugs but, in a giveaway to pharmaceutical giants, the budget omits proposals like H.R. 3 that would allow Medicare to negotiate lower prices for drugs and provide actual relief to American families. Finally, the budget also takes an irrational approach to public health. It includes small increases for HIV research, for example, but guts the Medicaid program that 42 percent of Americans with HIV rely on for health insurance coverage. Amid a coronavirus public health emergency, the budget cuts discretionary budget authority for the Centers for Disease Control and Prevention (CDC) by nearly 19 percent, severely threatening the CDC's ability to respond to this and other epidemics in the future.

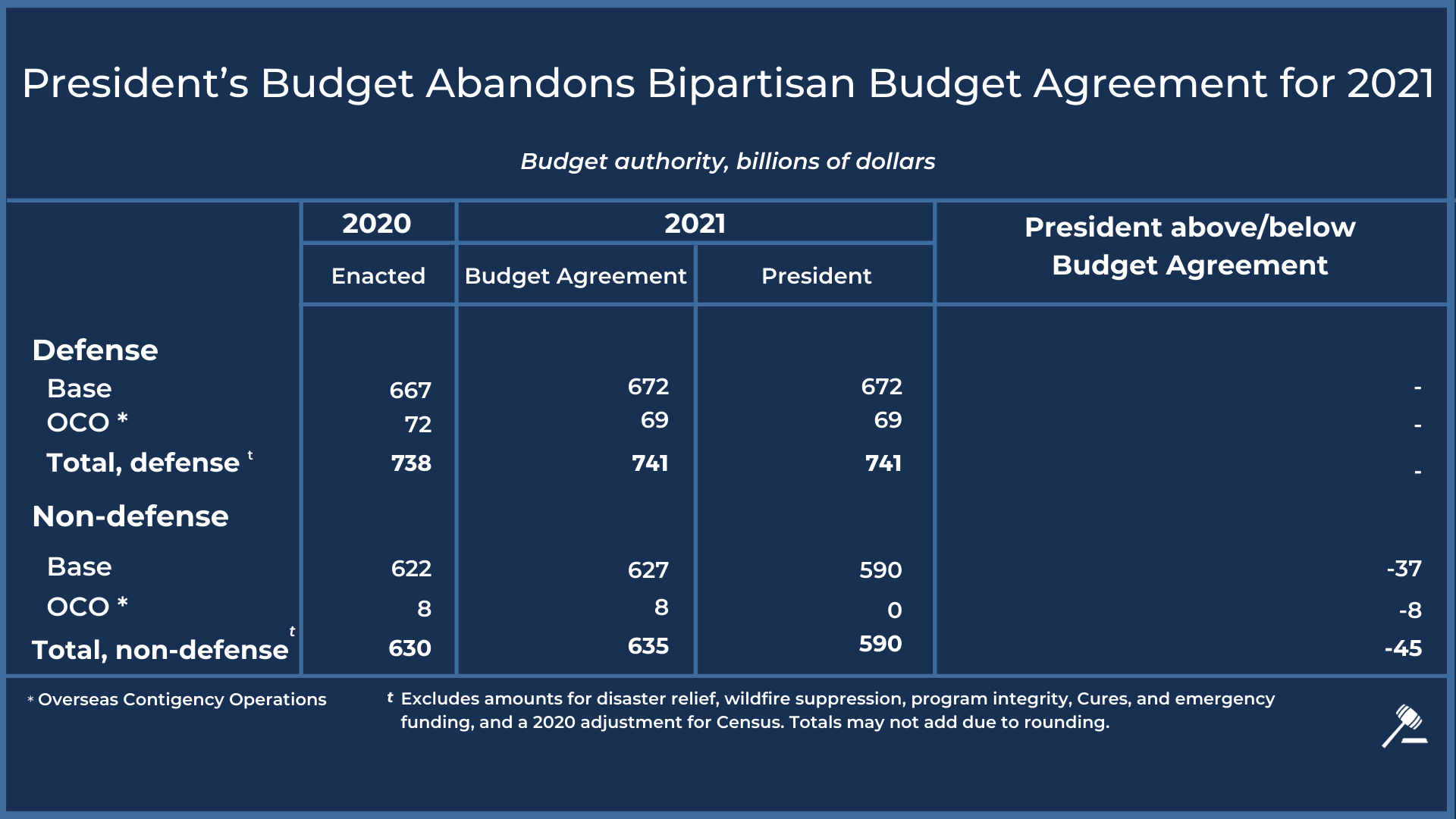

Reneges on the bipartisan budget deal signed into law six months ago — The President abandons the Bipartisan Budget Act of 2019 (BBA19), enacted last August, and instead undercuts investments in our national and economic security.

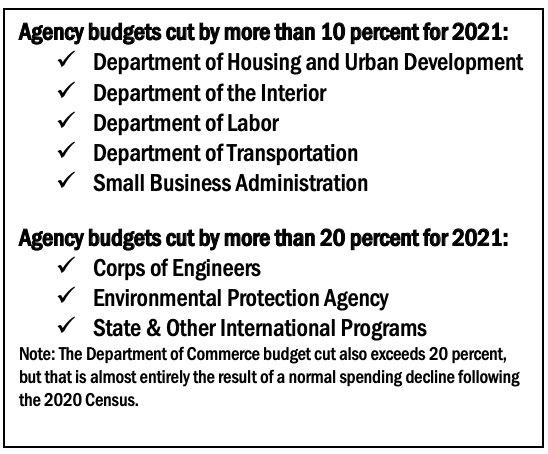

The budget cuts non-defense discretionary (NDD) base funding by $37 billion relative to the BBA19 agreement, and it zeroes out the agreement's $8 billion designated for non-defense Overseas Contingency Operations (OCO). Taking NDD base and OCO funding together, the President's budget provides $45 billion less than the agreement he signed – a 7 percent cut. These cuts are not spread equally across NDD. The Department of Homeland Security, the Department of Veterans Affairs, and NASA see increases, which makes spending cuts that much deeper and more destructive in other agencies.

After 2021, the President further assumes annual 2 percent reductions in NDD funding that compound over time, resulting in a 2030 level that is $138 billion below 2020 enacted amounts for base and OCO. Even before adjusting for inflation, this translates to a 2030 NDD funding cut of more than 20 percent.

Adheres to bipartisan defense funding agreement but drastically cuts diplomatic and foreign aid operations — The President's 2021 budget provides $741 billion for Function 050 (National Defense), including $69 billion for Overseas Contingency Operations (OCO), consistent with the BBA19. However, the budget once again makes drastic and illogical cuts to diplomacy and foreign aid, activities that national security experts across the political spectrum agree are crucial to a comprehensive and effective national security strategy. It cuts funding for Function 150 (International Affairs) by $12 billion, or 21 percent, below the 2020 enacted level of $56 billion. It eliminates all $8 billion of the non-defense OCO funding intended for Function 150 that Congress and the President agreed to in last year's bipartisan budget agreement. In the outyears, the budget includes increases for defense of just over 2 percent per year through 2025 and a freeze for the rest of the ten-year budget window. The budget freezes funding for international affairs programs at the 2021 level through the entire 10 years.

Cuts Social Security and other disability programs — The budget again includes a plan to restructure and reduce federal disability benefits, including Social Security's Disability Insurance (DI) program. The DI program is closely integrated with Social Security's retirement benefits and is a core component of the Social Security program. The President's disability "reform," which also affects Supplemental Security Income (SSI), cuts spending by a total of $63 billion. The budget includes an additional $12.5 billion in savings from payment integrity measures affecting programs administered by the Social Security Administration. Altogether, the budget's policies cut Social Security benefits by at least $24 billion – despite the President's claims he would leave Social Security alone.

Disinvests in America's students — The budget slashes discretionary resources for the Department of Education by $5.6 billion, or nearly 8 percent, for 2021, while giving $45 billion in tax credits over 10 years to businesses and individuals who fund scholarships for private education – continuing the Administration's attacks on public schools while providing another tax break for the wealthy and corporations. The budget also doubles down on making college less affordable and unattainable for many American families with a $170 billion cut to student loan programs over 10 years. This includes increasing costs for new students by eliminating subsidized student loans and making it more difficult for students to repay their loans by eliminating the Public Service Loan Forgiveness program.

Fails to support struggling families and communities — The budget cuts $292 billion over 10 years from mandatory programs that support working and vulnerable families, including $182 billion from the Supplemental Nutrition Assistance Program (SNAP). The cuts to SNAP are in addition to the Administration's new and proposed rules that will make more than 3 million people food insecure. Yet again, the budget attempts to build a bureaucratic wall between families and the assistance they receive from the Earned Income and Child Tax Credits, resulting in a $73 billion cut to these important benefits (including revenues as well as outlays from the refundable portion of the credits). Together with the budget's Medicaid cuts, these budget policies not only undermine vital supports for struggling families, but also weaken the federal government's ability to serve as an automatic economic stabilizer when recessions come.

The budget hits struggling families even harder by disinvesting in the communities they live in. The President's budget again eliminates the Community Development Block Grant program and the HOME Investment Partnerships Program, a combined $4.8 billion cut that hinders communities' housing rehabilitation and economic development opportunities. Further, the budget provides no new funding to the Housing Trust Fund, choking off resources that help states reduce costs for families struggling to afford housing.

Neglects to make meaningful investments in infrastructure — For the third year in a row, the budget includes a $200 billion 10-year infrastructure initiative that pretends to encourage additional private investment of more than $800 billion. In reality, the President has done little to actually advance infrastructure initiatives, and we are likely to see more of the same inaction from the White House this year. The budget also includes an additional $75 billion increase in transportation funding through a reauthorization of the highway bill that expires this fall. However, the budget cuts 2021 discretionary funding for the Department of Transportation by 13 percent. This cut includes reductions to some discretionary infrastructure funding, thereby irrationally undercutting a portion of the budget's own highway bill increase and infrastructure package. It also significantly cuts funding for Essential Air Service and Amtrak.

Strangles environmental protection and clean energy innovation — President Trump's budget lays bare Republicans' disdain for clean energy innovation and the health of our environment. It drastically slashes funding for applied energy research and development and other non-defense energy programs by more than half from the 2020 enacted level, while also eliminating clean energy tax credits and advanced technology loan programs. It also cuts the Environmental Protection Agency by $2.4 billion – or 26 percent – as the Administration continues recklessly to dismantle the protections that keep our air and water clean and safe, ignore the dangers of climate change, and put the profits of polluters ahead of the American people.

Continues pursuit of an ineffective border wall — Once again, the budget fails to include comprehensive immigration reform – a logical way to improve our economic outlook and strengthen our fiscal position. Instead, the budget includes $2 billion of taxpayer dollars to fund construction of an irrational, impractical, and ineffective border wall. This is a costly and wasteful method for dealing with the country's broken immigration system and not a sensible approach to the problem.

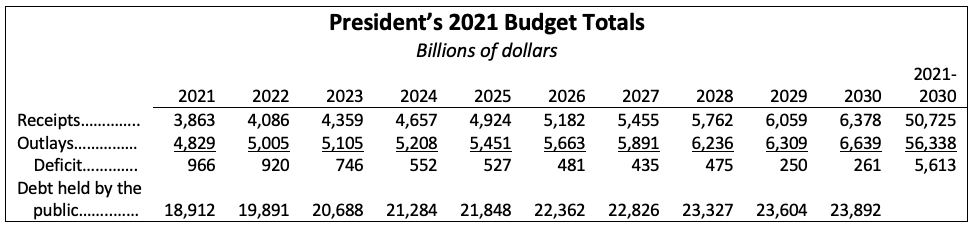

Relies on fantasy economic projections — The Administration continues to assume the economy will grow about 3 percent annually over the next decade. This is despite its failure to hit that target (or the President's promise of "4, 5, or even 6 percent" annual growth) in any year so far, even with the temporary boost from the 2017 tax law. The growth rates assumed in the budget are significantly higher than those projected by private forecasters and the Congressional Budget Office, which forecasts average annual growth of just 1.7 percent, largely due to slower labor force growth associated with our aging population. Maintaining 3 percent growth over the long run is therefore unlikely unless we were to pass policies, like comprehensive immigration reform, to substantially increase our workforce – a solution this Administration has vehemently opposed.

Additional Reports on the President's Budget

- Trump Budget Devastates Rural America

- States and Localities Power the Economy, but the Trump Budget Pulls the Plug

- President Trump's Extreme Budget Cuts Hurt Veterans

- Trump Budget Priorities: Vulnerable Families and Communities Sacrificed to Extend Tax Cuts for the Wealthy

- The President's 2021 Health and Human Services Budget

- Trump's Vision for a More Dangerous and Polluted Future

- Trump's Irrational Budget Undercuts Our National Security

- Trump Budget Priorities: Pad Tax Cuts for Corporations And Stiff the Middle Class